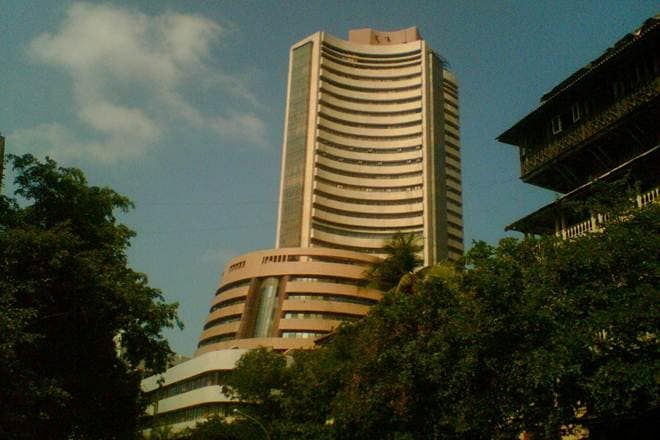

The stock markets in India witnessed a major correction last week as the benchmark Sensex lost over 1000 points in 5 trading sessions. However, Indian equities were continuously gaining, with the benchmark indices Sensex and Nifty rising 17-18% since so far this year since January 2017. But last week turned out very choppy for the domestic markets after a series of unlikely events which turned down the market activity.

The major drag on the Dalal Street came after the Indian market watchdog SEBI has asked the exchanges to restrict the trading in shares of 331 companies that are suspected to be shell entities. The investors’ sentiment further deepened following the geopolitical concerns between the United States and North Korea followed by the lower-than-expected first quarter corporate earnings which also distressed the mood of market participants.

As for the last six months, both the indices, Sensex and Nifty have returned around 10%, which is also a good enough return. However, a comparison with some other stocks may make even Sensex and Nifty returns look dull this year.

Edelweiss Financial is one such stock, which has grown exponentially in just last six months of trading. As on 13 February 2017, shares of Edelweiss Financial quoted at Rs 118.65, while on 11 August 2017, the stock closed at Rs 236.95, rising 99.71% during the six-month period.

The stock of Edelweiss Financial on Friday rose 2.22% to Rs 236.95 while the benchmark Sensex ended 300 points down at 31,213.59 points and it has lost over 1,000 points – the worst weekly fall since mid-February 2016. Earlier this month, shares of Edelweiss Financial jumped over 5% after the financial services firm reported 40.55% rise in net profit at Rs 196.32 crore for the April-June quarter of FY 2018 versus Rs 139.68 crore in the corresponding quarter previous year.

The Edelweiss Group is one of India’s leading diversified financial services company providing a broad range of financial products and services to a substantial and diversified client base that includes corporations, institutions and individuals.