The National Stock Exchange (NSE) has picked up an additional 9.42% stake in National Securities Depository Ltd (NSDL) on Monday increasing its total shareholding to 25.05%. The deal valued at approximately Rs 125 crore was executed after Specified Undertaking of the Unit Trust of India (SUUTI) expressed its willingness to offload 9.42% of its 25% equity stake held in NSDL. Even after this transaction, IDBI still continues to be the largest sponsor of NSDL with a 30% equity stake.

NSDL with over one crore active investors account with a demat custody value of over Rs 53 lakh crore had reported a net profit of Rs 26.68 crore during the financial year 2009. After undertaking several central government projects like Tax Information Network (TIN) and setting up a Central Record Keeping Agency (CRA) for the New Pension System (NPS), NSDL is looking forward to participate in the dematerialization of LIC policies and automation of SEZ transactions. The move by NSE comes close on the heels of Bombay Stock Exchange (BSE) planning to take a controlling stake in Central Depository Services Ltd (CDSL) by increasing its holding to 51% from the current 36.6%. Since NSE?s stake in NSDL is less than 26%, it cannot be termed as a strategic stake according to market participants.

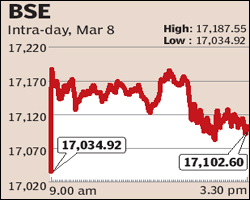

Meanwhile, on Monday, the Indian equity bourses opened the week on a robust note on strong buying from overseas institutional investors. The provisional data from stock exchanges showed that foreign institutional investors (FII) were net buyers of equities worth Rs 1,132 crore while domestic institutional investors (DII) remained sellers to the tune of Rs 569 crore. Sustained buying by overseas investors helped BSE Sensex to regain the 17,000 level to close the day 17,102.60, gaining 108 points or 0.64% while the broader 50-share NSE Nifty closed at 5,124 gaining 0.69% or 35 points.