By Dharmesh Shah

The Indian equity benchmarks followed global markets higher as concerns around the global financial crisis subsided. Nifty closed the week at 17360 levels up 2.5%. The broader market relatively underperformed the benchmark as Nifty Midcap and Small cap indices gained 1.6% and 0.8%, respectively. Sectorally, all major indices ended in green led by financials, IT, and metal.

Technical Outlook

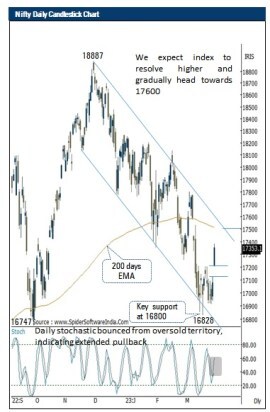

- On expected lines, buying demand emerged from the lower band of consolidation 16800 amid oversold conditions that helped the index to resolve higher and form a bull candle carrying higher high-low after five weeks, indicating a pause in downward momentum

- The index has logged a resolute breakout from recent consolidation 17200-16800 underpinned by a gap up opening (17080-17210) in Friday’s session, indicating acceleration of upward momentum. In the upcoming truncated week, we expect the index to resolve higher and head towards 17600 as it is a confluence of 200 days EMA coincided with the upper band of the falling channel and the implicated target of consolidation breakout (17200-16800). Thus, any dip from hereon towards 17100 should be looked at for accumulating quality stocks in a staggered manner as it is a good time to construct a portfolio from a medium-term perspective. Our view of extended pullback is further validated by the following observations:

- India VIX has decisively breached 14 levels indicating further cool-off, which is positive for equities

- Global indices have outperformed YTD with Nasdaq leading (+18%) while European indices are up in mid-teens. The domestic market has a positive correlation with global peers. Currently, Nifty is down 4% YTD and expected to catch up from hereon

- US dollar index is trending down currently at 102.20 which is a key global positive for EM equities.

- Historically, episodes of higher volatility, along with negative news flow and oversold prices have been a key ingredient for durable bottom formation as sentiment is usually at its bearing extremes in such scenarios

- Sectorally, BFSI, IT, PSU, Capital goods and Infra, Auto to lead the rally

- On the stock front, in large-cap Kotak Mahindra Bank, SBI, HUL, L&T, LTI Mindtree, Ultratech Cement, Tata Motors, Bosch, Dr Reddy are in focus while in midcap Canara Bank, Trent, Lemontree, TWL, KEC, Abbott India, Balrampur Chini, JK Cement

- In spite of a host of negative news, the index has managed to hold the key support of 16800 highlighting strong support which we expect to hold in coming weeks as it is a confluence of:

- September 2022 low is placed at 16747

- 61.8% retracement of CY22 rally 15183-18887, placed at 16600

Bank Nifty Outlook

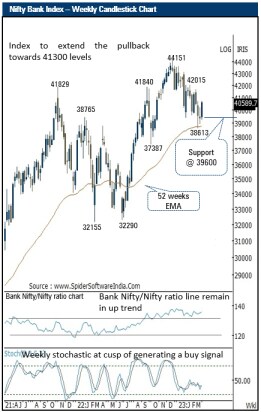

- The Bank Nifty snapped three weeks decline and closed higher by more than 3% at 40608 levels during the previous week amid firm global cues. The pullback was broad-based as both PSU and private banking stocks closed with healthy gains. The weekly price action formed a sizable bull candle with a higher high-low signalling pullback on expected lines from the oversold territory.

- Index during last week surpassed short-term hurdle of 40200 with a gap up action, indicating acceleration in the coming truncated week. We expect the index to head towards 41300 levels being the 80% retracement of the February-March 2023 breather (42015-38613). With key support placed at 39600, dips should be used as a buying opportunity

- Bank Nifty/Nifty ratio line continues to trend higher and sustain the above major breakout area signalling continuation of the outperformance

- Structurally, the ongoing corrective phase has already consumed 16 weeks to retrace 80% gains of preceding 10 weeks rally of October–December (37387-44151). A slower pace of retracement signifies the corrective nature of the current decline

- The index has support at 39600 levels being the confluence of last Wednesday’s low and the 50% retracement of the last two weeks’ pullback (38613-40690)

- The weekly stochastic is at the cusp of generating a buy signal moving above its three periods average thus supports the continuation of the pullback in the index in the coming weeks.

(Dharmesh Shah – Head Technical, ICICI Securities. Views expressed are author’s own.)