Central banks have played an important role in driving up gold prices. The consistent buying by central banks since 2022 has driven gold prices to an all-time high.

But, where are the central banks buying gold from?

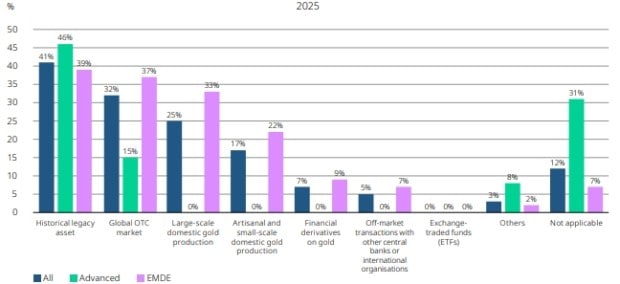

According to World Gold Council (WGC) 2025 data, while 41% is a Historical legacy asset, 32% of all central bank buying is from the Global OTC market.

Large-scale domestic gold production accounts for 25% while 17% is from Artisanal and small-scale domestic gold production.

Large-scale domestic gold production, Artisanal and small-scale domestic gold production were not recorded by WGC in 2024 and were added in 2025, while Domestic gold production was removed.

47% of central banks surveyed purchased gold both from Large-scale mining and Artisanal and small-scale gold mining (AGSM). Large-scale mining by itself accounted for 37% while 16% of central banks bought solely from AGSM.

Source: WGC’s Central Bank Gold Reserves Survey 2025

Gold prices have remained steady around $3,345 for over two months, following an all-time high of $3,500 in April. But, the central banks are still on a buying spree.

WGC’s Central Bank Gold Reserves Survey 2025 shows 43% of central bankers stated their own central bank would increase their gold reserves and 95% believed that for all central banks, official gold reserves would continue to increase in the next 12 months.

Gold has long been a reserve asset for international banks. Recently, inflation and geopolitics have emerged as the two primary reasons for central banks to accumulate gold.

Global central banks purchased a net 20 tonnes of gold in May. The 12-month average of central bank’s gold purchases is 27 tonnes. Central banks of Kazakhstan, Turkey, Poland and China were the major buyers of gold in May.

In 2024, central banks bought a record 1,180 tonnes of gold, up from 1,082 tonnes in 2022 and 1,037 tonnes in 2023. The United States is the greatest holder of gold, with 8,133 tonnes, while India has 876 tonnes.

Recently, the US dollar (USD) has been cited as the next major cause for the gold bull run to continue.

Trump’s tariffs are expected to unleash currency wars in which the US dollar could be the biggest casualty. US dollar index is already down 9.8% YTD and trades below 100 for the first time in several years.

Also, the Trump administration’s pressure tactics on Fed Chair Powell call into question the independence of the US Federal Reserve, placing pressure on the US dollar.

But that’s not all. The US debt is predicted to rise by more than $3.9 trillion as a result of Trump’s One Big, Beautiful Bill. Moody’s Ratings had previously cut the US credit rating due to concerns about the country’s mounting public debt and increasing budget deficit. These all factors taken together are expected to see the dollar get weaker against other major world currencies.

Who else but the central banks are in the best spot to sense the strength and weakness of the world’s financial system? And, perhaps it’s the gold they are betting on in the face of global geopolitical and economic threats.