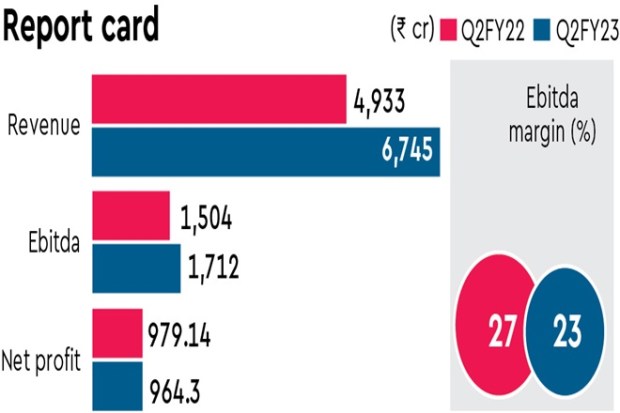

Grasim Industries, the flagship company of Aditya Birla Group, posted a 1.5% fall in standalone net profit of Rs 964.30 crore for the quarter ended September, falling below analysts’ estimates. In comparison, the company had posted a net profit of Rs 979.14 crore during the same period of last financial year.

During the quarter under review, the company’s revenue rose 37% to Rs 6,745 crore, compared to Rs 4,933 crore posted in the second quarter of last fiscal. The firm also posted its high-ever quarterly Ebitda of Rs 1,712 crore, it said in a statement.

A consensus estimate of Bloomberg analysts was expecting the firm to post standalone net profit of Rs 1,084.70 crore on revenue of Rs 6,939.20 crore.

In the quarter, Grasim Industries’ net profit fell 25.75% to Rs 1,009 crore on a consolidated basis, compared to Rs 1,359 crore it posted during the same quarter of previous fiscal. The firm’s revenue on a consolidated basis rose 22% to Rs 27,486 crore from Rs 22,567 crore posted during the same period a year ago. Its Ebitda on a consolidated basis fell 12% to Rs 3,783 crore from Rs 4,282 crore recorded during the same period a year ago.

During the quarter, Grasim Industries also received a dividend of Rs 628 crore from its subsidiary, UltraTech Cement, it said.

Also read: PSU Banks may arrest decline in market share

The company’s Viscose Staple Fibre (VSF) sales volume for the quarter rose 10% to 170 kilo tonne on a year-on-year basis, though it was down 14% on a quarter-on-quarter basis due to demand conditions coupled with cheaper imports from Indonesia and China.

In view of this, the company has rationalised the production of VSF in phases, leading to overall capacity utilisation at about 70% currently, it said, adding the India-centric demand for VSF remained largely intact, but global markets have started witnessing the impact of recessionary conditions.

During the quarter, the caustic soda sales volume was up 17% YoY to 296 KT on the back of new capacities commissioned in second half of last year. The global caustic soda prices softened this quarter compared to sequential first quarter, mainly due to easing of global supply chain conditions, it said.

On its foray into paints business, the company said the first plant would be commissioned in the fourth quarter of FY24, and the remaining by FY25 in a phased manner. Its B2B e-commerce business plan is also under execution for launch by the second quarter of FY24, it added.

The company’s actual budget spend till the first half of FY23 was at ?1,524 crore, against the total capex plan of ?6,720 crore for FY23. Its board has approved an additional capex of ?565 crore for existing businesses, out of which ?382 crore is expected to be spent in FY23.