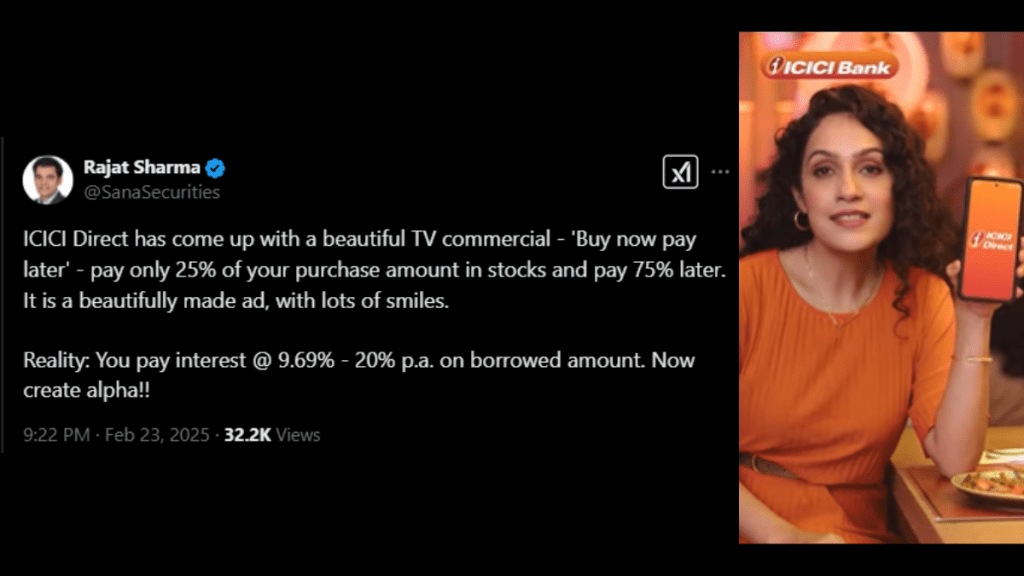

ICICI Direct’s latest TV commercial promoting its “Buy Now, Pay Later” (BNPL) offer for stock purchases has sparked a heated online debate, with many financial experts and netizens raising concerns over the hidden risks and potentially misleading messaging in the ad.

Rajat Sharma, founder of Sana Securities, took to Twitter to share his concerns, warning users about the potential financial pitfalls of the offer. “Not everyone can read between the lines,” he tweeted. Sharma pointed out that the interest on the borrowed amount, which ranges between 9.69% and 20% annually, is charged on the full amount — not just on the unpaid 75%. This means that, if the stock value does not increase or underperforms, the investor could end up paying much more than anticipated.

In the commercial, ICICI Direct introduces a seemingly attractive offer — customers can buy stocks with just 25% of the amount upfront and pay the remaining 75% later. The ad, filled with happy faces and cheerful moments, portrays a simple and enticing opportunity for investors. However, beneath the surface, the deal involves significant hidden costs that many people may not fully understand, according to online reactions.

Several other Twitter users echoed similar sentiments. One user expressed frustration, stating, “Simple lessons will be learned the hard way!” Others raised alarms about the risks of using borrowed money to invest in stocks, especially if those stocks perform poorly. “What if people start using this money to buy poor-quality stocks? It’s a ticking time bomb,” one user commented.

Netizens also voiced concerns about the ad’s potentially misleading nature. “Innovative ways of trapping people in debt,” another Twitter user said. Some even questioned why regulatory bodies like SEBI have not intervened, calling for stricter oversight of such marketing tactics. “This is just repackaging a loan as BNPL,” said one user, urging the RBI to step in and prevent such practices.

Despite the backlash, ICICI Direct maintains that the offer is designed to provide flexibility for investors.