Economic Survey 2021 India: Following are the highlights of Economic Survey 2020-21, tabled in Parliament by Finance Minister Nirmala Sitharaman on Friday.

State of economy amidst once in a century crisis:

* Economic contraction projected at 7.7 pc in FY21

* 11 pc GDP growth projected in FY22, farm sector remains silver lining

* V-shaped recovery supported by COVID vaccination drive

* Rebound to be led by low base and continued normalization in economic activities as vaccine rollout gathers traction

* Govt consumption, net exports have cushioned growth from further diving down

* Exports to decline by 5.8 pc, imports by 11.3 pc in 2nd half of FY21

* India expected to have a Current Account Surplus of 2 pc of GDP this fiscal, a historic high after 17 years

* India’s sovereign credit ratings do not reflect its fundamentals, India’s willingness to pay is unquestionably demonstrated through its zero sovereign default history

* India’s fiscal policy should reflect Gurudev Rabindranath Tagore’s sentiment of ‘a mind without fear’

Check latest updates on Economic Survey 2021 here:

Healthcare:

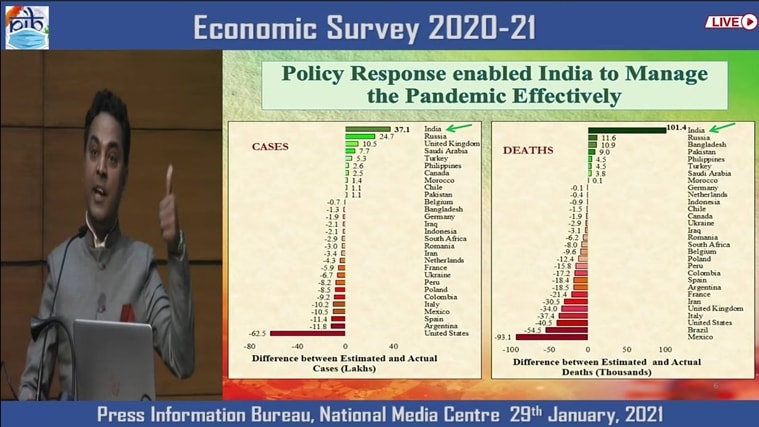

* India’s lockdown strategy prevented 37 lakh COVID-19 cases, 1 lakh deaths

* Survey recommends increase in public healthcare spending from 1 pc to 2.5-3 pc of GDP

* India’s health infrastructure must be agile to respond to pandemics – healthcare policy must not become beholden to ‘saliency bias’

* Telemedicine needs to be harnessed to the fullest by investing in internet connectivity and health infrastructure

Process reforms:

* India over-regulates the economy resulting in regulations being ineffective even with relatively good compliance with process

* The solution is to simplify regulations and invest in greater supervision which, by definition, implies greater discretion

* India’s business sector needs to significantly ramp up investments in R&D

* Survey suggests asset quality review exercise immediately after the forbearance is withdrawn

* Forbearance represents ’emergency medicine’ that should be discontinued at the first opportunity when the economy exhibits recovery, not a ‘staple diet’ that gets continued for years

* Legal infrastructure for the recovery of loans needs to be strengthened de facto

Fiscal Developments

* India adopted a calibrated approach best suited for a resilient recovery of its economy from COVID-19 pandemic impact, in contrast with a front-loaded large stimulus package adopted by many countries

* India remained a preferred investment destination with FDI pouring in amidst global asset shifts towards equities and prospects of quicker recovery in emerging economies

* Net FPI inflows recorded an all-time monthly high of USD 9.8 billion in November 2020, as investors’ risk appetite returned

* India only country among emerging markets to receive equity FII inflows in 2020

* India the fastest country to roll out 10 lakh vaccines in 6 days and also emerged as a leading supplier of the vaccine to neighbouring countries and Brazil

* India’s mature policy response provides important lessons for democracies to avoid myopic policy-making.