As a financial advisor, I am often asked about investment options so that people can take advantage of new-age technologies, such as ChatGPT and Web 3.0, among others. ChatGPT (Chat Generative Pre-trained Transformer), launched in November 2022, is a chatbot that has been developed by a San Francisco-based technology lab Open AI.

ChatGPT is a generative AI software application. It uses reinforcement learning from human feedback (RLHF)—a machine learning technique—to imitate human-written responses based on wide-ranging user ques. It has undergone vast training with huge resources and has the capacity to respond to nearly any kind of query. Now, people are using it to find more precise answers. ChatGPT has become very popular and within just five days of its launch received 1 million users. When ChatGPT was asked, how to become RICH? It said becoming rich was a complex goal that required a mix of such factors as hard work, smart planning and luck…

People are interested in ChatGPT from an investment point of view, as well. This is because these new-age technologies have the potential of creating immense wealth in future.

How to Invest

Indian Investors have started looking at investment options outside India in a large way—something very new. Basically, the availability of such platforms as Interactive Brokers, Vested and Ind Money, among many others, has prompted this. Besides, there is no minimum or maximum amount issue. An individual can begin with just Rs 100,000 or even less. However, there are going to be some changes from 1st July 2023.

Also Read: Top investment strategies for financial stability of your daughter

Budget 2023 Impact:

In this year’s Union Budget, it was announced that if anyone wanted to remit Rs 100,000, a TCS (tax collected at source) of Rs 20,000 would be applicable from 1st July 2023. Currently, on remitting Rs 700,000 (and above), a TCS (Tax collected at source) of Rs 35,000 is applicable. There is no TCS applicable while remitting any amount below Rs 7 lakh. However, if you invest through the mutual fund route, you can save this TCS even after 1st July 2023.

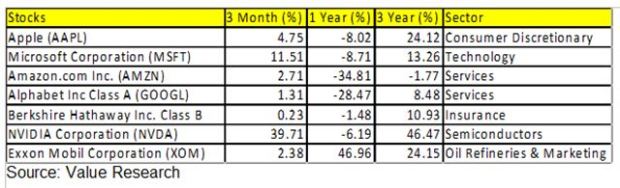

Recent Performance of some heavyweights:

The table below clearly shows that the past year was quite tough for big names like Apple and Microsoft, among others. However, it is the right time to deploy gradually now to build exposure:

Mutual Funds, the Best Route

The best way to build exposure in US stocks is through some of the index funds available in the Indian market. You can even make smaller investments and hold on for the long term. There is no TCS applicable here. Moreover, these are tax efficient:

Taxation of Mutual Fund Options

The above funds are good for long-term investments if you continue with them for at least three years. If you sell after three years, the gains would fall under the long-term category and thus be taxed at 20% with an indexation benefit. This indexation benefit is not available for Indian stocks and Indian Mutual funds. Effectively, it will be taxed at around 10% on the long-term realized gains. If you sell before 3 years, the gains would fall under the short-term capital gains category and will be added to your taxable income and taxed according to your slab.

Conclusion

You can invest in newer technologies like ChatGPT by investing in companies like Microsoft, rather than investing in its stocks directly. It is also advisable to invest in Index Funds so that your investments are diversified.

Over the past few years, AI stocks have become trendier because investors are looking for ways to gain exposure to newer and more advanced technologies and companies in this rapidly growing market. This way, investors can make huge gains from advancements in AI research and reap the benefits of the latest trends.

(By Kunal Jain, Senior consultant at Alpha Capital)

Disclaimer: This is the author’s personal opinion. Readers are advised to consult their financial planner before making any investment.