Expect revenue, EBITDA, PAT CAGR of 34%, 42%, 45% in FY22-24

Avenue Supermarts’ (DMart) Q2 revenue performance was decent with ramp up of new stores. However, it was slightly underwhelming given (1) sales per sq. ft. was still below pre-Covid levels, (2) discretionary (non-FMCG) demand has still not fully recovered and (3) footfalls recovery has been dull. Gross margin print of 14.5% was also slightly below pre-Covid levels (and down 133bps QoQ) due to weak product mix. EBITDA margins came in at 8.6% despite the operating leverage benefit.

We believe DMart has value and volume tailwinds: (1) inflation (higher absolute gross profit per unit, operating leverage) and (2) likely higher footfalls as more number of consumers prioritise value (read lower prices in the trading area). We maintain our TP of Rs 4,200, downgrade to HOLD from ADD (expensive valuation).

Also read| HDFC Bank Rating: BUY; Merger continues to be key overhang

Q2FY23 revenue performance continues to be robust: Revenue / EBITDA / recurring PAT grew 36% / 34% / 31% YoY, respectively. Even as the new stores opened in the last two years continue to ramp-up well, sales per sq. ft. for the quarter were still lower by ~9% as compared to Q2FY20. Management highlighted that FMCG and staples segment have performed better than general merchandise and apparel segments. Secondly, discretionary (in non-FMCG) has still not recovered to pre-Covid level given (1) lower footfalls and (2) stress in the lower price points in discretionary non-FMCG categories. We believe high inflation led pricing hides the stress on volume growth due to inflationary impact on consumers. LFL growth (for stores older than five years) was at a 3-year CAGR of 6.5%. It has opened new DMart stores close to the existing stores, at some locations, where the throughput is significantly higher than the company average.

DMart Ready continued to scale-up well with 82% YoY revenue growth while expanding its presence in six new cities (total 18 cities) with focus on larger cities. More than 90% of the revenue of DMart Ready still comes from five cities – Mumbai, Pune, Bangalore, Hyderabad and Ahmedabad.

Also read| Avenue Supermarts Rating: Hold; Downgrade from add

Store addition: DMart added eight stores in the quarter, taking its total store count to 302 (12.4mn sq. ft.). In the quarter it seems to have added stores of smaller sizes – as per our math, the average size of new stores is ~37,500 sq. ft. versus overall average of ~41,000 sq. ft.

EBITDA margin back to pre-Covid levels: Gross margin was down ~60bps vs 2QFY20 at 14.5% (2QFY22: 14.3%). As highlighted above, a relatively weak mix continued to impact the gross margin print. EBITDA margin was also weak at 8.6% similar to 2QFY20 (8.7%).

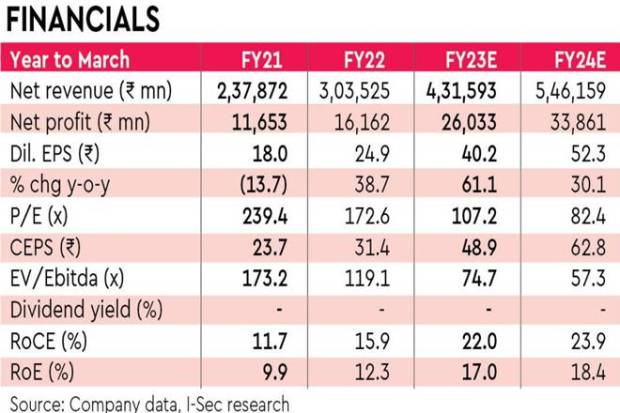

Valuation and risks: We cut our earnings estimates for FY23E / FY24E by 4%; we model revenue / EBITDA / PAT CAGR of 34% / 42% / 45% over FY22-24E. Downgrade to HOLD (from ADD) with a DCF-based unchanged target price of Rs 4,200. Key downside risks are slower turnaround of e-commerce operations and higher-than-expected competitive intensity. Key upside risk is significant improvement in footfalls.