NMDC’s Q2FY24 EBITDA fell short of our expectations, primarily driven by lower realisations attributed to the increased volume contribution from Karnataka. Despite strong demand, alleviation of evacuation constraints resulted in a 25% y-o-y volume growth in in the first seven months of fiscal year 2024 (7MFY24). Consequently, we are revising our volume estimates upward by 5%/3% for FY2024/ 25E (estimates). In the short term, there is an upside risk to domestic iron ore prices, influenced by buoyant international iron ore prices. However, this may be partially offset by downward pressure on domestic steel prices. We revised our FV to Rs180 based on the rollover and improved earnings outlook.

Ebitda miss on lower realisations

NMDC posted revenues of Rs 4,010 crore (+21% y-o-y, -26% q-o-q), Ebitda of Rs 1,190 crore (+40% y-o-y, -40% q-o-q), and net profit of Rs 1,030 crore (+16% y-o-y, -38% q-o-q), falling short of our estimates of Rs 4,400 crore, Rs 1,350 crore, and Rs 1,150 crore. Volumes reached 9.6 million tonne, up 13.5% y-o-y but down by 12.8% q-o-q. Blended realisation declined sequentially to Rs 4,194/tonne (+6.2% y-o-y, -15% q-o-q), primarily due to an unfavourable geo-mix. Karnataka, accounting for 37% of volumes in Q2FY24 compared to 30% in Q1FY24, contributed to this decline due to its lower quality iron ore and consequently, lower realisations compared to Chhattisgarh.

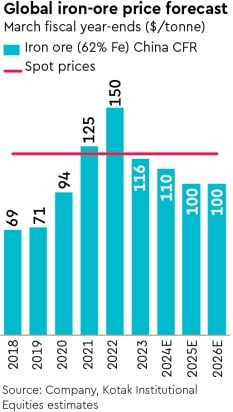

The seaborne ironore price has surged by 10-12% from the Q2FY24 average to its current levels, hovering around the $125/tonne range. This upward momentum is primarily driven by growing optimism regarding China’s stimulus measures, coupled with supply concerns emanating from major producers. In October 2023, NMDC implemented a 6% price hike, and presently, its current pricing reflects an 8% discount compared to export parity prices. In the short term, we anticipate upward pressure on domestic iron ore prices, although this may be partially counteracted by recent declines in domestic steel prices. Our projections for NMDC’s Ebitda stand at Rs 1,665/1,479/tonne in FY2024/25E, representing an increase from Rs 1,552/tonne recorded in 1HFY24.

Ongoing projects to drive volume growth

The company has provided guidance for volumes in FY2024E, targeting 47-49 million tonne, reflecting a robust y-o-y growth of approximately 25%. Furthermore, the outlook for FY2025E is optimistic, with an anticipated increase to around 50 million tonne. NMDC foresees substantial growth driven by various projects, including the development of a slurry pipeline, the expansion of the K-K rail line, and the establishment of a beneficiation and pellet plant. We see structural headwinds in the domestic iron ore market for merchant miners given increasing iron ore integration of steel majors. We upgrade our volume estimates to 44/45.5 million tonne in FY2024/25E (+5%/+3%) factoring the 7MFY24 performance but remain lower than the company guidance and have upside risks.

We have increased Ebitda estimates by 5.1%/8.6%/9.7% for FY2024/25/26E factoring higher volumes and margins. Downgrade rating to ADD from BUY given the recent outperformance.