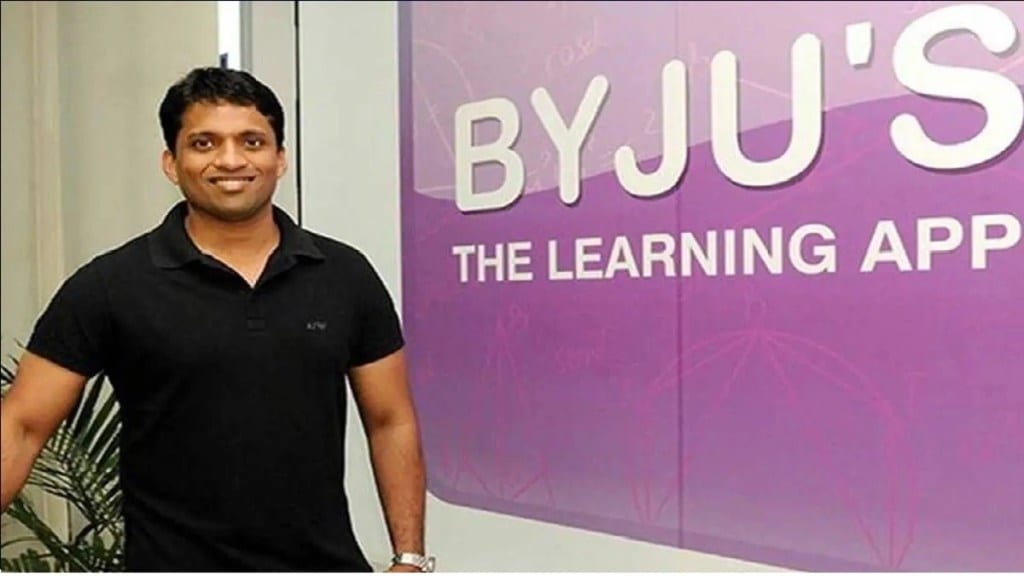

BYJU’S, the major edtech company is experiencing steady and sustainable growth and is nearing profitability at the group level, according to Raveendran, CEO, Byju. In order to address concerns regarding the company’s future and growth uncertainty, a town hall meeting was organised with Raveendran. He expressed confidence that the issues with the $1.2 billion Term Loan B lenders are being resolved through discussions, and he expects a positive outcome within the next few weeks without the need for court intervention. He emphasised BYJU’S dedication to financial management and operational optimization, highlighting the company’s progress towards achieving profitability despite the challenges faced by tech companies worldwide, according to an official statement.

Furthermore, BYJU’S had set a target to achieve profitability by March 2023. The CEO stated that the company is currently experiencing slow but sustainable growth, with most of its business verticals in favourable conditions relative to the overall challenges. Various reports have surfaced regarding BYJU’S financial performance, debt burden, delays in filing financial results, and a recent instance of Prosus, an investor in the firm, lowering its valuation of a 9.6% stake to $578 million, the statement mentioned.

Prosus’ stake of 9.6% indicates that the edtech firm’s value is approximately $6 billion, contradicting BYJU’S claim of $22 billion. In the midst of various controversies, BYJU’S received a significant boost when a Delaware Court ruled in their favor. “Byju provided an important update, stating that the TLB dispute is being resolved through constructive discussions, and the company is confident about achieving a positive outcome in the next few weeks without court intervention,” stated another source. Raveendran expressed that the productive discussions with lenders demonstrate the company’s ability to overcome challenges through proactive engagement and find solutions, the statement said.

The CEO addressed the resignation of the director and auditor, Deloitte, clarifying the situation to the employees. “Byju explained the strategic decision to appoint BDO as BYJU’S statutory auditors for the next five years, which led to Deloitte’s departure. He emphasised that this decision was mutually agreed upon to focus on efficient and timely audits moving forward,” the source shared. During the town hall, Raveendran mentioned that the company is actively expanding and diversifying its board to align with the scale, scope, and reach of its operations, which is a common practice for large companies, it added.

With inputs from PTI.