India’s shipbuilding and maritime capex cycle is booming, supported by government policies and a strong execution pipeline. This aligns with the government’s ambition to position India among the top five shipbuilding nations and a global ship-repair hub over the next decade.

This ambition is anchored by the Indian Navy’s force-level roadmap, which targets a fleet of 175–200 warships by 2035, up from the current strength of about 132 vessels. The near-to-medium-term order visibility is already meaningful. According to Krishna Defence, the Indian Navy currently has 68 warships and vessels on order, valued at around ₹2 lakh crore.

This ongoing build-out, combined with future fleet additions, ensures sustained demand not just for shipyards but across the wider maritime ecosystem. In parallel, port-led development and coastal infrastructure spending continue to support dredging, marine services, and specialised maritime construction.

The ₹2.35 Lakh Crore Horizon: India’s Maritime Super-Cycle

Against this backdrop, proxy plays become more important. Companies supplying defence components and building complex maritime structures are directly linked to the same capex cycle. Krishna Defence indicates that mega shipbuilding orders of nearly ₹2.35 lakh crore could materialise in FY26-27, about 3.1x the current combined order book of listed defence shipyards.

This capex is expected to benefit not only listed shipyard companies but also proxy plays. Let’s take a look at three such beneficiaries…

#1 Krishna Defence & Allied Industries: The Metallurgy Moat

Krishna Defence (KDAIL) is an engineering and manufacturing firm specialising in high-precision components for the defence and dairy sectors. Initially a manufacturer of dairy equipment, the company has become a critical player in India’s defence ecosystem, in naval shipbuilding and indigenous technology.

Business Vertical

Its clients include major shipbuilding companies such as Mazagon Dock, Cochin Shipyard, Garden Reach Shipbuilders, and Larsen & Toubro. The company operates in two business segments. In H1FY26, 92% of revenue came from the defence segment, and the remaining 8% from the dairy segment.

The “Bulb Bar” Bottleneck: Controlling the Navy’s Entry Barrier

In defence, KDAIL is an approved vendor for the Indian Navy and the Indian Army. Its core defence product portfolio includes Shipbuilding Steel Sections (Bulb Bars). These are KDAIL’s “hero” products, developed in-house to serve as stiffeners for the hull construction of Naval warships.

These sections offer a high strength-to-weight ratio, which maximizes a ship’s resistance to buckling. Notably, KDAIL is one of only two players approved to supply this product. KDAIL also manufactures steel-alloy welding wires and electrodes. These are used for high-tensile and high-impact-toughness weld joints on critical Naval platforms.

KDAIL produces armoured steel profiles for the chassis of main battle tanks, such as the T-90. This segment is expected to grow by 20% to 30% as the company adds more chassis-building products. The company also produces ballast bricks. These specialized steel-alloy bricks are used for underwater applications, offering high corrosion resistance and a low magnetic signature.

From T-90 Chassis to Silent Seas: The AUV Pivot

KDAIL is also aggressively expanding into higher-technology segments. This includes Autonomous Underwater Vehicles (AUVs). KDAIL has commenced construction on what is reportedly India’s largest AUV, built in accordance with advanced Naval designs.

This is a full-scale prototype intended for trials in December 2026. This is a great opportunity, as the Indian Navy has allocated approximately US$1 billion to the AUV program. Then come the Composite Doors and Hatches.

In a joint venture with VABO Composites (Netherlands), KDAIL is in the final stages of trials for supplying fire-resistant composite doors and hatches to the Indian Navy. The management’s goal is to capture 50% of the estimated market size of ₹100 crore. The company is also venturing into the aerospace components market.

KDAIL has successfully completed trials for large castings (up to five tons) for a major strategic defence project. Through its associate company, Waveoptix Defence Solution (40% stake), KDAIL is diversifying into the manufacturing of secure communication systems, radar telecom, and RF-over-fiber technologies for land, naval, and air applications.

In H1FY26, Waveoptix reported a profit of about ₹5 crore on revenue of ₹18 crore.

Asset Utilization: Scaling Without the Sunk Cost of Fresh Capex

To support this growth, KDAIL has doubled its capacity at its Halol, Gujarat facility, which became fully operational in April 2025. As of Q2 FY25, the facility’s capacity utilization was 60%, leaving room for increased production without any immediate capital expenditure.

KDAIL order book stood at ₹196 crore, providing revenue visibility of about one year. It expects an additional inflow of ₹100 crore to ₹150 crore during the second half of FY26.

The company’s growth is linked to the Indian Navy’s long-term roadmap to expand its fleet to 175-200 warships by 2035. Management expects to receive significant orders from upcoming mega-projects, including orders for next-generation corvettes, destroyers, frigates, and other fleet support ships.

Defence Industry Overview

From a financial perspective, revenue increased by 28% year-on-year to ₹120.5 crore. Of 92% defence contribution, 65-70% of revenue came from bulb bars. EBITDA grew by 52.9% to ₹21.6 crore, while margins expanded by 291 basis points (bps) to 17.9%.

Net profit increased by 47.4% to ₹15.6 crore. EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. Management attributed the improvement in margins to operational leverage gained from higher volumes.

#2 Dredging Corporation of India: The Depth Insurer

Dredging Corporation of India (DCIL) specializes in providing comprehensive dredging and marine solutions. The company acts as a strategic partner for major and minor ports in India, the Indian Navy, fishing harbors, shipyards, and inland waterways.

The Maintenance Mandate: Capturing 90% of India’s Navigable Depths

DCIL growth is tied to the Maritime India Vision 2030 and the Maritime Amrit Kaal Vision 2047, which seek to expand port capacity and transform major ports into transshipment hubs. Achieving these goals requires a significant increase in dredging capacity, which in turn fuels the requirement for a larger, more modern fleet built by the domestic shipbuilding sector.

DCIL provides an integrated value chain of essential services for marine infrastructure. Its core activities include maintenance dredging, which involves removing silt and debris to maintain specified depths in ports and harbors. DCIL holds an 89.6% market share in this segment among major Indian ports.

The Ageing Fleet Paradox: Navigating Interest Burdens and Breakdowns

DCIL operates a versatile and powerful fleet that includes 10 trailing suction hopper dredgers, 2 cutter suction dredgers, and a backhoe dredger, along with various ancillary crafts. However, the fleet faces a significant challenge due to an average age of over 23 years, leading to frequent breakdowns and high maintenance costs.

This fleet replacement cycle acts as a long-term demand catalyst for shipbuilders, particularly under the “Atma Nirbhar Program,” which prioritizes indigenous construction to reduce reliance on foreign contractors. In fact, to modernize its fleet, DCIL is currently overseeing the construction of the DCI Dredge Godavari at Cochin Shipyard.

Project Godavari: The October 2026 Turning Point for Capital Efficiency

Scheduled for commissioning in October 2026, this 12,000-cubic-meter vessel will be India’s largest and most advanced dredger. This dredger aims to enhance operational efficiency and support both maintenance and capital dredging orders.

This agreement with Cochin is part of a larger program to build three dredgers over the coming years, with the second scheduled for 2028. The cost of the new dredger is about €104.59 million, representing a big capital flow into the domestic shipbuilding ecosystem.

In addition, DCIL promotes growth in the shipbuilding and heavy engineering sectors through strategic alliances. It has signed a Memorandum of Understanding with BEML to promote the indigenous manufacturing of dredgers and spare parts. DCIL also facilitates technology transfer to Indian shipyards through partnerships with global companies.

Turning the Tide on Maintenance Costs

DCIL’s management is also focusing on backward integration to diversify into new business areas. This strategy specifically includes expanding into shipbuilding and ship repair, manufacturing of auxiliary vessels, and manufacturing of spare parts. Financial performance, however, has been weak.

Ageing Fleet Continues to Weigh on Profitability

In H1FY26, revenue increased by 28% year-on-year to ₹454 crore, driven by an increase in orders and project execution. However, it reported a net loss of ₹34 crore, the same as the previous year. Ageing fleet costs and foreign exchange fluctuation impacted its bottom line.

As of 30 September 2025, DCIL’s order book stood at ₹1,422 crore, providing revenue visibility for approximately 1.25 years. Management expects a significant improvement in the revenue profile once the new vessel becomes operational in FY27.

#3 Cemindia Projects: The Adani Era of Maritime Civil Engineering

Cemindia Projects (formerly ITD Cementation) maintains a robust presence in the construction of specialized maritime and defence-related infrastructure. Cemindia became an Adani Group entity following its acquisition by Renew Exim DMCC in 2025. It operates across 15 states and one union territory in India, with a presence in Sri Lanka and Bangladesh.

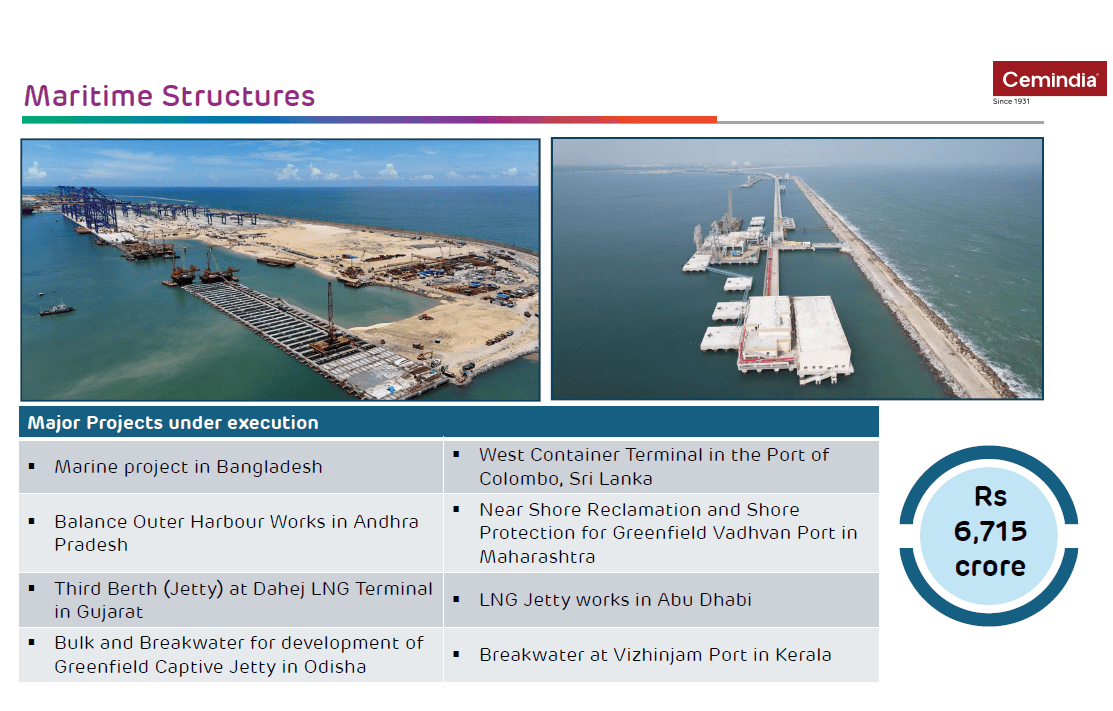

Cemindia Maritime Segment

The Maritime Structures segment accounts for the largest share of the order book, with ₹6,715 crore, representing 32.5% of the total order book as of H1FY26. Its expertise includes a variety of structures critical for the docking, repair, and protection of ships:-

- Ship Lifts and Dry Docks: The company builds ship lifts, dry docks, and wet basins, which are specialized civil structures used to lift ships out of the water for repair or maintenance.

- Breakwaters: These structures protect harbors and ships from wave action. The company is currently executing breakwater projects at Vizhinjam Port in Kerala and a captive jetty in Odisha.

Strategic Deep Dives: Executing the “Tough Jobs” of Project Varsha

Cemindia is deeply involved in high-stakes infrastructure for the Indian armed forces.

- Project Varsha: This is a major project for the Indian Navy. Management described it as a “tough job” that they successfully delivered, meeting the client’s strict requirements for timeline and quality. As of late 2025, the company is the L1 for additional work on Project Varsha, with a contract value close to ₹1,000 crores.

- Project Sea Bird: Cemindia lists this as a landmark project in which the company has participated, further establishing its credentials in naval infrastructure.

Beyond naval ships, Cemindia is involved in other defence-related industrial structures, such as the Thal Sena Bhawan (the new Indian Army headquarters) in Delhi and an Aerospace museum at the Air Force station in Palam, Delhi.

Strategic Synergy: The Adani Infrastructure Flywheel

Looking ahead, the company sees a significant opportunity in the government’s initiative to develop shipbuilding clusters. These clusters are expected to be located near ports and will require the construction of specialized shipyards. Management states that Cemindia is well-positioned for this because it can build the necessary infrastructure.

From a financial perspective, Cemindia’s revenue in H1 FY26 increased by 8% year-on-year to ₹4,718 crore, driven by execution of the order book. EBITDA grew by 13% to ₹496 crore, with a margin of 10.5%. Net profit increased by 42% to ₹245 crore. Management maintains a revenue growth target of approximately 20% to 22% for FY26

The Valuation Gap

Dredging Corporation’s return ratios are not available due to its negative bottom line. This is why, despite being a leading company, it trades at a discount to both its 5-year median and the industry median. Krishna Defence and Cemindia have strong Return on Capital Employed (RoCE) and Return on Equity (RoE).

| Valuation Comparison (X) | |||||

| Company | EV/EBITDA | 5Y Median EV/EBITDA | Industry EV/EBITDA | RoCE (%) | RoE (%) |

| Krishna | 29.7 | 33.8 | 34.3 | 24.3 | 18.4 |

| Dredging | 16.3 | 15.4 | 35.3 | NA | NA |

| Cemindia | 13.8 | 7.1 | 11.0 | 27.6 | 21.8 |

| Source: Screener.in | |||||

Krishna is trading at a discount relative to both its median and the industry median multiples, while Cemindia is trading at a premium relative to both its median and the industry median. Taken together, these companies offer indirect exposure to India’s shipbuilding and maritime build-out, each anchored to distinct demand drivers, execution profiles, and capital-return characteristics within the same capex cycle.

Disclaimer:

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data were unavailable have we used an alternate, widely accepted, and widely used source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities, or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.