Mukul Agarwal has done it again. He has sent the rumour mills into overdrive with his bold fresh moves. He has just added 10 new stocks to his portfolio worth Rs 385 cr. That is one of the biggest portfolio additions this filing season.

Agarwal now holds a total of 71 stocks in his portfolio with about Rs 7,440 cr, but it is these 10 new additions that have caught the fancy of investors all across. From Tech to Green energy, Engineering to Finance and from Drugs to Manufacturing, his new picks cover an entire spectrum.

What has triggered this mega buying spree? Let us try and decode.

#1 OSEL Devices: Riding the LED & hearing aid wave?

Incorporated in 2006, Osel Devices Limited manufactures LED display systems and hearing aids.

With a current market cap of Rs 1,024 cr, the company manufactures a comprehensive range of LED display systems and the latest hearing aids, including all major components, at an ultra-modern plant.

Mukul Agarwal just bought a 7.6% stake in the company worth Rs 77.5 cr.

The company’s sales have grown at a compound rate of 35% from Rs 57 cr in FY21 to Rs 186 cr in FY25.

The EBITDA has grown from Rs 3 cr in FY21 to Rs 33 cr in FY25, logging a compound growth of 82%.

As for the net profits, they have grown from Rs 1 cr in FY21 to Rs 20 cr in FY25, which is a 111% compounded growth in 4 years.

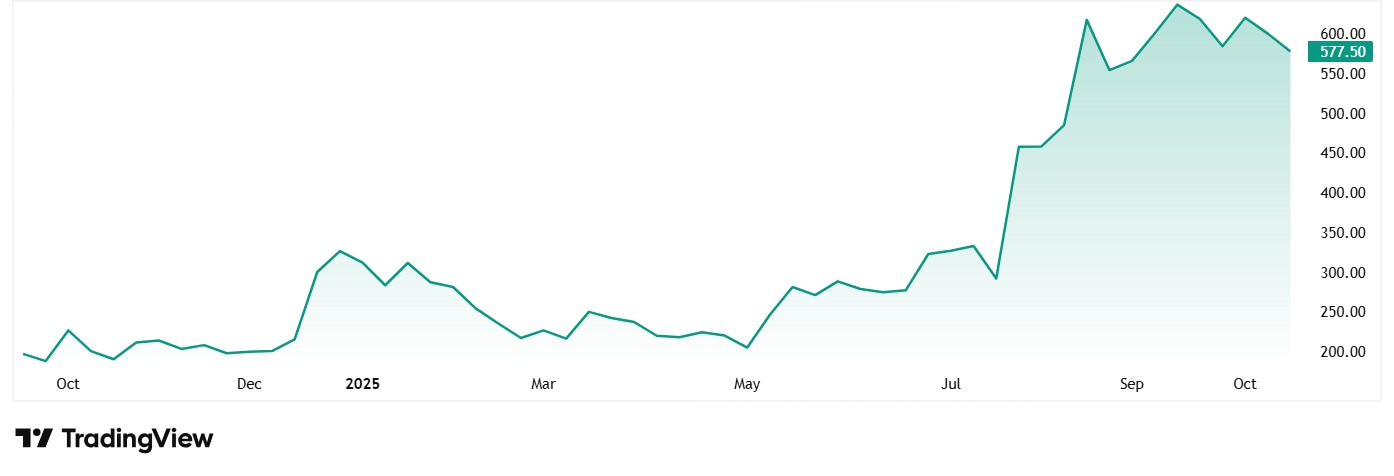

The share price of OSEL Devices Ltd was around Rs 208 when it was listed in September 2024 and as on 24th October 2025, it was at Rs 585, which is a 181% jump in just over a year.

The company’s share is currently trading at a PE of 51x, while the industry median is at 48x.

In the recent annual report, the Managing Director Rajendra Ravi Shanker Mishra said, “Looking ahead to FY 2025-26 and beyond, we see strong opportunities in expanding our product portfolio, exploring new markets, and leveraging technology for sustainable growth. Our focus will be on building upon our strengths to create value for our shareholders, customers, and all stakeholders.”

#2 IFB Industries: A bet on home appliance recovery?

IFB Industries Limited originally known as Indian Fine Blanks Limited started its operations in India in 1974 in collaboration with Heinrich Schmid AG of Switzerland.

With a market cap of Rs 7,816 cr, IFB Industries is engaged in the business of manufacturing diverse parts and accessories for motor vehicles etc. and home appliances.

Mukul Agarwal bought a 1.2% stake worth Rs 96.5 cr as per the latest exchange filings.

The company’s sales have grown at a compound rate of 14% in the last 5 years from Rs 2,551 cr in FY20 to Rs 4,942 cr in FY25. The EBITDA logged in a compound jump of about 19% in the same period from Rs 121 cr to Rs 293 cr. The net profits grew at a compounded rate of 36% from Rs 28 cr to Rs 129 cr in the same period.

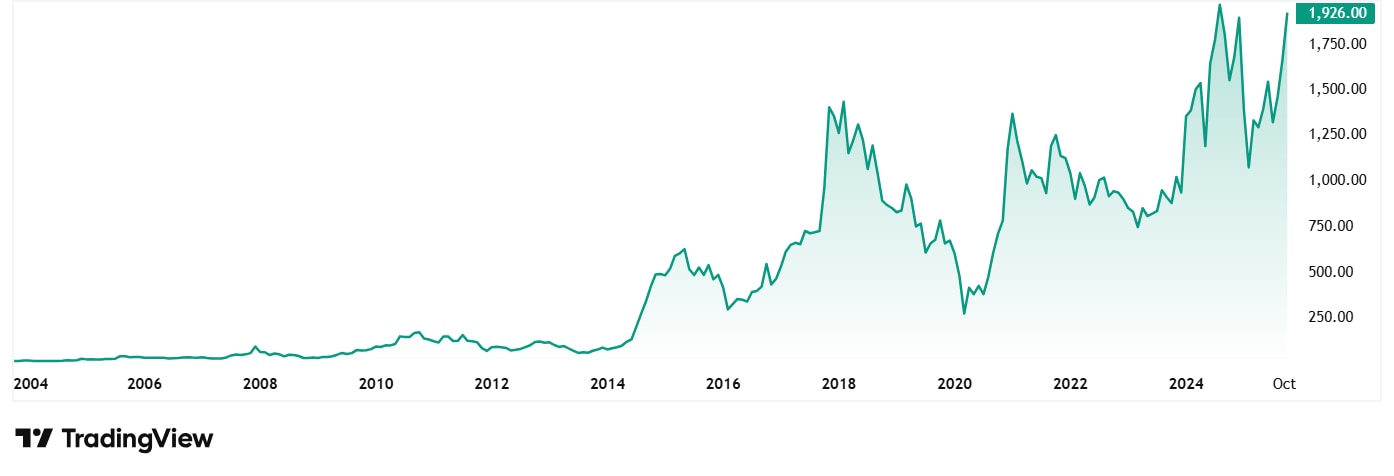

The share price of IFB Industries Ltd was around Rs 715 in October 2020, which has grown to Rs 1,919 as on 24th October 2025, which is a 168% jump.

The company’s share is trading at a current PE of 68x, and industry median is around 56x.

According to the recent investor presentation from August 2025, Q1FY26 was marked by margin compression due to higher material and fixed costs, with management acknowledging executional slippages. However, the company has a comprehensive cost optimization program underway, with significant recurring savings expected from FY26 onwards. The management remains confident of regaining margin momentum and volume growth in core categories.

The other big additions

Apart from the above 2 companies, Agarwal has also bought stakes in the following companies.

Kilitch Drugs (India) Ltd – A 1.3% stake worth Rs 8.7 cr

N R Agarwal Industries Ltd – A 2% stake worth Rs 16 cr

Protean eGov Technologies Ltd – A 1.5% stake worth Rs 52 cr

Solarium Green Energy Ltd – A 2.9% stake worth Rs 20 cr

Unified Data- Tech Solutions Ltd – A 5.3% stake worth Rs 45 cr

Laxmi India Finance Ltd – A 3.8% stake worth Rs 30 cr

Vikran Engineering Ltd – A 1.2% stake worth Rs 30 cr

Zelio E-Mobility Ltd – A 2% stake worth Rs 11 cr

That’s a total fresh investment worth Rs 385 cr!

Strategic investments or big risky bets?

Mukul Agarwal’s buy or sell decisions always influence the investor community. He makes every move in a calculated way backed by solid research. So, when he moves, the market takes notes. And this time, he has gone all out with a huge bet of over Rs 385 cr, sending shockwaves amongst the investor circles.

Once again, these 10 companies are not from any particular industry or sector. They are across sectors like tech, manufacturing, engineering, finance etc. The important question is, however, what is it that triggered this mixed bag of big buys.

Only Mukul Agarwal would be able to tell the reason. But for those interested in knowing how this big bet fares in the short and long term, add these stocks to a watchlist maybe?

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.