As banks and non-banking financial companies become stringent in disbursing unsecured personal loans and credit card receivables after the Reserve Bank of India (RBI) increased the risk weights on these loans, borrowers should now keep the credit utilisation ratio (CUR) below 30%, experts say. Till now, loans were disbursed even at a CUR of 50%.

The credit utilisation ratio (CUR) will be a pivotal factor for borrowers as lenders will now exercise greater caution. Lenders closely look at CUR — the ratio of total balance on credit cards and total credit limit — to assess the borrower’s unsecured debt. Applicants who demonstrate responsible credit management are likely to be favoured by lenders as it reduces the perceived risk of default.

Adhil Shetty, CEO, Bankbazaar.com, says a low CUR can ensure your credit score is not adversely impacted. “A higher CUR can lower your score marginally. Regardless of the CUR, timely payments are the top priority. But if you have a high CUR along with late payments, getting a new credit card becomes tougher,” he says.

The credit risk assessment, approval and pricing of loans vary across lenders. Individuals planning to avail personal loans should compare the interest rates of many lenders and approach the one with whom they maintain deposits and have taken loans or credit cards. To be sure, lenders often offer personal loans at preferential interest rates to their existing customers.

Borrowers should aim for a credit score of at least 750 crucial for determining the loan eligibility and the interest rate. And for additional security, borrowers may consider guarantors or some collateral. Individuals facing difficulties due to a lower credit score, should explore alternative options such as secured loans or seeking guidance from credit counselors.

Avoid multiple loan applications

Borrowers must keep in mind that making direct loan applications with multiple lenders in a short span of time adversely impact their credit score and reduce their chances of availing a personal loan. Naveen Kukreja, co-founder and CEO, Paisabazaar, says, direct loan applications are considered as hard enquiry and credit bureaus reduce the credit scores of loan applicants by a few points for each hard enquiry. “So, making direct loan applications with multiple lenders within a short span of time would lead to sharper reduction in their credit scores.”

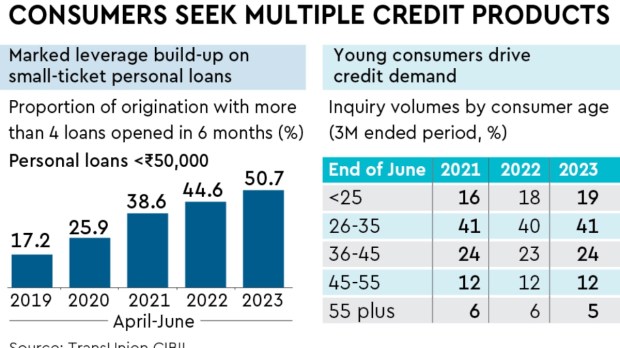

Those with multiple loans are considered riskier and have to pay higher interest rates. In fact, a TransUnion CIBIL shows in the three months to June this year, 50% of consumers who availed small-ticket personal loans already had more than four credit products at the time of availing a new loan, compared to 17% in the same period of 2019.

Mahesh Shukla, founder and CEO of PayMe, an online personal loan platform, says one should make informed decisions about which lenders to approach, evaluate their financial needs, and customise their applications to fit their profiles. “This focused strategy increases the likelihood of acceptance and preserves the borrower’s credibility in the eyes of lenders,” he says.

Review lending norms of fintechs

Given the potential for heightened credit requirements from fintech lenders, borrowers should scrutinise the key terms and conditions of the loans. They should be aware of all fees and charges associated with the loan, including origination fees, closing costs, late payment fees and even the duration of the loan.

Gaurav Jalan, founder & CEO, mPokket, says it is essential to compare interest rates among different fintech lenders, considering potential variations based on the lender’s policies and the borrower’s credit profile. “Evaluating the loan tenure offered is crucial, as it directly influences the overall interest accrued over time. Flexibility in the repayment structure can contribute to effective debt management.”

Beware of ‘no-cost EMIs’

Borrowers need to make sure they are aware of the higher processing costs that the lender may charge upfront now on ‘no-cost EMIs’ that have penetrated many segments of lending, especially for purchase of durables. They need to review the penalties for defaults and missed payments. Moreover, they must understand any pre-closure charges and ensure if the goods and service tax is a part of the EMI or has to be paid as an additional charge.