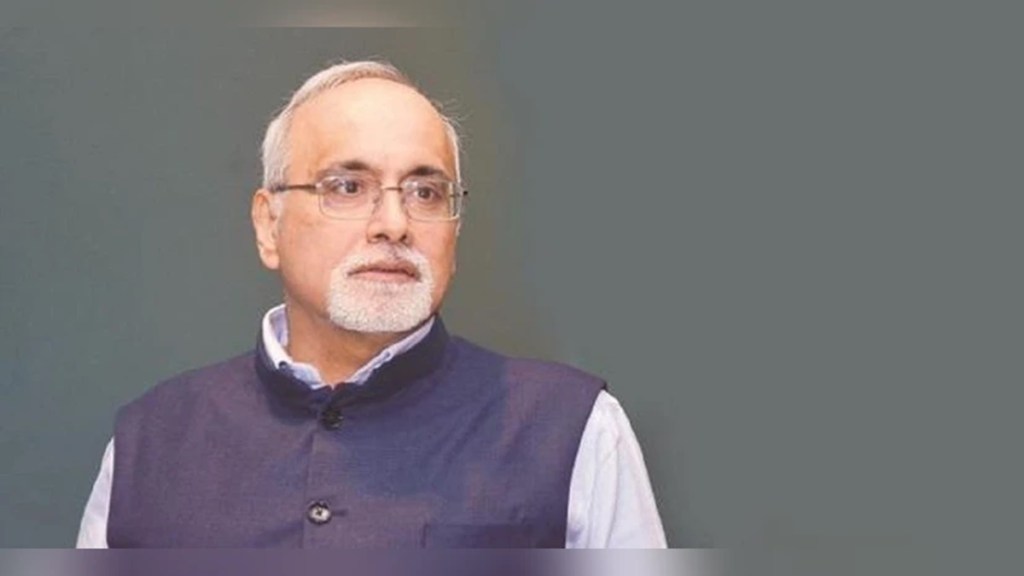

Reserve Bank of India (RBI) deputy governor M Rajeshwar Rao emphasised the significance of trust in the banking sector and the potential role of AI.

“Even as we broaden the credit coverage using algorithms and digital interfaces, maintaining the trust will be our biggest challenge and also our biggest responsibility,” Rao said at CNBC-TV18 Banking Transformation Summit on September 16. The regulator uploaded the speech on its website on Monday.

AI to strengthen banking and credit monitoring

Rao highlighted various areas where banks can leverage artificial intelligence (AI) to facilitate smooth banking services to customers and make it more inclusive. Moreover, it also helps lenders to keep track of the credit portfolios, he said.

“AI-based early warning systems can help lenders monitor credit portfolios more effectively through dynamic risk scoring and real-time default probability tracking. By flagging early signs of financial stress, these systems protect the lender’s balance sheet while giving borrowers a chance to course-correct. The goal, ultimately, is not just to lend more but to lend better,” the deputy governor said.

Bridging credit gaps in India

Though retail growth has seen a strong progress over the years, Rao said there is still a gap, which could be addressed through AI. “A lot of distance still needs to be traversed, as the gap in credit penetration persists. Even today, only around 25% of India’s adult population have formal access to institutional credit while in the MSME sector, only a part of their credit needs is met by formal institutions.”