On stand-by for disinvestment, PFC expects no harm from coalgate

Power Finance Corporation is back in disinvestment focus, with the government asking the power sector lender to be prepared to hit the capital market just in case of need.

The government mopped up R1,145 crore in May 2011 by divesting 5% of its stake in PFC. Besides, the company also raised R3,433 crore through sale of 15% fresh equity.

The PSU has been able to leverage its sovereign backing to raise cheaper capital from domestic and overseas markets to meet the ever growing funding requirement of the power sector. It has delivered robust financial performance in recent years, with demand for power outpacing supply.

The PSU has been able to leverage its sovereign backing to raise cheaper capital from domestic and overseas markets to meet the ever growing funding requirement of the power sector. It has delivered robust financial performance in recent years, with demand for power outpacing supply.

But now dark clouds are hovering over the sector. The power sector has been beset by problems like non-viability of state-owned distribution companies, fuel crisis and land acquisition hurdles. Will the exploding coal block allocation controversy stunt the sector’s growth and short-circuit PFC?s dream run? It is unlikely given the demand and supply situation in the power sector, say market analysts.

PFC?s business fundamentals are so strong that even the coalgate is unlikely to impact the company?s top line or bottom line, according to market analysts. ?The controversy over coal block is unlikely to affect PFC given the robust demand for electricity in the country,? said Madhumita Ghosh, senior vice-president, Unicon Financial Intermediaries, an equity research firm.

PFC?s business fundamentals are so strong that even the coalgate is unlikely to impact the company?s top line or bottom line, according to market analysts. ?The controversy over coal block is unlikely to affect PFC given the robust demand for electricity in the country,? said Madhumita Ghosh, senior vice-president, Unicon Financial Intermediaries, an equity research firm.

However, there are others who think that the coalgate could impact investor sentiments about the power sector, though not the demand for electricity as such. V Srinivasan, a power sector analyst with Angel Broking, a retail broking firm, told FE: ?Investor sentiments will be affected by the controversy to an extent.?

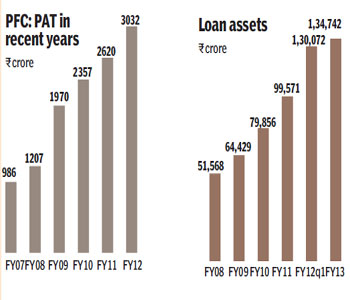

PFC has been consistently profit making since inception. Its profit after tax (PAT) grew at a compounded annual growth rate (CAGR) of 25% during past five years. The PSU has seen its PAT grow 42% to R972 crore during the April-June 2012 quarter.

The robust business growth of PFC comes from loan sanctions and disbursements, which were about R60,000 crore and R40,000 crore, respectively, in 2011-12.

The company has sanctioned loans worth R1.6 lakh crore as at the end of June 2012, which are yet to be disbursed. PFS?s loan assets are estimated at R1.35 lakh crore. PFC?s financial health is driven by factors like a strong build-up of loan assets, spread and net interest margin ratios (2.63% and 4.19%, respectively, during April-June 2012 quarter) and low non-performing assets (0.91% in Q1 FY13).

The PFC management is not disturbed by issues like the financial non-viability of power distribution companies and fuel shortage which pose risks to the non-banking finance company?s future growth potential. It believes that the recent regulatory initiatives will ensure timely tariff revision. Some 13 states have already revised tariffs while other four states have started the process for tariff revision following the Appellate Tribunal for Electricity’s judgement that regulators have the powers to initiate tariff revision proceedings on their own if discoms fail to approach them on time.

The government is also finalising a debt restructuring plan that would take care of the discoms? cash crunch problem.

Similarly, the company sees a penalty clause inserted by Coal India in fuel supply agreements recently as a positive development for the sector. It feels that the current fuel crisis has been caused by the fast-paced capacity addition in the power sector, which has left the coal sector behind.

PFC has no exposure to companies being hounded by the

CBI for cornering coal blocks through suspected illegal means.