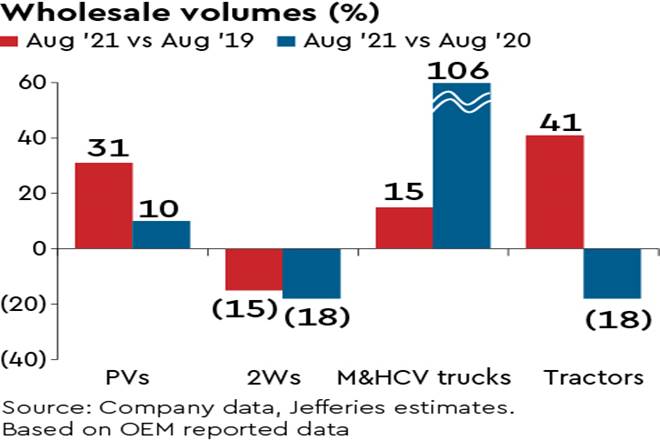

Indian auto industry wholesales diverged across segments in August. We estimate that PVs grew ~10% YoY while trucks almost doubled YoY (15% above 2019). 2Ws and tractors, on the other hand, fell ~18% YoY. 2W exports remained strong, up 35-40% YoY. August wholesales raise our confidence on an imminent revival in trucks and cyclical fall in tractors. Chip shortage is hurting production and the impact might worsen in Sep. We prefer BHFC, MSIL and TTMT.

Good PV wholesales; Maruti lagged on chip shortages: Based on OEM reported data, we estimate that August passenger vehicle (PV) wholesales grew ~10% YoY (~31% above 2019). Maruti’s domestic wholesales were down 9% YoY though as production was impacted by chip shortages. The effect of semiconductor shortages is likely to worsen for Maruti in September and the company expects production to be ~40% of normal level.

Tata Motors’ PV volumes rose 51% YoY. Hyundai’s India volumes were up a slight 2% YoY while Mahindra’s SUVs rose 18% YoY in the month.

2Ws lagging: We estimate that domestic 2W wholesales (excluding Honda whose volumes were awaited) fell ~18% YoY. Domestic 2W wholesales declined 11% YoY for Bajaj, 18% for Royal Enfield and TVS, and 24% for Hero. 2W exports, on the other hand, remained strong with August wholesales growing an estimated 35-40% YoY.

Big fall in tractors; trucks improving: We estimate that tractor industry wholesales fell ~18% YoY in August — first big fall in more than a year. Domestic volumes declined 15% YoY for Mahindra and 27% for Escorts. Both OEMs mentioned in their press releases that consumer sentiment is good heading into the festive season. We estimate that August truck wholesales more than doubled YoY and were ~15% above 2019 level.

Royal Enfield launched upgraded Classic 350cc: Royal Enfield (Eicher) has launched an upgraded version of its top-selling bike Classic 350. The product has been developed on a new engine platform to offer a better biking experience, although vehicle design has been largely retained.