US-based asset management company Baron Capital has marked up the fair value of its stake in food delivery platform, Swiggy by nearly 17% to $87.2 million as of December 31, from $74.7 million in the previous quarter, as per its latest quarterly report. This puts Swiggy’s valuation at $12.1 billion, 13% higher than the $10.7 billion when it last raised funds in 2022.

In the December quarter, Swiggy was among the top ten holdings in Baron Capital’s emerging markets fund, which also has Taiwanese chipmaker TSMC, Samsung Electronics, Tencent Holdings, Alibaba Group, along with India’s Bajaj Finance, HDFC Bank and Bharti Airtel, among others.

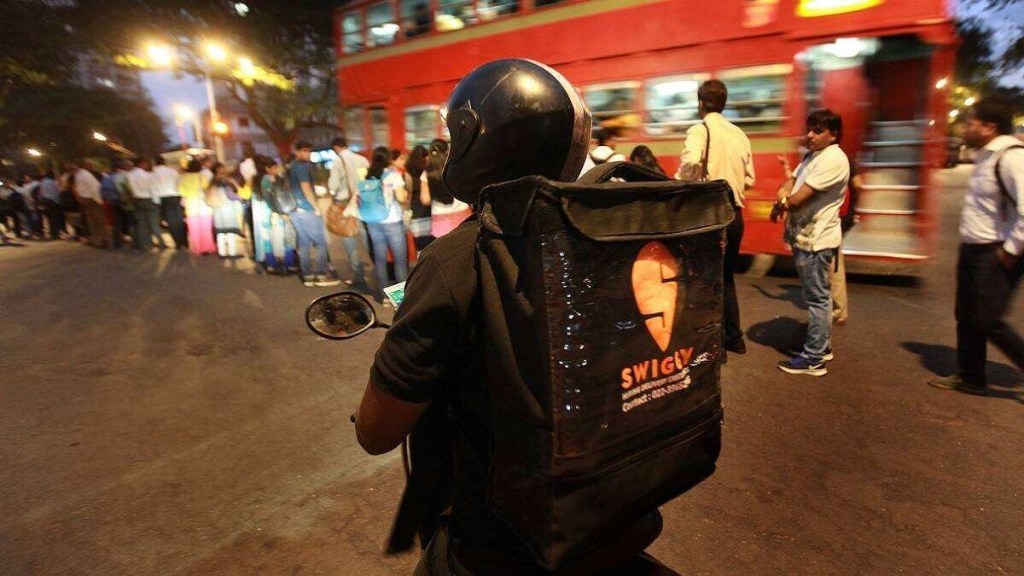

In an earlier quarterly filing, Baron Capital noted that Swiggy is India’s leading food delivery platform with a roughly 50% market share, and the company is benefitting from increasing penetration of food delivery in the country and improving profitability.

“We believe India’s food delivery industry is still in its infancy and will continue to scale over the next several years, driven by a growing middle class, rising disposable income, higher smartphone penetration, and a structural shift in consumer preference driven by a technology savvy younger population,” the firm had said.

Besides Baron Capital, Swiggy’s other investor Invesco had also recently marked up its valuation to $8.5 billion as of October 31, from $7.8 billion as of July. Prior to that, Invesco had slashed Swiggy’s valuation to $5.5 billion as of January 2023, from $8.2 billion as of October 2022.

Both Invesco and Baron Capital were a part of Swiggy’s last fundraising round of $700 million in January 2022. Baron Capital had bought into that round as a fresh investor with $76.7 million in exchange for a 1.9% stake.

In FY23, Swiggy’s revenue from operations had grown about 45% to Rs 8,264.6 crore, compared to Rs 5,705 crore in the preceding year. Its losses also increased 15% to Rs 4,179 crore during the year, compared to Rs 3,629 crore in FY22.

Besides Swiggy, Baron Capital also marked up the fair value of its investment in Indian fintech firm Pine Labs to $74 million as of December 31, up from $66.8 millon in the previous quarter. The asset management firm had paid $40 million for 107,278 shares of the company in 2021.

Byju’s markdown

As for the troubled edtech firm Byju’s, Baron Capital slashed the fair value of its investment by 66.4% to $15.4 million as of December 31, from $45.9 million in the previous quarter. The asset manager had invested in the company in 2021 through two of its funds – Baron Global Advantage Fund and Baron Emerging Markets Fund.

“Weak performance was driven by a marked slowdown in business momentum as Covid-related tailwinds that benefited online/digital education have begun to dissipate,” Baron Capital wrote in the report.

Besides this, the resignation of its auditor Deloitte, and that of three investor appointed directors in June had also impacted the fair market value of the company. In the June quarter of last year, the firm had slashed Byju’s valuation by to $11.7 billion, from $21.2 billion in the previous quarter.

However, the firm continues to bullish on the structural growth in the online education space in India. “While we are disappointed with recent developments, we continue to believe that Byju’s remains a dominant franchise and can sustain low-to-mid-20% earnings growth over the next few years,” it said.