Yes Bank announced its Q1 numbers today, and as part of the investor presentation, the private sector bank also shared details of its transaction with the Sumitomo Mitsui Financial Group. As per the Yes Bank investor presentation, one of the highlights of its Q1 performance report was SMBC’s 20% stake buy agreement.

The transaction between Yes Bank and SMBC is a significant milestone. It is set to drive “Yes Bank’s next phase of growth, profitability, and value creation, leveraging SMBC’s global expertise in this phase,” the bank stated.

Yes Bank: Details of SMBC and SBI stake

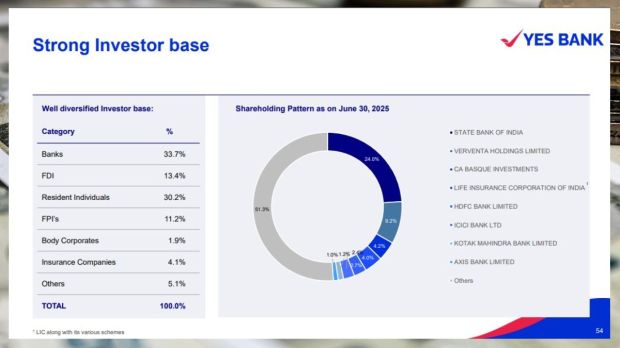

The Sumitomo Mitsui Corporation Bank (SMBC) entered into a definitive agreement to acquire a 20% equity stake in Yes Bank from SBI & Other Banks. The State Bank of India, however, continues to be a major shareholder. SBI had 24%, and other investor banks cumulatively had a 9.7% equity stake in the bank.

SMBC inked an agreement to acquire a 20% stake from SBI and other investor banks. Once this happens, SMBC will become the bank’s largest shareholder. A strong partnership with SBI has been pivotal in Yes Bank’s journey, and SBI will remain a major shareholder. SMBC is among the leading foreign banks in India, and Sumitomo Mitsui Financial Group’s (“SMFG”) wholly owned subsidiary, SMFG India Credit Company, is among the largest diversified NBFCs in India

Yes Bank: List of key investors

Overall, Yes Bank has a well-diversified investor base. Apart from State Bank of India, the list of other other marquee investors includes

-Verventa Holdings

-CA Basque Investments

-Life Insurance Corporation of India

-HDFC Bank

– ICICI Bank

– Kotak Mahindra Bank

-Axis Bank

Apart from the 33.7% stake held by banks, FIIs also hold a significant 13% stake in the private bank. FPIs or foreign portfolio investors, hold over 11%, and insurance companies have a 4% stake.