The beginnings of an economic turnaround, driven by the government’s reform initiatives, may not translate into higher returns at the stock market, says a report from Kotak Institutional Equities.

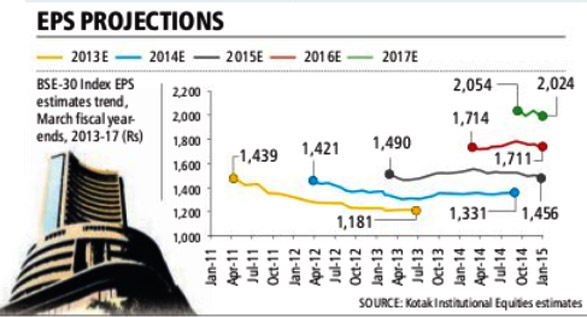

The brokerage has identified two reasons — stretched valuations of quality stocks and possible earnings downgrades. That, however, can be reversed if there is a higher-than-expected interest rate cut, but the report says any aggressive action from the RBI could be constrained by external developments.

RISK FACTORS:

1. Interest rate cut: While domestic factors such as inflation and the fiscal situation has improved, the external factors — currency and uncertainty around the US Fed rate increase could restrain the RBI.

2. Reforms: While the market has factored reforms through executive actions or legislations, the prospect of failure to convert ordinances into proper Acts is a risk.

3. Valuations, earnings upgrades: Valuations of quality stocks in high-growth sectors are quite high, and the report has identified downgrade risks to sectors such as automobiles and industrials. The energy sector is under pressure on falling crude prices.