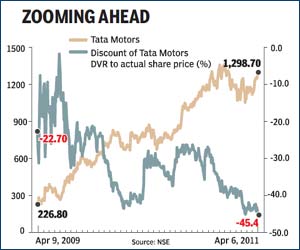

The discount between Tata Motors? deferential voting rights (DVR) shares and its ordinary shares widened to an all-time high level of 45.4% on Wednesday. The widening of discount is on the back of significant outperformance by Tata Motors? ordinary share price since November, which has gained 11%, while DVR shares have lost close to 17% during the same period. The DVR shares traded at an average discount of 34% in 2010.

The current discount, market experts say, is an aberration and see it as a buying opportunity from a long term horizon.

The current discount, market experts say, is an aberration and see it as a buying opportunity from a long term horizon.

?This is an attractive opportunity for investors to buy DVR shares driven by an above-average discount ? expected to reduce in few months ? and better dividend yields,? said Sorabh Talwar of HDFC Securities in its latest report.

Globally, DVR shares typically trade at a discount of about 10-15% compared with the ordinary shares. Investors with DVR shares can get an additional 5% dividend compared to ordinary shares but have only one voting right for every 10 shares held. Such instruments are normally issued to minority shareholders.

Tata Motors had offered the DVR shares through a rights issue in 2008. Due to the poor response and abolishment of the underwriting close with JM Financial, Tata Group, the promoter group company, ended up buying over 84% of DVR shares. Since then, Tata Group has been liquidating its holdings. In last 5-6 quarters, the promoters have liquidated their holding to 19%. This has kept the DVR prices in check.

?There is a lot of supply of DVR shares in the market as the company is still in the sell mode,? said a head of institutional equities at a leading domestic broking firm. ?The discount could narrow once the company is done with its selling?

At present, about 70% of DVR shares are held by institutional investors (FIIs own 41% and MFs 25%). Besides Tata Motors, Pantaloon is the only other company in India to have DVR shares. The DVR shares of Pantaloon are currently trading at a 30% discount to its ordinary shares.