Market Update at 14:15 PM: The stock market remained under pressure, with the Sensex plunging 893.90 points to 74,415.95, while the Nifty slipped 255.55 points to 22,540.35, marking a decline of over 1.12%. The Nifty Bank index also traded lower, down 0.83% at 48,537.85.

Market Update at 13:15 PM: The stock market continued to trade in the red in the intraday trading, with both Sensex and Nifty slipping over 1%. The Sensex fell 805.32 points to 74,508.69, while Nifty dropped 234.50 points to 22,561.45 as selling pressure gripped investors.

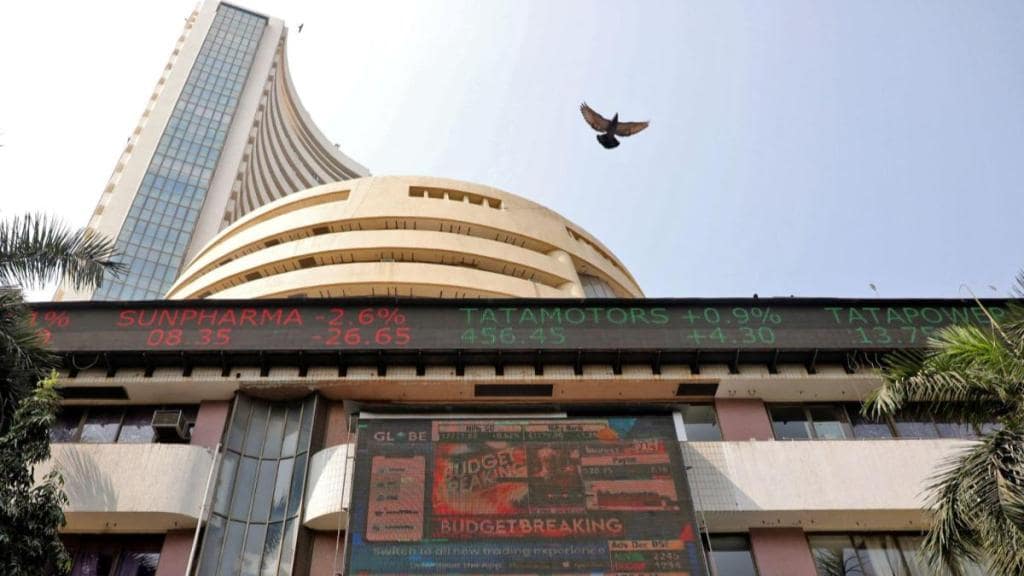

IT stocks took a sharp hit, with Wipro, HCL Tech, Infosys, Bharti Airtel, and TCS among the biggest losers. Meanwhile, some stocks bucked the trend such as Dr Reddy’s Labs, Eicher Motors, M&M, Nestle, and Bharat Electronics managed to stay in the green. Midcap and smallcap indices down 0.5% each.

Market Update at 11:25 AM: The Indian stock markets were trading in the red, extending their losses for the fifth consecutive session. Sensex was down 734.34 points or 0.98%, trading at 74,576.72. Nifty 50 slipped 218.20 points or 0.96%, falling to 22,577.70.

BSE MidCap index declined 0.92% to 40,000.97. Similarly, BSE SmallCap index was also in the negative, losing 0.91% to trade at 45,438.36.

Among the top gainers in the market as of now include Nestle India, M&M, ITC, Sun Pharma, and Hindustan Unilever. On the other hand, major laggards included HCL Tech, Zomato, Infosys, TCS, and HDFC Bank, dragging the indices lower.

“Technically, on both daily and weekly charts, the market is still holding a lower top formation and is trading below the 20-day SMA (Simple Moving Average), which is largely negative. We believe that the larger market texture remains on the weak side; however, we could expect a quick technical pullback rally if it succeeds in holding above 22950/76000. If it does, it could bounce back to 23100-23200/76500-76800. On the other hand, if it falls below 22720/75100, the correction wave is likely to continue. Below that level, it could slip to 22500-22400/74400-74100. Near 22400/74100, contrarian traders may prefer to take a long bet with a strict stop loss of 22320/73800,” said Shrikant Chouhan, Head – Equity Research.

As of now, the major gainers from the Sensex 30 pack include M&M, Sun Pharma, Maruti, Bajaj Finserv, and Nestle India. On the other hand, the laggards in the early trade were HCL Tech, Zomato, Tech Mahindra, TCS, and Infosys.

Market Recap

The Indian stock market ended the week on a weaker note, with both the BSE Sensex and NSE Nifty closing lower on Friday. The benchmark Sensex dropped 0.56%, settling at 75,311.06, while the Nifty slipped 0.51% to end at 22,795.90.

This marks the fourth consecutive session of losses for the market. Over the past four trading days, Sensex has shed 685.8 points or 0.90% while the Nifty has declined by 163.6 points or 0.71%.

“The market is facing headwinds from relentless FII selling and global uncertainties relating to Trump tariffs. The sharp surge in Chinese stocks is another near-term headwind. The ‘Sell India, Buy China’ trade may continue for some time since Chinese stocks continue to be attractive. The sharp spike in CBOE VIX indicates that volatility will continue for some time. In the US, long-term inflation expectations are rising and, therefore, the expected rate cut by the Fed is unlikely to materialise. The Fed might even turn hawkish, impacting US stock markets. If this happens and the US bond yields start declining, FIIs may cease to be sellers in India and may even resume buying. The near-term scenario is highly uncertain,” said Dr. V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services.

Gold price today

Gold prices in India saw a slight decline on Monday, February 24, with 24 carat gold priced at Rs 8,805 per gram, while 22 carat gold rate today is available at Rs 8,071 per gram, according to Goodreturns.

For those looking at 18-carat gold, the price stands at Rs 6,604 per gram. When it comes to 10-gram rates, the latest prices are 24K gold at Rs 87,760; 22K gold at Rs 80,440 and 18K gold at Rs 65,810.