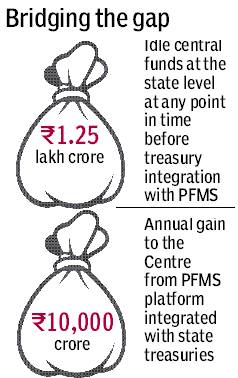

Despite initial opposition from a few states, the Centre has managed to integrate treasuries of almost all states into the Public Finance Management System to track fund utilisation up to the last mile as well as transfer funds “just-in-time” for central schemes. This would help the Centre save R10,000 crore annually by ending floating of funds or idling of cash at banks, Controller General of Accounts Archana Nigam told FE.

West Bengal, which was opposed to integration of state treasuries with the PFMS, is not yet on board while Arunachal Pradesh could not join it due to connectivity issues. The Centre has set a target of integrating all state treasuries with PFMS by March 31, 2017.

Integration of treasuries has virtually wiped out indefinite parking of central funds at the state level from about R1.25 lakh crore annually to virtually nil now, Nigam said. Floating of funds was very high in the case of government’s flagship Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), another official said. The Centre has budgeted to spend R48,000 crore in MGNREGA scheme in FY18, nearly the same as in FY17.

The Department of Expenditure is administering the PFMS, which is an end-to-end online solution for processing payments, tracking, monitoring, accounting, reconciliation and reporting. The efficient fund management would help the Centre save on borrowing costs as well as on opportunity costs, the CGA said. Currently, there are nearly 600 central schemes.

“You cannot have indefinite parking of government money at various ends because that itself not only leads to inefficiency, but also leads to impediment to growth,” finance minister Arun Jaitley had said in September 2016, batting for PFMS.

In August, 2016, West Bengal chief minister Mamata Banerjee opposed the Centre’s move to integrate state treasuries with the PFMS, terming the move as serious infringement of federal structure. In July, the Centre had issued advisories to states to integrate their treasuries for improved financial management in implementation of Central schemes so as to facilitate “just-in-time” releases and monitor the usage of funds including information on its ultimate utilisation. Though joining PFMS is a must to get funds for central sector schemes, the Centre has not yet made it mandatory, keeping in the spirit of cooperative federalism.

Integrating of state treasuries with the PFMS will enable the Centre to track the money that is meant for a particular purpose is being spent for that purpose or not. “Earlier, funds used to get released without knowing whether previous transfers have been fully utilised or not and whether it has gone to the right agency or not,” Nigam said. PFMS is now integrated with 1,35,000 bank branches and 20 lakh service providers and NGOs. Now, CGA is also undertaking forensic audit of service providers to check whether they are capable of delivery of services or not. “We have to check whether NGOs/service providers can deliver or not. We just can’t give money and get done with it,” she added.

You may also like to watch this video

The Centre has budgeted to spend R6.67 lakh crore in FY18 under central sector schemes, up from R6.21 lakh crore in FY17. It will also spend another R2.78 lakh crore on centrally sponsored schemes — where part contribution comes from states — in FY18, up from R2.45 lakh crore in FY17.