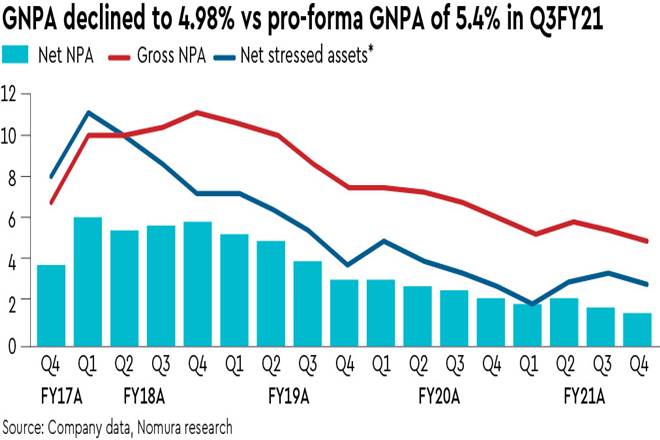

SBIN (standalone) reported 80% y-o-y increase in Q4FY21 net income, driven by 19% y-o-y growth in NII (7% below expectations owing to Rs 21 bn of accrued interest write-off and Rs 8.3 bn of interest-on-interest waiver). Asset quality surprised positively with aggregate of slippages and restructuring at Rs 464 bn against a guidance of Rs 600 bn. The second wave of COVID-19 may cause greater distress in the Tier III & below geographies and SBI could face relatively higher NPLs vs. the first wave. But, we feel SBI may still undershoot the FY21 credit cost. We expect RoA at ~80bp and RoE at ~14% in FY22F.

Asset quality: The impact of the second wave of COVID-19 is still uncertain. While management chose to not provide a guidance on credit costs, we raise the loan credit cost by 10bps to 93bps for FY22F but retain it below FY21 levels of 116bps. The comfort comes from the surprisingly lower NPL formation ratio (1.3%), far better than peer private sector banks in a pandemic year. The lower slippages are also a function of muted loan growth in corporate and SME businesses. Support also came by way of Rs 250 bn of emergency credit loans (ECLGS).

Meanwhile, two-thirds of retail is still secured mortgage and auto loans, where the delinquency levels are usually lower. The problem could have been the potentially largely unsecured retail book (“Xpress credit”, 22% of retail) where mgmt is deriving comfort that 95% of borrowers are salaried. Total restructuring book is 70bps.

Deposits and NIM: Loans grew 5.3% y-o-y/3.4% q-o-q, in line with the system. Domestic deposits were up 14% y-o-y/ 4.2% q-o-q, with CASA ratio improving 100bps q-o-q to 46%. While SA growth is steady (15% y-o-y), CA saw a blip up, growing at 32% q-o-q. Loan growth will likely remain weak in next two quarters. But SBI has managed NIM well so far, owing to its access to low-cost deposits. Even after NPLs & interest of interest waiver, it saw 7bps higher NIM in FY21 vs. FY20.

Retain Buy: We marginally tweak EPS for FY22-23F and introduce FY24F, forecasting 15% BVPS CAGR. We retain TP at Rs 550, which values the stock at 1.4x P/B FY22F book and 8x P/E FY23F consolidated earnings. The stock is trading at 1.2x P/BV on FY21 book (consolidated). We value the standalone bank at 1.3x P/B, SBI Life at Rs 1,175/share, Cards at Rs 1,100/ share, and SBI AMC at 8% of AuM.