KRN Heat Exchanger IPO Highlights: KRN Heat Exchanger is set to launch an initial public offering (IPO) worth Rs 341.95 crores. This issue is entirely a fresh offering of 1.55 crore shares. Bidding for the KRN Heat Exchanger IPO began on September 25, 2024, and concluded on September 27, 2024. Allotments are expected to be finalised on Monday, September 30, 2024. The shares are scheduled to list on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) on Thursday, October 3, 2024. The price band for the IPO is set between Rs 209 and Rs 220 per share. Holani Consultants Private Limited is the book-running lead manager for the KRN Heat Exchanger IPO, and Bigshare Services Pvt Ltd serves as the registrar for the offering.

KRN Heat Exchanger IPO 2024 Live Updates: Allotment, Subscription status, GMP, Listing Time and Date Details here.

KRN Heat Exchanger is launching a main-board IPO, offering 15,543,000 equity shares with a face value of Rs 10 each, amounting to a total of Rs 341.95 crores. The price range for the shares is set between Rs 209 and Rs 220 per share, with a minimum order of 65 shares required.

The IPO will open on September 25, 2024, and close on September 27, 2024.

Bigshare Services Pvt Ltd has been appointed as the registrar for the IPO, and the shares are expected to be listed on both the BSE and NSE.

KRN Heat Exchanger and Refrigeration Ltd is a premier manufacturer specializing in fin and tube-type heat exchangers. The company produces heat exchangers featuring copper and aluminum fins with copper tubes, including water coils, condenser coils, and evaporator coils. Their heat exchanger tubes come in a variety of shapes and sizes, ranging from diameters of 5 mm to 7 mm, 9.52 mm, 12.7 mm, and 15.88 mm. These products are widely used across domestic, commercial, and industrial applications within the Heating, Ventilation, Air Conditioning, and Refrigeration (HVAC&R) industry.

Source: KRN Heat Exchanger and Registration Limited

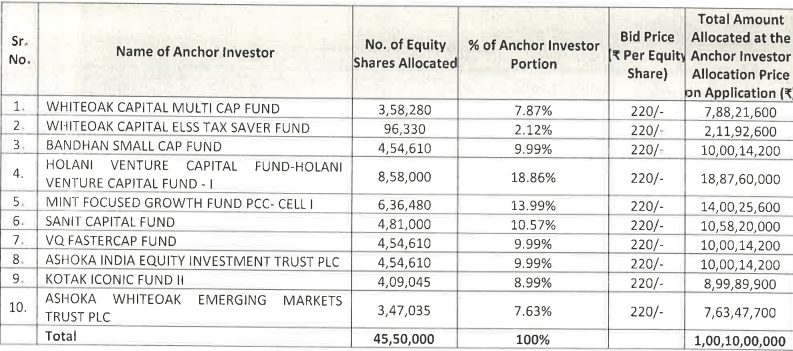

KRN Heat Exchanger's IPO has secured Rs 100.10 crore from anchor investors. The anchor bidding for the IPO took place on September 24, 2024.

Santosh Kumar Yadav, Anju Devi, and Manohar Lal are the company promoters.

With two exciting IPOs on the horizon—KRN Heat Exchanger and Diffusion Engineers—investors may find themselves torn between the two. If you're unsure which one to go for, here's a quick comparison of each company's valuation and the associated risks to help you make an informed decision. Read more

Follow these steps to check the KRN Heat Exchanger IPO share allotment status online:

1. Visit the NSE website and navigate to the IPO allotment status page.

2. Log in with your credentials. If you are a new user, create an account by registering.

3. After logging in, browse the list of IPOs and select "KRN Heat Exchanger and Refrigeration."

4. Enter your PAN card details.

5. Provide your IPO number and complete the CAPTCHA by checking the "I am not a Robot" box.

The price band for the KRN Heat Exchanger IPO is set between Rs 209 and Rs 220 per share. This range provides potential investors with a clear indication of the expected valuation for the shares being offered in the public issue. By establishing this price band, the company aims to attract a wide array of investors, from retail participants to institutional buyers. The final price within this band will be determined based on market demand during the subscription period. Investors looking to participate in the IPO should consider this price range when evaluating their investment strategies.

Holani Consultants Private Limited serves as the book-running lead manager for the KRN Heat Exchanger IPO, overseeing the offering's preparation and execution. Bigshare Services Pvt Ltd is designated as the registrar for the issue, responsible for managing the allocation and distribution of shares to investors.

The KRN Heat Exchanger IPO has a last Grey Market Premium (GMP) of Rs 275, as of September 29, 2024. With a price band set at ₹220, the estimated listing price for the IPO is Rs 495, which includes the current GMP. This suggests an expected gain of 125% per share. Investors are anticipating strong performance based on these figures as the IPO progresses toward its listing date.

The KRN Heat Exchanger IPO is a public offering of 15,543,000 equity shares. Of this total, 5,498,330 shares are allocated for retail investors, 3,107,455 shares for qualified institutional buyers (QIBs), and 2,387,215 shares for non-institutional investors (NIIs).

KRN Heat Exchanger's IPO was subscribed 213.41 times overall, with significant interest across various categories. As of September 27, 2024, the public issue saw a subscription rate of 96.74 times in the retail category, 253.04 times among Qualified Institutional Buyers (QIBs), and 430.54 times in the Non-Institutional Investors (NII) category on Day 3 of the offering.

The KRN Heat Exchanger IPO has a lot size of 65 shares, requiring a minimum investment of Rs 14,300. This means that investors must purchase at least one lot of shares to participate in the IPO. The lot size and investment amount are crucial for potential investors to consider, as they determine the entry point for participating in this initial public offering. Investors should evaluate their financial goals and market conditions before committing to the IPO.

KRN Heat Exchanger and Refrigeration is a leading manufacturer of fin and tube-type heat exchangers. The company produces heat exchangers with copper and aluminum fins, as well as copper tubes, water coils, condenser coils, and evaporator coils. KRN Heat Exchanger manufactures tubes in various shapes and sizes, ranging from 5 mm to 15.88 mm in diameter. Its products are used across the domestic, commercial, and industrial sectors of the heating, ventilation, air conditioning, and refrigeration (HVAC&R) industry.

The current Grey Market Premium (GMP) for the KRN Heat Exchanger IPO is Rs 275. The GMP indicates the premium at which the IPO is trading in the grey market, which refers to over-the-counter (OTC) trading or off-exchange transactions between individuals. This price was last updated on September 29, 2024, at 6:03 AM.

The expected listing price of the KRN Heat Exchanger IPO is influenced by several factors, including demand, the nature of the business, market conditions, and the overall state of the economy. While the gray market premium can provide some insights, predicting the actual listing price remains challenging. Investors should consider these elements when assessing the IPO's potential performance. As the listing date approaches, market sentiment and external economic indicators will play a crucial role in determining the final price at which KRN Heat Exchanger shares will debut on the stock exchanges.

The allotment status for the KRN Heat Exchanger IPO is anticipated to be available on September 30, 2024. To check your allotment status, click the green button labelled "KRN Heat Exchanger IPO Allotment Status" above. Please note that this button will remain disabled until the allotment information is officially released online. Once the status is live, investors will be able to see whether they have received shares in the IPO. Be sure to check back on the specified date for the latest updates regarding your allotment status.

The allotment status for the KRN Heat Exchanger IPO is expected to be available on September 30, 2024. Currently, the status is not accessible, but it will be provided once the basis of allotment is finalized. To check your allotment status, click the allotment status button, select the company name, and enter either your PAN number, application number, or DP client ID. Upon allotment, shares will be credited to your Demat account. For any queries, contact Bigshare Services Pvt Ltd at +91-22-6263 8200 or email ipo@bigshareonline.com with relevant details.

As of September 29, 2024, the gray market premium (GMP) for the KRN Heat Exchanger IPO stands at Rs 275. With the upper price band set at Rs 220, the estimated listing price for the shares is Rs 495, which combines the cap price and the current GMP. This suggests an expected percentage gain of 125% per share upon listing.

The IPO is backed by strong leadership from its promoters, who are supported by a highly experienced management team. The company has cultivated long-standing business relationships with prominent clients and maintains effective quality control measures. Additionally, it boasts a track record of consistent financial performance and operates from an established production facility.

The IPO activity is scheduled as follows: it opened on September 25, 2024, and closed on September 27, 2024. The basis of allotment finalisation is set for September 30, 2024, although this date is tentative. Refunds are expected to be initiated on October 1, 2024, with the credit of shares to the Demat account occurring on the same day. The IPO listing date is anticipated to be October 3, 2024.

On Day 1, September 25, the issue was subscribed 26.11 times overall, with QIB at 1.44 times, NII at 55.59 times, and retail at 27.24 times.

Bidding for the KRN Heat Exchanger IPO began on September 25, 2024, and ended on September 27, 2024. The allotment results are anticipated to be finalized on Monday, September 30, 2024. The IPO is slated for listing on both the BSE and NSE, with a tentative listing date set for Thursday, October 3, 2024.

The KRN Heat Exchanger IPO has established a price range of Rs 209 to Rs 220 per share. Retail investors can participate by applying for a minimum lot size of 65 shares, which requires an investment of Rs 14,300. Small and medium institutional investors (sNII) need to invest in at least 14 lots (910 shares), totaling Rs 200,200. In contrast, large institutional investors (bNII) must commit to a minimum of 70 lots (4,550 shares), amounting to Rs 1,001,000.