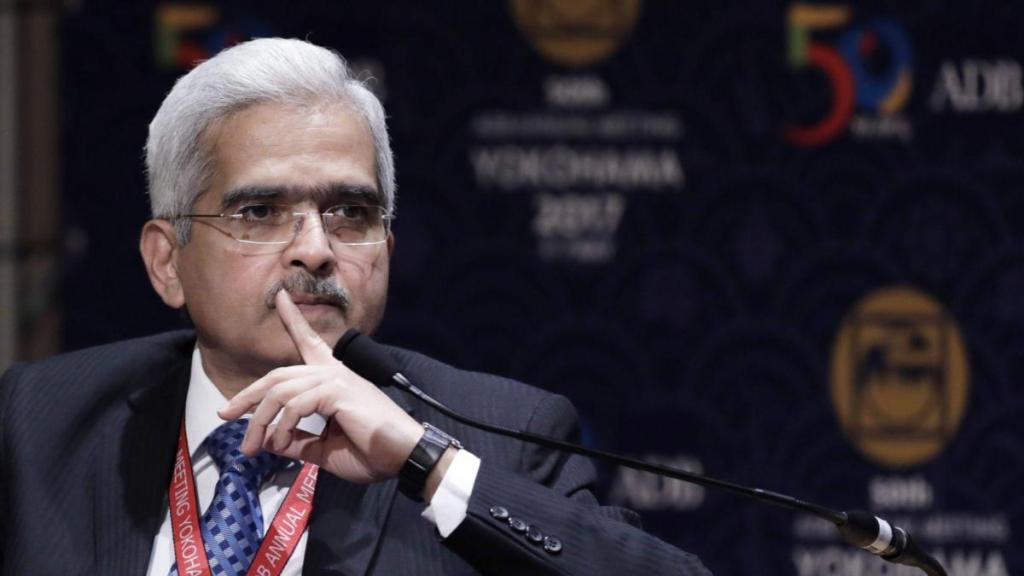

The Reserve Bank of India’s (RBI) monetary policy committee (MPC) will stay resolute in its goal to align headline inflation with 4% target on a durable basis, Governor Shaktikanta Das said. His statement was part of the RBI’s bulletin for February, released on Tuesday.

“The MPC will carefully monitor any signs of generalisation of food price pressures which can fritter away the gains in easing of core inflation. Monetary policy must continue to be actively disinflationary to align inflation to the target of 4% on a durable basis. The MPC will remain resolute in this commitment,” he said.

Even as India’s retail inflation, as measured by the consumer price index (CPI), fell to a three-month of low of 5.10% in January, it has stayed above the RBI’s target of 4% for 52 months straight. Das said recurring food price shocks could interrupt the ongoing disinflation process, with risks that it could also lead to de-anchoring of inflation expectations and generalisation of price pressures.

Further, the global economy continues to present a mixed picture with odds of “soft-landing” increasing with inflation moving closer to the target and growth holding up better than expected in major advanced and emerging market economies.

The ongoing wars and conflicts globally and the emergence of new flashpoints in different parts of the world, with disruptions in the Red Sea being the latest in the series, impart uncertainty to the global macroeconomic outlook, he said.

“Going forward, the momentum of economic activity witnessed during 2023-24 is expected to continue in the next year (2024-25). Agricultural activity is holding up well despite lower rainfall, lower reservoir levels and delayed sowing. Rabi sowing has surpassed last year’s level as well as the normal acreage,” Das said, adding that the allied sector too is expected to provide major support to agriculture with continued momentum in horticulture and fisheries.

On liquidity front, Governor Das said after remaining in surplus during April-August 2023, system level liquidity has turned into deficit from September after a gap of four and half years. Adjusted for government cash balances, however, potential liquidity in the banking system is still in surplus, he said.

“Financial market segments have adjusted to the evolving liquidity conditions in varying degrees. While the short-term rates have fluctuated, long term rates have remained relatively stable, reflecting better anchoring of inflation expectations as indicated in the softening of term spread in the G-sec market,” he said.

Lastly, the MPC’s stance of withdrawal of accommodation should be seen in the context of incomplete transmission of interest rates in credit and inflation ruling above the target of 4%. As far as liquidity conditions are concerned, they are being driven by exogenous factors, which are likely to correct in the foreseeable future, aided by RBI’s market operations, he said. “On our part, the Reserve Bank remains nimble and flexible in its liquidity management through two-way main and fine-tuning operations, in both repo and reverse repo,” he added.