By Vinkesh Gulati

India’s automotive sector contributes 6.4% to GDP, 35% to manufacturing GDP and Rs 1.5 lakh crore of GST contribution. Since the goods and services tax (GST) came into effect five years ago, auto OEMs shifted to a single ex-showroom price across India, putting an end to the decades-old practice of different vehicle prices based on local taxes.

But the pre-GST situation persists in on-road prices. State-wise on-road prices differ significantly, and there are occasions when buyers purchase cars outside their state of residence (in a state with lower road tax and thus lower on-road price).

Often, one gets to hear from friends/relatives that they have a car registered in another state (either having bought from there, or as a result of having shifted homes) and need to get it re-registered at their current place of residence. But this is usually a big hassle because road tax in different states is different.

Road tax (motor vehicle tax) is levied on every new vehicle you buy. While ex-showroom prices are the same for all vehicles across India, road tax is different, and in some cases the difference is big.

Also Read| Global growth headwinds weigh on auto exports in July

An example of a popular car

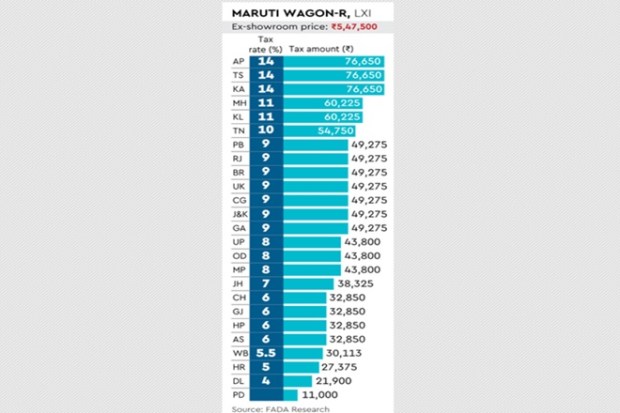

Let’s take the example of Maruti Suzuki Wagon R, which was India’s highest-selling car in FY22. While the ex-showroom price of the Wagon R LXi variant is Rs 547,500, the road tax in Andhra Pradesh, Telangana and Karnataka is Rs 76,650 and thus the on-road price is Rs 668,784. In Puducherry, on the other hand, the road tax is just Rs 11,000 and the on-road price is Rs 588,108.

Road tax is levied on the basis of various factors including engine capacity, seating capacity, unladen weight, price, etc. States levy different levels of road tax on different types of vehicles, such as private and company vehicles (the latter are taxed higher). Some states also tax vehicles based on the fuel they run on (petrol, diesel or CNG). Tax slabs also exist, i.e. vehicles costing more than a certain amount attract higher tax than the ones below that amount. There are additional charges for things like greenification, parking and more.

Benefits of a single road tax

There are many benefits if India migrates to a uniform road tax rate. Firstly, it will discourage buyers to buy from other states that have a comparatively lower rate. Secondly, it would make it easier to transfer a vehicle’s registration from one state to another. In the current system, before one can apply for a new registration number at the new place of residence, he/she needs to get a no-objection certificate (NOC) from the original regional transport office (RTO). A uniform tax system will make re-registering vehicles upon relocation easy. In addition, many people indulge in the practice of evading taxes by registering their cars in states with lower road taxes. With a one tax structure, this problem will be eradicated.

In 2017, 451 cars were seized over a month in Mumbai by the area’s RTO officials, due to road tax evasion amounting to about Rs 10 crore. Most of these cars were found to be registered in Jharkhand, Daman & Diu and Sikkim, all of which have lower road tax rates. If India moves to a uniform tax structure, it will help authorities keep a check on such practices as well.

Bringing in a uniform tax system will directly impact state revenues. The on-road price of vehicles will also change, with some rising and some falling. While there is some scepticism about the shift, the fact that road tax in every state might be governed by the same parameters will help in streamlining the entire process associated with buying, selling and owning a vehicle in India.

The author is president, Federation of Automobile Dealers Associations of India