India’s specialty chemical sector has emerged as one of the fastest-growing segments of the economy. It’s driven by strong global demand, a strategic China+1 shift, and robust domestic manufacturing capabilities.

These chemicals are used in pharma, agrochemicals, electronics, batteries, and personal care, offering high margins and strong export potential.

Backed by aggressive capex, R&D investments, and government support, these companies are delivering strong revenue growth and consistent returns.

This article highlights five fastest-growing specialty chemical stocks in India, exploring what sets them apart, their strategic plans, and why they present compelling opportunities for long-term investors.

These stocks are filtered using Equitymaster’s powerful stock screener – Fastest Growing Speciality Chemical Stocks.

#1 PI Industries

First on the list is PI Industries Ltd.

PI Industries Ltd is a leading player in the agro-chemicals space, having a strong presence in both Domestic and Export markets.

Th key business segments of the company are:

1. Agro Chemicals: This segment is divided into agchem CSM exports and domestic agri brands.

2. Pharma: This comprises Contract Research and Manufacturing Services (CRAMS), key starting materials, and intermediates used in the pharma industry. The company is a leader in CRAMS, catering to global MNCs, with long-term, high-margin contracts.

The management anticipates a growth trajectory of 20-25% YoY in the pharma segment over the next two to three years.

The biologicals segment is also expected to grow at more than 25-30% next year, with aspirations to become a dominant player in the market.

The company is building a strong portfolio in electronic chemicals due to emerging semiconductor opportunities in India.

It has planned investments of Rs 8-10 billion (bn) for the upcoming year, including the construction of two new multiproduct plants.

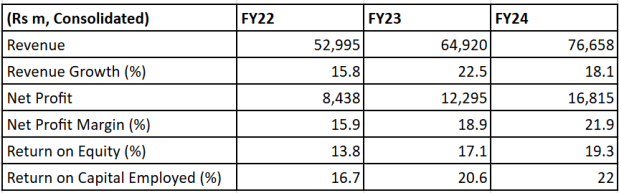

PI Industry’s Financial Snapshot (FY22-24)

Its revenue grew at a CAGR of 18.8% over past three years, while its net profit grew at the CAGR of 31.6%.

The company maintained strong financial health, with an average RoE of 16.7% and RoCE of 19.8%.

#2 Gujarat Fluorochemicals

Next on the list is Gujarat Fluorochemicals Ltd (GFCL).

Incorporated in 2018, it is one of the leading producers of Fluoro-polymers, Fluoro-specialities, chemicals, and refrigerants in India.

It’s one of the top five global players in the fluoropolymers market with exports to Europe, the Americas, Japan, and Asia, and the only Polytetrafluoroethylene (PTFE) / fluoropolymer manufacturer in India.

The company is also a leading producer of industrial chemicals such as caustic soda, chloroform, methylene dichloride, CTC, etc. It is one of the major producers of chloroform and MDC.

The company is planning for the capacity expansion of 30,000 tons of R-32 (a refrigerant gas commonly used in air conditioning systems), with the first phase expected by Q4 FY26, with an initial investment of Rs 1.5 bn.

GFCL is committed to a cumulative capital expenditure of Rs 60 bn by FY28.

The company has begun offering EV battery materials through its 100% subsidiary, GFCL EV Products Limited, which caters to 40% value of lithium iron phosphate (LFP) battery cost.

It’s preparing to tap significant global opportunities presented by the EV & ESS eco-systems with a fully integrated battery materials complex in Jolva, Gujarat, with the initial capacity already set up.

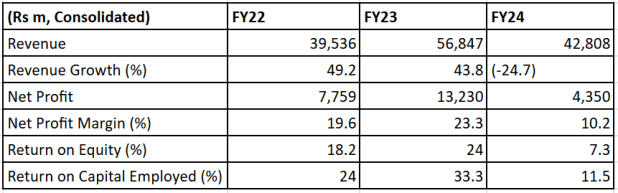

Gujarat Fluorochemicals Financial Snapshot (FY22-24)

Its revenue grew at a CAGR of 17.3% over past three years, while its net profit grew at the CAGR of 75.6%.

The company maintained strong financial health, with an average RoE of 16.5% and RoCE of 22.9%.

#3 Navin Fluorine International

Next on the list is Navin Fluorine International Ltd.

Navin Fluorine International Ltd is primarily engaged in producing refrigeration gases, inorganic fluorides, specialty organofluorines, and offers contract research and manufacturing services (CRAMS).

The company’s product portfolio comprises 60+ fluorinated compounds, with application in various industries, like agrochemicals, pharmaceuticals, aluminium smelting, refrigeration, metal processing, abrasives, glass, and ceramics.

The company’s business segments are:

1. High-performance products (HPP), which include refrigerant gas, inorganic fluorides, etc. Recently, the company has started manufacturing HPP, named hydro-fluoro-olefins (HFO) (used as refrigerants, blowing agents, propellants, and solvents in various applications).

2. Contract Development and Manufacturing Organization (CDMO) (includes the CRAMS segment)

3. Specialty chemicals (specialty fluorochemicals).

In the HPP business vertical, Anhydrous Hydrogen Fluoride (AHF) capex for Rs 4.5 bn is expected to be commissioned by Q2 FY26.

In the specialty business segment, two new molecules are planned, with supplies to begin in Q1FY26.

The company is expanding its footprint into a niche advanced materials space to address data centre cooling needs created by AI and next-generation chips.

It has formed a strategic partnership with Chemours and set up a manufacturing facility at Surat, Gujarat, at an estimated capex of US$ 14m, including a US$ 5 m contribution by Chemours.

The project is expected to be operational between April-June 2026.

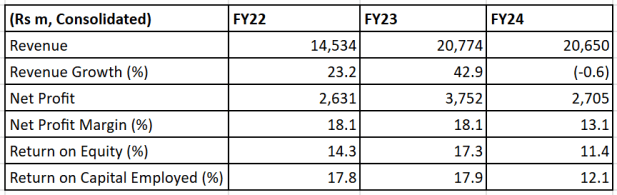

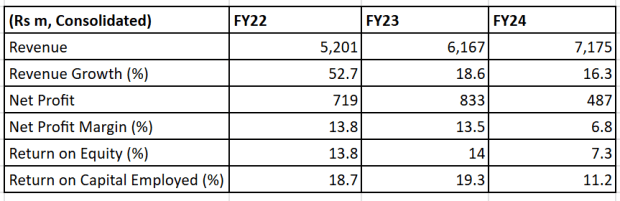

Navin Fluorine’s Financial Snapshot (FY22-24)

Its revenue grew at a CAGR of 20.5% over past three years, while its net profit grew at the CAGR of 3.1%.

The company maintained strong financial health, with an average RoE of 14.3% and RoCE of 15.9%.

#4 Vinati Organics

Next on the list is Vinati Organics Ltd.

Incorporated in 1989, Vinati Organics Ltd manufactures specialty organic intermediaries and monomers.

The company offers various intermediates used to manufacture pharmaceutical products, flavour and fragrance ingredients, polymer additives, and more in its specialty aromatics segment.

It also offers a range of chemicals that are used for designing unique polymer structures in its specialty monomers segment.

The management anticipates double-digit growth in FY26 for ATBS (acrylamido tertiary-butyl sulfonic acid).

Veeral Organics (VOPL), a subsidiary of Vinati Organics, a specialty chemicals manufacturer, has a revenue guidance for FY26 estimated at Rs 1 bn.

The revenue guidance by management is 20% CAGR over the next 3 years, led by Acrylamido tertiary-butyl sulfonic acid (ATBS), butyl phenols, AO, and new VOPL products.

The company’s upcoming products in Q2/Q3 FY26 are targeting polymerization inhibitors, oil filters, resins, flavours, fragrances, personal care, and pharma.

The expected capex of Rs 3.6 bn will be for expansion, innovation, and efficiency.

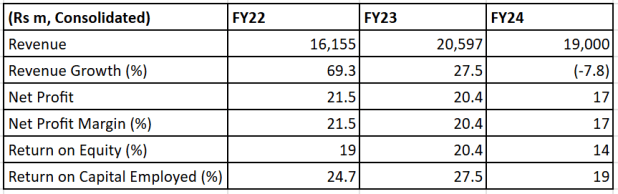

Vinati Organics’ Financial Snapshot (FY22-24)

Its revenue grew at a CAGR of 25.8% over past three years, while its net profit grew at the CAGR of 6.2%.

The company maintained strong financial health, with an average RoE of 17.2% and RoCE of 23.7%.

#5 Ami Organics

Last on the list is Ami Organics Ltd.

Ami Organics is a leading research and development-driven manufacturer of specialty chemicals.

The company manufactures different types of active pharmaceutical ingredients (API) for new chemical entities, and materials for agrochemicals and fine chemicals.

Key offerings in the specialty chemical segment include parabens and their formulations, methyl salicylate, semiconductor chemicals, and electrolyte additives used in energy storage cell manufacturing.

These products find applications in cosmetics, fine chemicals, agrochemicals, battery chemicals, and semiconductor industries.

The company is also in the semiconductor chemicals business through Baba Fine Chemicals – the only Indian player in photo resist chemicals. This is the first company in India to manufacture electrolyte additives, which are used in manufacturing cells for energy storage devices.

The company has signed an MOU with the government of Gujarat for investment of Rs 3 bn for an electrolyte manufacturing facility. The electrolyte additive plant, with a total planned outlay of Rs 1.77 bn, is on track for completion by H1 FY26.

Top clients in the specialty chemical segment are Reliance Industries, Himalaya, Cosphatec, and Huntsman.

Ami Organics’ Financial Snapshot (FY22-24)

Its revenue grew at a CAGR of 28.2% over past three years, while its net profit grew has seen a degrowth

The company maintained strong financial health, with an average RoE of 11.7% and RoCE of 16.4%.

Conclusion

Strong demand across end-user sectors, driven by expanding domestic consumption, strong export growth, and increased import replacements, is likely to be the key growth drivers for the speciality chemical sector.

Many Indian specialty chemical firms have developed specific competencies and built supply partnerships with global supply chains.

However, one factor to keep in mind is that aggressive pricing and subsidies from Chinese players can impact profitability and investor sentiments.

Investors should evaluate the company’s fundamentals, corporate governance, and valuations of the stock before making any investment decisions.

Happy Investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.