The Congress party on Sunday accused the Centre government of implementing “retrograde policies” that have shattered investor confidence in India. They further slammed the BJP for turning the ease of doing business into “unease in doing business.” Ahead of the Union Budget, the opposition party stated that the upcoming budget must eliminate “raid raj and tax terrorism” to address this issue.

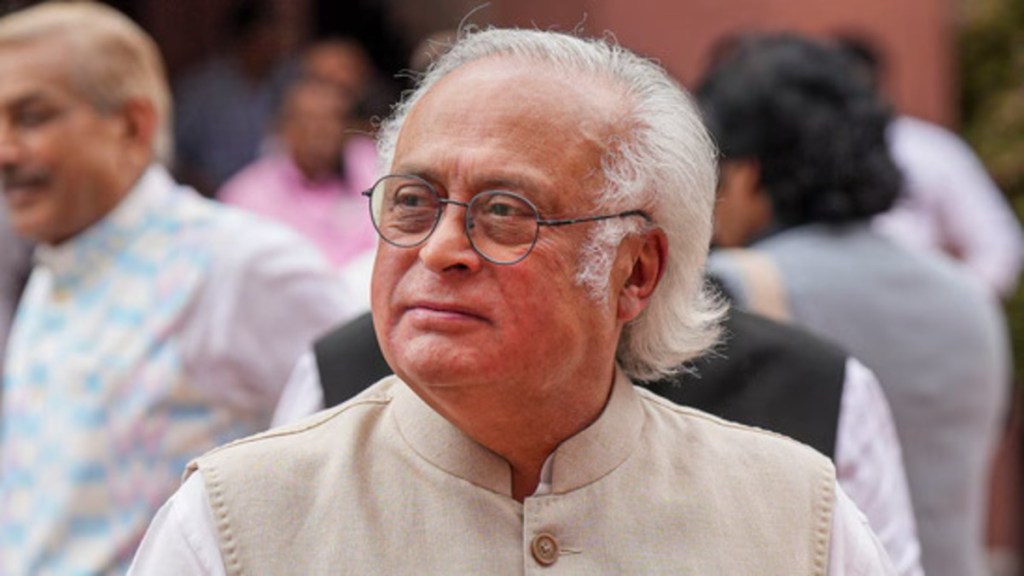

The Congress also urged the government to take measures to protect Indian manufacturing jobs and implement decisive actions to strengthen wages and purchasing power. Congress general secretary in-charge of communications, Jairam Ramesh, criticised the Modi government for its long-standing claims of improving the “ease of doing business” in India.

He pointed out that, over the past decade, India has witnessed a decline in private investment to record lows, alongside a significant exodus of businesspersons leaving the country for foreign shores.

“A byzantine, punitive, and arbitrary tax regime covering both GST and income tax – which amounts to sheer Tax Terrorism -is now the greatest threat to India’s prosperity and has contributed to an ‘unease of doing business’,” he said in a statement.

Ramesh highlighted that the largest component of investment—private domestic investment—has remained weak since 2014. He added that during Manmohan Singh’s tenure as Prime Minister, it was consistently in the 25-30 percent range of GDP.

“In the last ten years, it has collapsed to the 20-25 per cent of GDP range. This sluggish investment has been accompanied by a mass exodus of high-net-worth individuals. More than 17.5 lakh Indians have acquired the citizenship of another country over the past decade,” he said.

Sharing his statement on X, Ramesh said, “The 2025/26 Union Budget will be presented thirteen days from today. Here is our statement on how the Modi Government has converted the ease of doing business to unease in doing business – thereby depressing private investment sentiment. Radical action is necessary to fix the damage.”

Ramesh claimed that an estimated 21,300 dollar millionaires left India between 2022 and 2025. He attributed this exodus to three main reasons. “Firstly, a complicated GST. According to former Chief Economic Advisor Arvind Subramanian, the GST, which the PM hailed as a Good and Simple Tax, actually has up to 100 different tax rates, including cesses,” he said.

Ramesh further criticized the GST system, stating that the multiplicity of rates and confusion has led to alarming GST evasion amounting to Rs 2.01 lakh crore, nearly double the Rs 1.01 lakh crore reported in FY23. He claimed that 18,000 fraudulent entities have been uncovered, with many more likely still undetected.

“Secondly, despite claims to the contrary, Chinese imports into India continue unabated, with a record trade deficit of $85 billion in 2023-24. This has severely impacted Indian manufacturing, particularly in labor-intensive sectors,” Ramesh added.

Ramesh also pointed to weak consumption and stagnant wages as a major factor behind reduced consumption growth in India, despite the widespread availability of personal debt. “According to Ministry of Agriculture data, real wages for agricultural labor grew by 6.8 percent per year under the UPA, but have declined by 1.3 percent per year under the Modi government,” he said.

Referring to the Periodic Labour Force Survey data, he noted that average real earnings stagnated between 2017 and 2022 across all worker categories—salaried, casual, and self-employed.

“These retrograde policies have broken the confidence of investors in India. To fix this, the budget must eliminate ‘raid raj’ and ‘tax terrorism,’ protect Indian manufacturing jobs, and take decisive action to boost wages and purchasing power. This will incentivize Indian businesses to invest. Nothing less will do,” Ramesh asserted.

(With PTI Inputs)