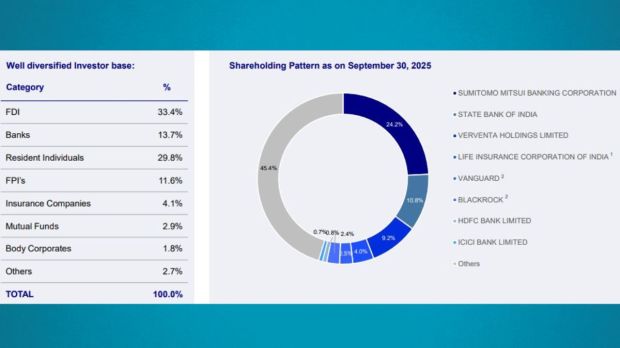

The highlight of Yes Bank’s Q2FY26 results is no doubt the sequential improvement in slippages. However, it is also a key quarter in terms of the changing shareholding dynamics. SMBC, or Sumitomo Mitsui Banking Corporation, has become the largest shareholder in Yes Bank with 24.99%. SBI, or State Bank of India, continues to remain a major shareholder as well.

Yes Bank: SMBC transaction details

SMBC or Sumitomo Mitsui Banking Corporation, acquired a 24.2% stake from SBI and other investor banks and CA Basque Investments (an affiliate of the Carlyle Group) and is now the largest shareholder in Yes Bank.

In August, Sumitomo Mitsui Banking Corporation got the RBI nod to buy up to 24.99% from State Bank of India and seven other shareholders. The deal was originally inked in May to buy 20% stake for $1.6 billion. This is one of the country’s largest cross-border financial sector M&A in recent times.

Yes Bank, in its investor presentation, reiterated that “the transaction is a significant milestone to drive Yes Bank’s next phase of growth, profitability and value creation, leveraging SMBC’s global expertise in this phase.”

SMBC is among the leading foreign banks in India and Sumitomo Mitsui Financial Group’s (SMFG) wholly owned subsidiary, SMFG India Credit Company, is among the largest diversified NBFCs in India

Yes Bank: SMBC may not raise stake further in near-term

A Reuters report on October 17 highlighted that the Japanese lender Sumitomo Mitsui Banking Corporation does not have any immediate plans to raise its stake in Yes Bank beyond this current 24.99%

According to Reuters, in his first interview since the deal concluded in September, Rajeev Kannan, group executive officer and head of SMBC Group’s India division, said the bank is focused on contributing to Yes Bank’s growth as its largest shareholder. The international news agency quoted Kannan saying, “We are not actively looking at increasing our stake in Yes Bank beyond the regulatory permissible limit of 24.99%”

Yes Bank: Other key stakeholders

SBI too continues to remain a major shareholder with a 10.8% stake in Yes Bank.

The other key shareholders include –

-Verventa Holdings

-Life Insurance Corporation of India (LIC)

–Vanguard

-Blackrock

–HDFC Bank

–ICICI Bank

Yes Bank: Two SMBC nominee directors inducted

This quarter also saw the induction of two SMBC nominee directors, further strengthening the governance structure. These include Rajeev Veeravalli Kannan – Managing Executive Officer and Head of the India Division in SMBC as well as in SMFG and Shinchiro Nishino – Head of Global Credit in the Risk Management Unit of SMBC.