The basic reason for purchasing a term plan has not changed through the years and that is the life cover benefit. There is in fact no other financial instrument that gives a lump sum or regular payout to the beneficiary if the life-insured passes away. While this is the heart of any term plan, with changing times, our protection needs are also evolving.

So, life insurance companies are starting to customise term plans to look beyond death benefit and include other features that focus on benefiting the policyholders during their lifetime. One such term plan is the recently launched Axis Max Life Smart Term Plan Plus.

Read on to learn of 6 key features that make this newly introduced term insurance plan from Axis Max Life Insurance stand apart from traditional term insurance plans in India.

Unmatched Discounts for Women and Salaried

Everyone likes to get a discount on purchases and the Axis Max Life Smart Term Plan Plus offers a range of discounts on premiums:

- Lifetime Discount for Women – Flat 15% lifetime discount over male rates on due premiums

- Additional discount for Salaried Women – Apart from the 15% lifetime discount over male rates applicable for all women, salaried women will receive an additional discount of 15% on the first year premium i.e. a total discount of 27.75% on first year premium on male rates

- For Salaried Men – Flat 15% discount on the 1st year premium of the policy

To understand, how the savings can add up, let’s take an example. Suppose the premium for a 30-year policy is Rs. 20,000 annually for a standard male applicant. As a result of these discounts, the savings on just the first year premiums for a salaried female will be Rs. 5,550. While the lifetime savings over the remaining 29 years of the premium payment term years will be an additional Rs. 87,000. So total savings of premiums payable for a salaried female life-insured in this case will be Rs. 92,550.

Up to 200% of Premiums Back with Special Exit Value

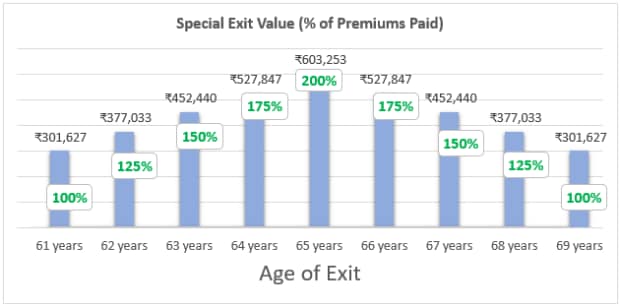

The option of availing special exit value (SEV) from a life insurance policy as a refund on premiums already paid has been around for a while now. But the Axis Max Life Smart Term Plan Plus offers a higher special exit value that is equivalent to 200% of premiums paid. What’s more, no additional premium needs to be paid to avail the benefit as it is built into the term plan.

To better understand how the special exit value calculation works, let’s take an example. Suppose Deepak, a salaried 25-year old male non-smoker opts For Axis Max Life Smart Term Plan Plus with 50 years’ policy term (offering coverage till age 75) and pays annual premiums for 10 years. The total premium he would pay for the policy would be ₹301,626 (excl. of GST).

In this case, the special exit value benefit will be available from the 30th policy year to the 46th policy year.

The SEV benefit offered at the time of exiting the policy as a % of premiums paid during this period is illustrated in the below graph:

Deepak gets the option to avail the Special Exit Value benefit starting 30th policy year, except during the last 4 years of the policy term.

Maternity Benefits for Women

A unique feature of the Axis Max Life Smart Term Plan Plus is the maternity benefit. This benefit can safeguard against various pregnancy-related complications as well as congenital anomalies in the newborn. This is offered as an optional add-on to eligible female life insured and requires the payment of an additional premium to avail.

The maternity cover payout under this benefit can be Rs. 2 Lakhs in total that is payable over and above the base sum assured. Up to 50% of this payout can be received on occurrence of maternity related complications such as Ectopic pregnancy, Molar Pregnancy, Uterine rupture, Choriocarcinoma, etc. While remaining 50% of maternity cover is payable on diagnosis of congenital anomalies in the newborn such as Down’s Syndrome, club foot, surgical repair of atrial septal defect, surgical repair of spina bifida, etc.

Lifeline Plus

Lifeline Plus is another unique benefit of Axis Max Life Smart Term Plan Plus that can be specifically availed by women. This benefit can provide additional protection to women in the case of the death of the spouse during the policy term by increasing their life cover.

Under this feature, female life insured will be allowed to avail Top up Sum assured subject to lower of 50% of base sum assured or 50 Lacs with same premium rates as applicable at inception and as per attained age.

3 Hours Claim Guarantee

The process of making and receiving a claim is often a difficult time for families who have just lost a loved one. While a life cover payout cannot bring back a loved one, a quick turn-around post claims intimation can definitely be helpful for the policy beneficiary. In view of this, Axis Max Life Smart Term Plan Plus is being introduced with a 3-hour claim guarantee post claim intimation and submission of mandatory documents.

The 3-hour claim guarantee is applicable to eligible, active, premium paying policies that have completed at least 3 continuous policy years with a sum assured of up to Rs. 50 lakhs (provided field verification is not required).

In order to qualify for this benefit, some mandatory documents need to be submitted, such as, original policy document, original attested death certificate, Death claim application form, discharge/death summary attested by hospital authorities or FIR & Post Mortem Report/Viscera report (in the case of accidental death), etc.

Up to 150% Sum Assured with Smart Cover Variant

In a traditional term plan, the sum assured payout remains the same throughout the policy term, however, this new term plan offers something more. The Axis Max Life Smart Term Plan Plus is available with the smart cover variant which provides a higher life cover during the first 15 years of the policy term.

If the life insured dies during the initial 15 years of the policy term the life cover payout will be 150% of the base sum assured under the policy. Post the first 15 years, the life cover payout will be 100% of the base sum assured under the policy.

Bottom Line

Since no financial plan can be considered complete without have adequate protection in place, having a term plan is no longer a matter of choice but a necessity for the vast majority. However, it is probably time that we consider benefits beyond just the life cover amount and period of coverage when selecting a life insurance plan that fits our family’s protection needs.

This is where the features such as maternity benefits and health services offered by this newly launched Axis Max Life Smart Term Plan Plus can help life insured individuals safeguard their financial interests during their lifetime while ensuring the financial protection of their loved ones after they are no more.

Disclaimer:

This article contains sponsored content that may not reflect the independent opinion or views of FinancialExpress.com. Further, FinancialExpress.com cannot be held responsible for the accuracy of any information presented here. Please consult a certified financial advisor before making any decisions based on this article.