Even as the unprecedented 35 bps cut by the RBI in the August 7 Monetary Policy Committee was on expected lines, the key rates may go down further in the upcoming outings in October and December. The rates may be reduced by 40 bps in the rest of FY20, Deutsche Bank said in a note. The RBI MPC may maintain a pause on the October 4 policy meet, the global brokerage added. In the December policy, the rates may be cut by 25 bps, it noted. There is sufficient headroom to stay near 4 per cent inflation, CITI said, adding the extent of upcoming policy rate cuts would be dependent on growth in the near-term.

The further rate cuts are contingent on NBFC recovery and if the problem worsens, any possibility of rate cuts may not be ruled out in FY21, Deutsche Bank also said. If the NBFC sector stabilises, the RBI may not cut the repo rate below 5 per cent, it added.

Also read: Auto industry captains meet FM Nirmala Sitharaman, demands GST rate cut

Meanwhile, RBI MPC on Wednesday, decided to lower the repo rate by an unorthodox 35 basis points to 5.40 per cent.This is the fourth consecutive cut this year, bringing down the repo rate, the rate at which the RBI lends funds to banks, by a total of 110 basis points from 6.50 per cent.

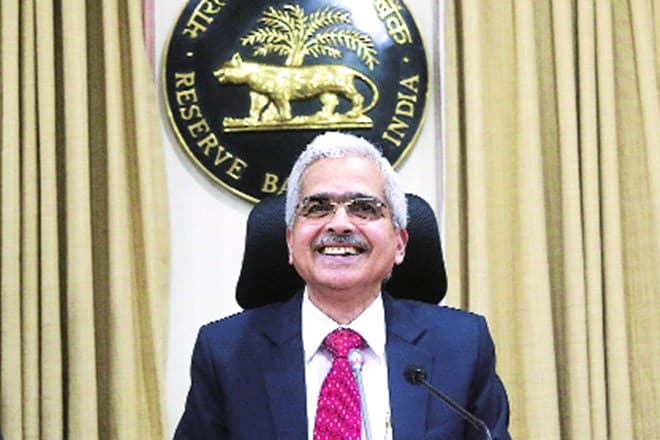

While announcing the policy review, the RBI Governor Shaktikanta Das said: “Addressing growth concerns by boosting aggregate demand, especially private investment, assumes highest priority at this juncture while remaining consistent with the inflation mandate.” The central bank also cut the real GDP growth for 2019-20 from 7 per cent projected in the June policy to 6.9 per cent. The growth is likely to be in the range of 5.8-6.6 per cent for the first half of 2019-20.