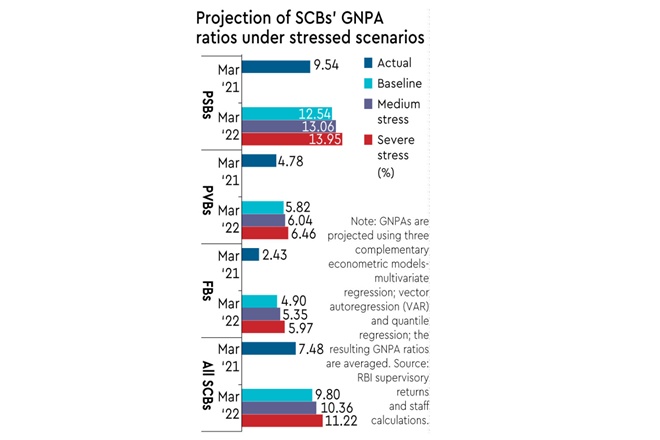

The Reserve Bank of India (RBI) estimates loan losses at banks could rise 232 basis points y-o-y to 9.8% by March 2022 in a baseline stress scenario, even as banks are well-capitalised to manage the stress.

With the pandemic having hurt businesses across sectors, the gross non-performing asset (NPA) ratio could rise to 10.36% by March 2022 if the stress is moderate and 11.22% if it is severe, the central bank said on Thursday.

Among the sectors that have been badly hit by the lockdowns and curfews are retail trade, travel, hospitality, aviation and MSMEs.

The government has come out with credit guarantee schemes for MSMEs as also for the healthcare sector which should help revive businesses and rein in defaults.

Public sector banks are now expected to fare less badly than earlier, with the bad loan ratio forecast to hit 12.5% by March next year; in March, this ratio was 9.54%.

The good news is that banks are well-capitalised and moreover, have high provision coverage ratios. The fall in the capital adequacy would be relatively small and, even if the going gets really bad, all 46 banks would have adequacy ratios well above the regulatory minimum of 9%.