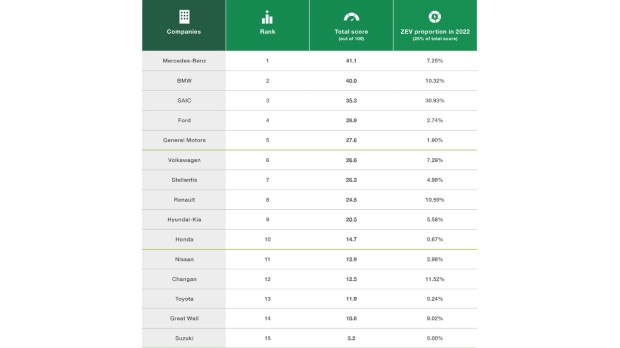

This year Japanese auto major Suzuki received the lowest score in Greenpeace East Asia’s annual auto ranking, followed by Great Wall Motor and Toyota. China’s largest automaker, SAIC, saw the highest volume of electric vehicle (EV) sales but took just third place in the ranking due to its slow progress on supply chain decarbonisation. Mercedes-Benz and BMW took first and second place respectively.

The report finds that the global transport sector’s carbon emissions rose by 2.1% in 2022, an increase of 137 metric tonnes of carbon dioxide (CO2) from the year prior. The automotive industry is a significant contributor to global carbon emissions including road transport, which consists of passenger and goods vehicles accounting for 17.9% of global carbon emissions in 2022.

Within the transport sector, passenger vehicles represent the greatest share of emissions, comprising 45% of the sector’s CO2 emissions in 2018. Greenpeace says that despite the rising popularity of electric vehicles (EVs) in recent years, CO2 emissions from the transport sector have continued to grow at a rate that exceeds all other end-use sectors, except industry. Decisive measures and strong leadership from the automotive industry are necessary to enable the mass adoption of EVs and the swift phase-out of internal combustion engine (ICE) vehicles. Necessary measures include targeted and ambitious ICE phase-out regulations and legislation, and investment in EV-compatible infrastructure.

Auto Environmental Guide 2023

Greenpeace says the Auto Environmental Guide 2023 examines carmakers’ decarbonisation efforts under three pillars:

- ICE phaseout,

- Supply chain decarbonisation

- Resource reduction & efficiency.

These pillars address tailpipe emissions, production-related emissions, and materials procurement-related emissions, and the weighting corresponds to lifecycle emissions of the average passenger vehicle.

“Unfortunately, automaking giants like Toyota, Volkswagen and Hyundai aren’t reducing their emissions as quickly as many people believe. Despite rapid growth in EV sales, a staggering 94 percent of cars sold last year by the world’s biggest traditional automakers were powered by fossil fuels. Industry leaders like Toyota and Hyundai continue to flood the roads with combustion engine vehicles and a growing number of SUVs. Leading automakers need to accelerate the shift away from fossil fossils, rather than boasting about their minimal EV sales share,” said Ada Kong, Greenpeace East Asia Deputy Program Director.

The ranking evaluates the world’s 15 largest traditional automakers on their phase-out of combustion engine vehicles, supply chain decarbonisation, and resource reduction and circularity. The findings are based on Greenpeace analysis of MarkLines data.

India highlights

While the report focusses majorly on the efforts of automakers across the east Asia region, some of the key factors/highlights around India find –

Suzuki’s decarbonisation and electrification performance is almost nonexistent in a time when nearly all major carmakers are transitioning away from ICE vehicles and tailpipe emissions in response to the climate emergency, albeit at varying rates. This is despite the fact that Suzuki CEO Toshiro Suzuki expressed concern in 2017 about a potential rapid shift to electrification in India – Suzuki’s largest market.

India is among the 13 global markets that see Internal Combustion Engine (ICE) vehicles continue for a comparatively longer time than the global average. The other countries in the list include – Australia, Brazil, Canada, Japan, Indonesia, Mexico, The Philippines, South Korea, Thailand, Turkey, the United States, and Vietnam.

SAIC is noted for its exceptionally high ZEV sales, both proportionally and in absolute numbers. This performance is underscored by a sharp rise in ZEV sales in the last five years that has seen a more than doubling from year to year between 2018 and 2021. SAIC is the only carmaker that exceeded the target of 30% ZEV sales in 2022 and was awarded full score for that criterion. The carmaker has not published information about any plans to reach a partial or full ICE phase-out and it remains unclear whether SAIC is gearing towards full electrification. It has a sizable presence in three emerging ZEV markets — India, Indonesia, and Thailand.

Key findings

Suzuki, Great Wall Motor, and Toyota received the lowest scores in the ranking. Toyota is the world’s largest automaker, yet fewer than one in 400 vehicles sold by Toyota in 2022 were battery electric vehicles (BEVs). Suzuki sold zero BEVs in 2022.

Mercedes-Benz and BMW received the top scores in this year’s ranking, but both automakers continue to sell more combustion engine vehicles than is compatible with limiting the global average temperature increase to 1.5deg C.

SAIC reported the highest volume of EV sales but took just third place due to its slow progress on supply chain decarbonisation. In 2022, 3 out of 10 vehicles sold by SAIC were EVs.

Great Wall Motor and Hyundai-Kia continue to grow their SUV sales, worsening climate risk. In 2022, the share of SUVs in Hyundai-Kia’s total sales surpassed 50% for the first time. Due to high steel consumption and low fuel efficiency, SUVs have a larger carbon footprint than smaller vehicles.

Traditional automakers have sold few EVs outside of China and Europe. SAIC is the only automaker included in the ranking with sizable zero-emission vehicle sales in India, Thailand, and Indonesia. Automakers continue to sell high numbers of combustion engine vehicles in the Global South, which is inconsistent with the automakers’ climate commitments.

Greenpeace urges automakers to adopt ambitious zero-emission vehicle transition strategies worldwide. Automakers should end the sale of combustion engine vehicles in Europe by 2028 and in the US, China, Korea, and Japan before 2030. The transition to electric vehicles must be implemented alongside investment in battery recycling, decarbonisation of the steel supply chain, and a just transition for auto industry workers.

“Ultimately, we need traditional automakers to dramatically speed up their adoption of electric vehicles. Brands like Toyota and Hyundai face a very real market threat from all-electric vehicle-makers like Tesla and BYD, but in the face of evolving technology, they’re dragging their feet,” concluded Kong.