The low return environment that India seems trapped in may get a breather in 2017 thanks to better equity valuations, the bottoming of the growth cycle (disrupted temporarily by demonetisation) and higher correlations with world equities on which we are more constructive. If history is a guide, the trailing EPS growth sets up Indian stocks for strong medium term performance. Our proprietary sentiment indicator has still not hit the buy zone so there may be some downside in the near term and thus, the recovery from the recent damage to share prices may not be V-shaped. India’s macro stability remains in its best shape in years and policy momentum is the best since 2007. The inflation trajectory suggests more rate cuts are in the pipeline.

Case for asset reallocation shift

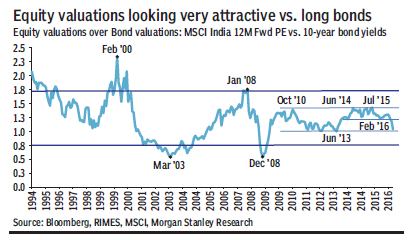

We think there is a case for a big asset allocation shift for domestic investors to equities – the last time an equivalent valuation opportunity in favour of equities arose was in June 2013. Valuation vs. EM is at a 26-month low. Superior growth prospects, a shift in funding mix to FDI, better terms of trade, reforms, and a domestic liquidity supercycle for stocks are driving India’s P/E premium. India’s overweight position in EM portfolios has eased to a 36-month low.

Three key calls

Stock returns: Equities likely to deliver 15% INR returns in 2017 compared to -3% in 2015 and 2016. Equity valuations relative to bonds best since the GFC. India is one of our top EM picks.

Strong demand for equities: Growth is in a U-shaped recovery albeit hurt in the near term by demonetisation. That said, we expect strong demand for equities from corporates (M&A) and domestic households (liquidity super cycle).

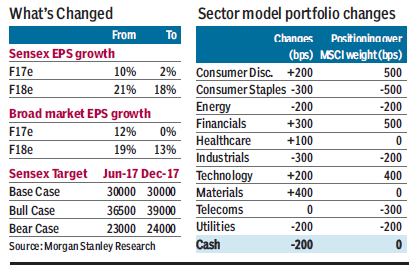

Underweight defensives, buy rate sensitives: We are putting cash back to work which we raised in September. We are overweight Consumer Discretionary, Financials, Technology and underweight Staples, Energy, Industrials, Telecoms and Utilities. We are adding JSW Steel, SCUF and Sun Pharma to our Focus List. Valuation dispersion may continue to fall and correlations across stocks should rise from here.

Key risks

1) Near term growth uncertainty arising from demonetisation; 2) further rise in commodity prices; 3) sharp decline in treasury yield premiums for India; 4) slippage in fiscal deficit; 5) elevated mid-cap valuations; and 6) rising return correlations globally.

Earnings: FY17 estimates fall

We cut our earnings estimates for FY2017 and FY2018 by 8% points and 3% points, respectively, and introduce estimates for FY2019.

We were more optimistic about earnings earlier this year but demonetisation has come as an unanticipated negative surprise leading to lower GDP growth estimates and therefore earnings. The estimates fall more for the broad market than the Sensex. While remaining in a U-shaped recovery, the recovery is likely to be pushed back by a couple of quarters.

We assess the outlook for earnings using two indicators: our proprietary Earnings Growth Leading Indicator (EGLI); and the Profit Equation approach. Our forecasts imply that broad market earnings growth may accelerate from -11% in FY2016 to 0% in FY2017 and 13% in FY2018 – a 6.1% CAGR. Correspondingly, we expect Sensex earnings growth of 2.5% for FY2017 and 16% in FY2018. For FY2019, we expect 15% EPS growth.

We arrive at the profit forecasts using changes in the macro variables of the investment rate, the external deficit and overall saving. Based on forecasts by Chetan Ahya, our Global Co-Head of Economics, profits may accelerate into FY2017 and FY2018 at a pace of 10.2% and 20.3%, respectively.

Index outlook

Base Case (50% probability) BSE Sensex: 30,000— All outcomes are moderate. Growth will slowly accelerate, and we expect Sensex earnings growth of 2.5%, 18% and 15% y-o-y in FY2017, FY2018 and FY2019, respectively. Broad market earnings growth will likely be 0%, 13% and 16%.

Bull Case (30% probability) BSE Sensex: 39,000— Better-than-expected outcomes – most notably on policy and growth – lead to a strong bull market aided by global factors. Earnings growth accelerates to 11%, 19% and 16% in FY2017, FY2018 and FY2019, respectively.

Bear Case (20% probability) BSE Sensex: 24,000—Policy response is tepid, and, more crucially, global conditions deteriorate. Sensex earnings grow -2%, 16% and 14% in FY2017, FY2018 and FY2019, respectively.

Catalysts for the market

Growth impact from demonetisation: We expect the growth impact to be more moderate than the street or share prices are estimating. Indeed, inflation could surprise on the downside.

Monetary policy: The RBI is likely to cut rates in December. Inflation trends may permit further rate cuts in 2017.

Policy momentum: While policy momentum is strong, further fillip to infrastructure spending, fiscal consolidation, progress on GST and corporate tax reforms could provide tailwinds to market.

Politics: There are significant state elections which have potential to create market volatility.

Global: Watch Fed rate moves, EM performance, commodity prices.

Bond markets: Bonds could exhibit volatility given the sharp drop in the yield gap with the US as the impact on liquidity from demonetisation ebbs.