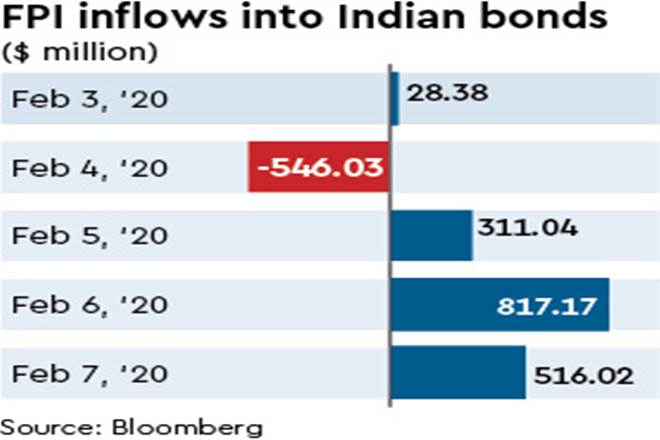

As bond yields continue to fall after the monetary policy, foreign portfolio investors (FPIs) have turned bullish on Indian debt having pumped over $1.6 billion into bonds in the last three days of the previous week, the latest Bloomberg data show. It is noteworthy that till early February, FPIs remained net sellers of Indian debt at over $2 billion on a net basis. Even with the recent buying spree, FPIs still remain net sellers of Indian debt, but the figure has come down to $958 million on a net basis.

Jayesh Mehta, India country treasurer at Bank of America, believes that yields have been down across the globe, but the effect was not seen in the Indian bond markets as investors were keenly awaiting the Budget and the monetary policy. “Concerns over the coronavirus has hurt the global growth figures at least for the January-March quarter. That has contributed to further yield chasing by foreign investors. Back home, the borrowing figures for FY21 announced in the Budget as well as the recent monetary policy, particularly the long-term repos, were extremely conducive for the bond market. The offshore overnight indexed swaps (OIS) have been significantly down in recent times,” Mehta said.

From the highs seen in January, the 10-year US Treasury yield has come down by almost 30 basis points to 1.56%. At the same time, the five-year non-deliverable OIS has come down by over 50 basis points to 5.02. Manish Wadhawan , founder and managing partner at Serenity Macro Partners, pointed out that a dovish monetary policy as well as fears of a slowdown at a global level seem to have worked in favour of incremental FPI inflows into Indian bonds. “Growth figures are being revised downwards globally because of the China factor and that could have led to increased allocations to emerging markets and to India. The US yields are also down and so are oil prices,” Wadhawan said.

Ajay Manglunia, MD and head of institutional fixed income at JM Financial, said the Budget provided clarity to FPIs by extending the lower withholding tax being till 2023. “Foreign investors were waiting for these major events like Budget and the monetary policy to get over to take a decision. The RBI’s introduction of the long-term repo operations as well as falling oil prices have pushed bond yields down,” Manglunia said.