Despite the ongoing rally in benchmark indices, the recovery hasn’t been broad-based. Only a handful of stocks have managed to climb back to their highs from last year’s market peak.

Consider the Nifty 50. The majority of its constituents are still catching up, even though it is currently less than 5% below its record high and has recovered by almost 14% from its most recent low of 21,750.

Indeed, more than 80% of the stocks—41 out of 50—have not yet recovered to their September 2024 levels.

It’s a similar story in the broader markets. More than 72% of NSE 500 stocks are still trading below their previous high levels.

And for nearly 1 in 4 of them, the gap is steep—down over 20% from those highs. On the flip side, only a tiny fraction, less than 5%, have managed to gain more than 25%.

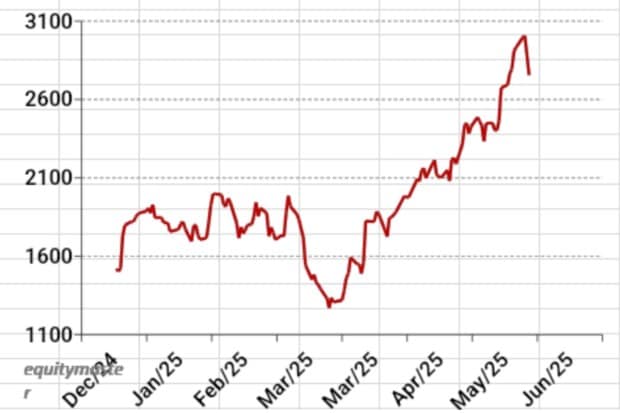

Among the rare bright spots is BSE Ltd, which has rallied an impressive 52% in 2025, making it one of the standout performers in an otherwise uneven recovery.

About BSE

The oldest stock exchange in Asia and one of the biggest in the world, BSE Limited was established in 1875.

The Mumbai-based business facilitates trading in derivatives, stocks, and other financial products.

The BSE, which has more than 5,600 listed companies, is important to the financial markets and economic development of India.

The biggest online mutual fund platform in India, BSE Star MF, adds nearly 200,000 new SIPs each month and handles over 2.7 million transactions.

BSE Bond is the transparent and efficient electronic book mechanism process for a private placement of debt securities.The stock hit its all-time high of Rs 3,030 on 10 June 2025. Here’s why the stock soared in 2025…

#1 A Strong Start to the Year

BSE’s rally really picked up steam in February after it posted a solid set of numbers for the December 2024 quarter.

Revenue nearly doubled, rising 94% to Rs 8.3 billion (bn) and net profit jumped to Rs 2.2 bn—twice what it was a year earlier.

Activity in the equity cash segment improved slightly, but the real boost came from the derivatives side, which saw a sharp spike in trading volumes.

#2 Big Boost from a Block Deal

Investor sentiment got another lift when global investment firm Goldman Sachs picked up 728,000 shares in a big-ticket block deal.

Block deals like this—usually involving large, one-shot transactions by institutions—often signal confidence in a company’s prospects.

This one certainly helped put BSE on many investors’ radars.

#3 Bonus Issue Sparks Buzz

On 30 March BSE announced a 2:1 bonus share issue. Shareholders will receive 2 extra shares for every share they own.

The announcement was well received. The record date for the same was 23 May and the news added to the excitement around the stock.

#4 Another Record-Setting Quarter

When the BSE released its Q4 FY25 results in May 2025, the momentum was still going strong. Operational revenue increased 74.9% year over year to Rs 8.4 billion.

Operating EBITDA increased by a staggering 291% year over year to Rs 14.9 billion, while margins improved from 28% to 51%. At Rs 4.9 billion, the net profit increased 361.7 percent year over year.

The net profit for FY25 increased 245% year over year to Rs 13.26 billion, and the net margin increased from 25% to 41%. The BSE’s highest-ever annual revenue of Rs 32.36 billion was achieved.

#5 Strategic Partnership

In order to strengthen its digital infrastructure, BSE announced a partnership with CtrlS Datacenters on June 5, 2025.

Through this partnership, BSE will be able to serve more than 110 customers and process over 7 billion transactions every day.

Shares of the BSE Take a Break

One of the most exciting stocks of 2025 was the BSE, but following an incredible surge, it is now beginning to show signs of exhaustion.

As investors booked profits, the stock fell more than 4% on Thursday, June 12, its second consecutive day of losses.

What Caused the Unexpected Drop?

The stock is now down more than 8% from its most recent peak after a similar 4% decline the day before.

What caused the sell-off?

In an effort to reduce excessive speculation, the NSE placed BSE under the Additional Surveillance Measure (ASM).

As a result, trading BSE shares now requires a 100% upfront margin, which tends to discourage short-term investors and calm down excessive trading.

The timing of the ASM move comes after a sharp 140% rally from BSE’s March lows.

Much of this surge was driven by growing interest in India’s equity derivatives market and excitement around the potential IPO of NSE, BSE’s privately held rival.

Cracks Beneath the Surface?

According to the market experts, there’s no doubt that BSE has been riding a wave of momentum, especially from its booming derivatives business.

The average daily premium turnover in its equity derivatives segment jumped a whopping 293% YoY in Q4 FY25.

However, things are not always easy. This industry is closely related to the mood of the market. Revenue can be thrown off course by any increase in volatility or decrease in trading sentiment.

Profitability is another issue.

The National Clearing Corporation Ltd. (NCL) receives a sizable amount of BSE’s clearing charges; although talks are underway to lower these expenses, the results are uncertain. Until resolved, this will continue to weigh on BSE’s operating margins.

And let’s not forget the global picture, geopolitical tensions and any shake-up in global markets could cast a shadow over Indian equities, including BSE.

Conclusion

Following recent regulatory actions and a 140% increase from its March lows, many investors have paused and reevaluated.

Individual goals determine what happens next. While some might adopt a more cautious stance, others might decide to ride out the volatility.

BSE is still concentrating on bolstering its operations in the interim. In addition to trying to draw in more foreign investors and broaden its product line, the exchange is modernizing its trading systems to increase speed and dependability.

Additionally, it seeks to increase interest in monthly contracts, especially for the bank index, and more evenly distribute trading activity throughout the week.

Exchanges like the BSE will be an essential component of the ecosystem as India’s capital markets develop further and more households invest in stocks.

Depending on their objectives, risk tolerance, and outlook, investors may react differently to recent events.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.