Revised Income Tax Slabs and Rates Explained: In her Union Budget 2025 speech, Finance Minister Nirmala Sitharaman introduced a revised tax structure aimed at reducing the burden on taxpayers.

What is the new tax regime in 2025?

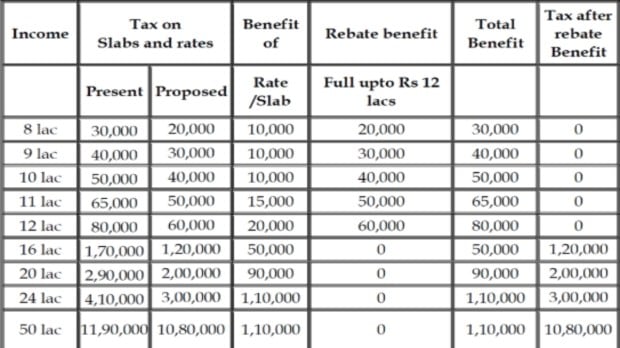

Under the updated tax regime, individuals earning up to Rs 12 lakh will be fully exempt from income tax. Additionally, salaried employees will benefit from a standard deduction of Rs 75,000, effectively raising the tax-free income threshold to Rs 12.75 lakh. This move is expected to provide significant relief to the middle class while boosting disposable income, consumer spending, and savings.

Is the old tax regime applicable for FY 2025-26?

The revised tax framework introduces a higher tax exemption limit of Rs 12.75 lakh and a newly structured 25% tax slab, aligning with earlier expectations. These proposed modifications to the income tax system are set to be implemented from April 1, 2025 (FY 2025-26), subject to parliamentary approval.

What is the tax rebate for 2025-26?

According to the Budget 2025 announcement, the tax rebate for resident individuals under the new regime has been revised. Individuals earning up to Rs 12 lakh will be fully exempt from taxation. Additionally, marginal relief will continue for those slightly exceeding this threshold, offering tax benefits similar to the previous system.

What is the taxable income structure under the new regime?

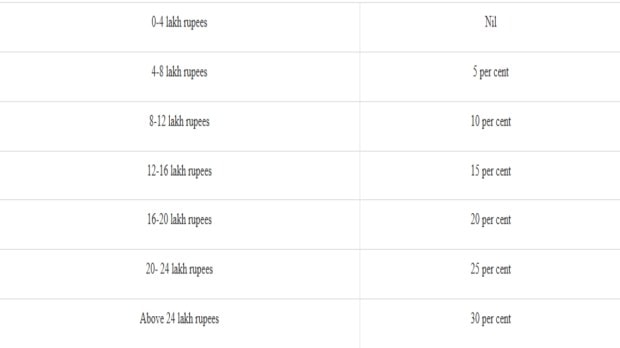

The revised tax slabs under the new tax regime are as follows:

- Up to Rs 4 lakh – 0%

- Rs 4-8 lakh – 5%

- Rs 8-12 lakh – 10%

- Rs 12-16 lakh – 15%

- Rs 16-20 lakh – 20%

- Rs 20-24 lakh – 25%

- Above Rs 24 lakh – 30%

Example: Tax Calculation for an Individual Earning Rs 13 Lakh

Let’s consider an individual earning Rs 13 lakh per annum under the new tax regime for FY 2025-26. After applying the Rs 75,000 standard deduction, the taxable income is Rs 12.25 lakh. The tax breakdown is:

- 5% on income between Rs 4 lakh – Rs 8 lakh (Rs 3.25 lakh) = Rs 16,250

- 10% on income between Rs 8 lakh – Rs 12 lakh (Rs 4 lakh) = Rs 40,000

- 15% on income above Rs 12 lakh (Rs 25,000) = Rs 3,750

- 4% cess on total tax = Rs 2,450

Thus, the total tax liability amounts to Rs 74,450 under the new regime.

Who will benefit from the change in tax slabs?

The tax deduction limit for senior citizens has been doubled from Rs 50,000 to Rs 1 lakh, providing them with greater financial relief. With higher disposable income, individuals are expected to spend more, stimulating economic growth. The expanded income tax exemptions under the new tax regime will benefit the middle class, encouraging a faster transition away from the old tax regime, which may gradually lose its appeal.

What is the maximum rebate available to taxpayers?

As per the Budget 2025, the maximum rebate available is Rs 60,000, applicable to taxpayers earning up to Rs 12 lakh.

What was the previous tax exemption limit?

Previously, the tax-free income threshold under the new tax regime was Rs 7 lakh. However, in the latest budget, no revisions have been made to the old tax structure. With increased disposable income, individuals are expected to boost consumer spending, further accelerating economic growth.

Standard Deduction History

- In the Union Budget 2023, a standard deduction of Rs 50,000 was introduced under the new tax regime.

- For FY 2024-25, this deduction was increased to Rs 75,000 under the new regime, while it remained unchanged for those opting for the old tax structure.