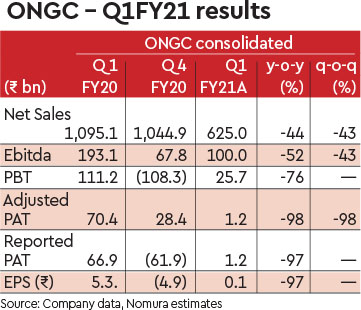

ONGC’s reported Q1 standalone revenue of Rs 130 bn (-51% y-o-y, -39% q-o-q) came in 7% below our/Bloomberg consensus’ estimates, driven by 4% lower oil sales volumes and 6% lower oil sales realisation. However, standalone Ebitda at Rs 59 bn (-61% y-o-y, -31% q-o-q) was 16% above consensus and 63% above our estimate, driven by lower other expenses (-51% q-o-q, -16% y-o-y) owing to lesser provisioning. Q1 standalone PAT of Rs 5 bn (vs our/consensus’ estimates of a loss) was down 92% y-o-y driven by a sharp decline in crude oil prices as well as lower production due to COVID-19 lockdowns.

Oil volumes below our estimates; COVID-19 impacted gas demand

Oil production at 5.7mmt (-4% y-o-y, -3% q-o-q) and sales at 5.2mmt (-3% y-o-y, -5% q-o-q) were 1%/4% below our estimates, respectively. Gas production at 5.6bcm (-14% y-o-y, -8% q-o-q) and sales at 4.2bcm (-15% y-o-y, -9% q-q) were in line with our estimates. Value-added product sales at 0.66mmt declined a sharp 29% y-o-y.

We note that while oil production/sales were relatively resilient, gas production/ sales decline was steeper due to demand destruction from COVID-19 lockdowns. However, with lockdown relaxations, gas demand has improved and production has been restored to pre-lockdown levels. The impact on oil production was not material; however, due to supply chain disruptions, timelines for key projects like KG gas block have been pushed back.

Q1 realisation weaker than our estimate Oil realisation (net of VAT/CST) at $29/bbl (vs Brent at $31.6/bbl, OINL: $30.4/bbl) was 6% below our estimate. However, oil prices have recovered to $45/bbl levels so far in Q2FY21F. Gas realisation at $2.4/mmbtu was down 28% q-o-q due to a sharp 26% cut in domestic gas prices from 1 April 2020. We note that domestic gas prices are likely to fall further to ~$1.9-2/mmbtu from 1 October 2020.

OVL continued to be in losses

OVL’s oil production at 2.2mmt fell 5% q-o-q and 10% y-o-y, while gas production at 1.2bcm declined 6% q-o-q and 10% y-o-y. OVL reported a Q1 loss of Rs 3 bn due to lower production and subdued oil/gas prices.

Valuation

We use a SOTP valuation methodology to derive our TP for ONGC. We value ONGC’s standalone domestic business at 0.33x FY22F adjusted price/book. We value its overseas E&P subsidiary, ONGC Videsh Ltd (OVL, unlisted), at 6x FY22F P/E. We value its stake in listed investments at the current market price less a 20% holding company discount to arrive at our TP of `65, implying 18% downside. The stock currently trades at 0.44x FY22F adjusted P/B (adjusted FY22 BVPS of Rs 126).