By Vikas Dahiya

How to your link Aadhaar card with PAN Card: The government of India had recently made it mandatory for every taxpayer to link their Aadhaar card with PAN card. This implementation has been authorized in the Finance Bill 2017-18 by finance minister Arun Jaitley to curb tax evasion through the use of multiple PAN cards. Also, in what is a good news for a lot of people, July 01 is not the last date to link PAN Card with Aadhaar card.

However, before linking your Aadhaar with PAN, you must first register yourself on the income tax e-filing portal. You can also take the assistance of tax solution providers like All India ITR.

Steps for Linking your Aadhaar with PAN

# With your Aadhar and PAN card handy, go to Income Tax e-Filing portal and register (if you haven’t done yet). Registered members can log in using their ID, password, and date of birth.

# Usually, a pop-up window prompting you to link PAN with Aadhaar card appears, but if you have activated a pop-up blocker, then you need to go to ‘Profile Setting’ menu and click on ‘Link Aadhar’.

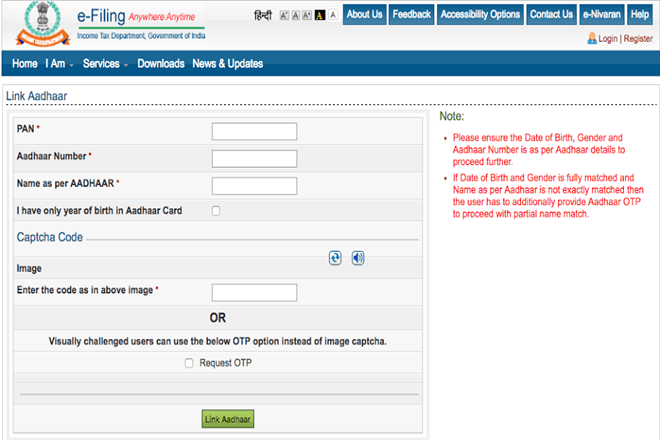

# Submit your details – name, Date of Birth as per the PAN, gender, Aadhaar card number and name as per Aadhaar. Verify the captcha and click ‘Link Aadhaar’ button.

# Upon successful validation of your Aadhaar, it will be automatically linked to your PAN.

# A pop-up will verify that the linking has been successfully processed.

Steps to Check if Aadhar Card and PAN Card are Linked

# Go to the official website of the Income Tax Department.

# Enter your credentials – user ID, password, date of birth and captcha.

# Under ‘Profile Setting’ select ‘Link Aadhaar’.

# If your Aadhaar is linked with your PAN, then the display on the page will mention the same.

The benefit of linking Aadhaar and PAN in the income tax e-filing portal is to eliminate the necessity of furnishing your Income Tax acknowledgment while filing for returns. Since the tax department inspects every claim very sternly, hence, tax consultants at All India ITR recommend e-filing for returns in advance, before the due date to avoid errors in your claim.

(The Author is founder and CEO of All India ITR)