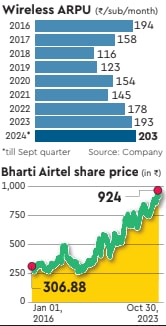

Sunil Bharti Mittal’s bet on premiumisation has paid off. After ten years, Bharti Airtel’s ARPU has one again crossed `200 with promise of more upside. By growing the base of data-users, converting pre-paid users to postpaid ones and nudging postpaid customers to sign on for Airtel Black, the company has enhanced the quality of its business. It hasn’t been easy. Bharti was initially jolted by the competitive intensity post the launch of R-Jio back in September 2016 which disrupted the Indian telecom sector altering the rules of the game. An imminent shift away from voice to data meant revenues—70% from voice—were under threat. The company did, in fact, see a sharp fall in the ARPU and revenues.

But it saw the opportunity in data and chalked out a plan to cater for the surge in data demand. Mittal often recalls how the strong competition from Jio had led to a collapse in the industry’s revenues. “I must say with great deal of satisfaction and pride that despite facing some very difficult times, we stayed on course. That means not taking any short cuts, but playing for the long term,” Mittal said recently. The telco’s comeback strategy has been a combination primarily of tariff hikes—two headline hikes-, accelerated investments in the network and a focus on premium subscribers. To execute the plan, Bharti made some smart spectrum acquisitions and timely fund-raises.Among its first initiatives to cash in on the rising data consumption was Project Leap in FY16 which included an investment of Rs 60,000 crore to bolster the network infrastructure in three years; Bharti’s overall network tower count rose by nearly 50% over FY15-21.

The growth in the Mobile Broadband (MBB) tower base was steeper, increasing by nearly 4x over FY15-21. In between, for the first time in 15 years, Bharti reported a net loss of Rs 2,866 crore in the April-June 2019 quarter. However, with bigger investments to strengthen the network, Bharti was able to not just retain its subscribers by catering to the surge in data usage but also increase its market share. The initiatives under the War on Waste included simplifying tariff plans from numerous circle-specific plans earlier to uniform plans nationwide and also enabling digital recharges instead of physical recharges. During the second wave of Covid-19 pandemic, nearly 65% of all recharges were made online.

By September 2021, five years after Jio, its share had risen to 34% from 29% in September 2016 when it was the market leader in Adjusted Gross Revenue (AGR) including National Long Distance (NLD) revenue. Jio’s share was, of course, a strong 39% with VI’s share, by then had collapsed to just 18% from 35% pre-Jio. The increase in Bharti’s share of the Visitor Location Registry (VLR) or peak active subscribers was even more remarkable, rising from around 27% pre R-Jio launch to35%. But it was in November 2022 that Bharti made its boldest move experimenting with a tariff hike in Haryana and Odisha circles; it withdrew the entry pack—Rs 99 recharge coupon—valid for 28 days and launched a minimum pack at Rs 155, offering unlimited voice, 1GB data and 300 SMSs, valid for 24 days.

The Rs 99 plan was available in other circles. Experts pointed out it would have been difficult to roll out such a sharp tariff hike across the country. After all it was a massive 57% surge in minimum recharge value, in the customer segment where affordability matters the most. Analysts were impressed with the company pointing out it could not have been an easy call. “It is difficult to raise tariffs especially since the market leader’s strategy is to be affordable, “pointed out an analyst, adding there is always the fear of losing market share.The move demonstrated Bharti’s determination Bharti’s to drive ARPU to Rs 300 (from Rs 190 in Q2FY23). It signalled to the competition, the telco was ready to walk-the-talk on tariff hikes. It was in the June, 2023 quarter that the ARPU hit `200 while the subscriber base touched 338.6mn.

Experts now expect Bharti to continue to benefit from its higher-quality subscriber base versus its peers and to be able to leverage its significant digital and enterprise initiatives in a 5G landscape. This should help it transition to more of a tech player in the coming years, they say. For Airtel, a large 72% of the mobile customer base of 342.3 million now comprises 4G/5G users. In Q2FY24, it added a million post-paid users—the highest in a quarter, to take the count to 44 million. In this manner it ramped up the premium –end of the customer base. “Bharti’s consistent focus on premiumisation delivers again, with continued improvement in subscriber mix,” wrote an analyst. It’s a fact that more customers are switching to Airtel Black plans. The family plans, small-format stores as also 5G rollouts are contributing to the momentum on postpaid net additions. As analysts have pointed out, Bharti has been able to consistently grow wireless revenues in double-digits, despite no meaningful tariff hikes in recent times. Airtel CEO Gopal Vittal pointed out last week that tariffs in India are very low in India and actually, right at the bottom. There’s probably a message in that somewhere.