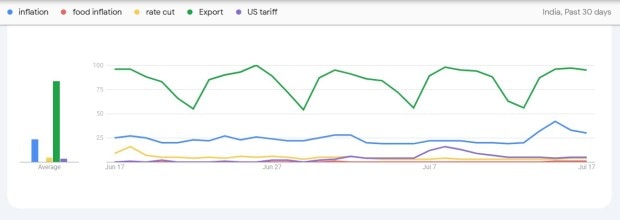

India’s economy is seeing a mix of encouraging and cautious signals in the month of July, from tumbling inflation and narrowing trade deficits to global tariff challenges. As retail inflation hits a six-year low and hopes to rise for further rate cuts, exporters are bracing for the impact of US tariffs. With India–US trade talks still underway and the deadline for a steep 26 per cent duty approaching, here are five key topics that have trended on Google over the past month.

India–US interim trade deal to avoid steep US tariff

The US tariffs imposed by US President Trump have caused a stir globally, with many countries rushing to secure trade deals to minimise the impact on their imports and exports. While nations like China, Vietnam, and the UK have already signed agreements, India is still in talks with the US to finalise an interim trade deal, as the suspension on an additional 26 per cent tariff ends on August 1. Traders and analysts are closely watching the developments, as failure to reach a deal by the deadline could subject Indian exports to a 26 per cent reciprocal tariff, in addition to a 10 per cent base levy.

Export: India’s exports hit seven-month low despite US demand

According to the June trade data India’s exports stood at $35.14 billion in June, 9 per cent lower than the previous month. The dip was the lowest since November even though the shipments to the US surged over 23 per cent year-on-year, reaching $8.27 billion despite higher tariffs.

India’s overall trade in services showed an estimated surplus of $15.62 billion in June, with services exports at $32.84 billion and imports at $17.58 billion, data showed.

Meanwhile, India’s trade deficit narrowed sharply to $18.78 billion in June, marking a four-month low, primarily driven by a steep decline in imports. June imports fell to $53.92 bn, down nearly 3.7% from May, with crude oil imports dropping to $13.7 bn and gold to $1.8 bn.

Retail inflation cools to over six-year low

India’s retail inflation eased sharply to 2.10 per cent in June, its lowest level since January 2019, thanks to a significant drop in food prices. This marked the eighth consecutive month of decline, reinforcing expectations that the Reserve Bank of India (RBI) could soon begin cutting interest rates to support growth.

Food prices fall for the first time in years

The decline in headline inflation was largely driven by negative food inflation, which fell by 1.06 per cent in June—marking the first contraction since January 2019. Prices of vegetables, pulses, and eggs fell steeply, helping offset the impact of costlier items like cereals and meat. Economists say the fall in food prices could be temporary, but it offers immediate relief for consumers.

Rate Cut: Cooling retail inflation opens door for further rate cuts

A day after India’s retail inflation fell to a more than six-year low of 2.1 per cent in June, Reserve Bank of India Governor Sanjay Malhotra said the Monetary Policy Committee (MPC) will consider cutting interest rates further if inflation falls below its projection or if growth comes under pressure.

In its previous monetary policy meeting on June 6, the RBI had announced a 50 basis point cut in the policy repo rate, bringing it down to 5.50 per cent. It also adjusted the Standing Deposit Facility (SDF) and Marginal Standing Facility (MSF) rates accordingly. Additionally, the RBI reduced the Cash Reserve Ratio (CRR) by 100 basis points.

The RBI is scheduled to hold its next MPC meeting from August 4 to 6, 2025.