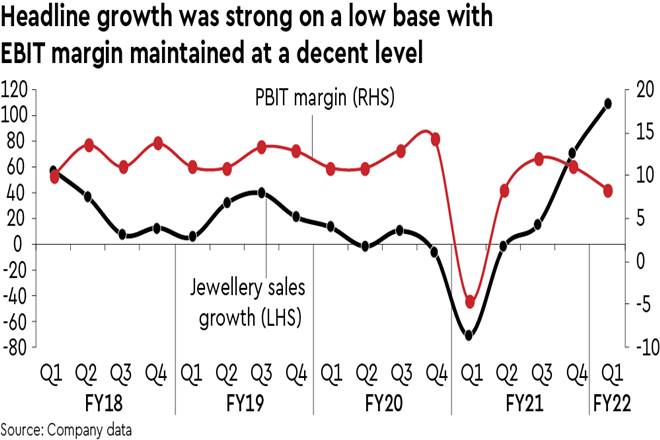

Titan saw a resilient performance amid disruptions, beating consensus: (i) impressive jewellery sales of cRs 25 bn (excluding Rs 4.2 bn bullion sales) in a disrupted Q1FY22 with store operational days in April/May/June of 73%/10%/ 58% of total. Recovery since June has been robust, led by new customers, faster rebound in metros, and pent-up demand for wedding sales; (ii) Titan delivered a jewellery Ebit margin of +8.4% (vs -4.6% last year), defying the Street’s scepticism on margins, aided by a better mix (studded sales 22% of total vs 18% in Q1), lower gold coin sales (7% vs 14% in Q1), and aggressive cost cutting; (iii) watch sales (up 3x y/y) and Eyewear (up 123% y/y) benefited from better traction in omnichannel sales. Ebit loss for both narrowed substantially y/y; (v) standalone sales grew 74% y/y and Ebitda/clean PAT came in at `1,440/`610 m, ahead of consensus.

Demand outlook remains strong: (i) Consumer sentiment is fast recovering. July demand rebounded well and Titan foresees robust demand in the coming quarters, especially in H2FY22; (ii) it added 26 jewellery stores in FY21 and it aims to open about 35 in FY22 to expand its network in middle India; (iii) together with the benign base in FY21, the accumulated network rollout augurs well for strong revenue growth in FY22e. We pencil in jewellery revenue growth of c25% in FY22e.

Market share gain for Titan should accelerate: (i) Titan is well placed to capture value from the jewellery sector’s long-term growth potential by gaining market share consistently; (ii) mandatory hallmarking (phased implementation from 16 June, 2021) is now another structural push for the industry towards organised trade, where Titan arguably has a ‘right to win’ with 100% of its jewellery hallmarked; (iii) It is also building long-term growth options, including choosing its international foray and new business such as Taneira (ethnic wear), which has begun well and could be a large value driver.

Retain Buy: The current share price builds in long-term earnings growth expectations of c15%, which can easily be achieved, as Titan is in a strong position to capture value from segment growth. We adjust our estimates and increase our TP to Rs 1,980 (from Rs 1,900); retain Buy.