-

Luxury items like art, watches, antiques, and jewellery are no longer just status symbols; instead, they are becoming more serious investment options. As the market volatility increases, ultra-high net worth individuals (UHNWIs) are looking for physical assets that have beauty, long-term worth, and legacy. According to Kotak Mahindra Bank’s 2024 report, 94% of UHNWIs in India are owners of jewellery, and 73% of them have invested in art. Auction houses like Christie’s International and Sotheby’s Holdings are noticing an increase in the number of millennial buyers. These assets are not only transportable but also inflation-proof. Here’s a look at 10 luxury investments that are modifying the way portfolios are made.

-

Jewellery as portfolio: With 94% of UNHWIs owning jewellery, vintage signed pieces, especially from legacy homes, are now considered portable and inflation-resistant assets. (Photo source: Canva)

-

Art collection: Indian art form is in its golden period. Christie’s International has recently auctioned MF Hussain’s Gram Yatra for a record of Rs 118 crore, whereas Sotheby’s Holdings Inc witnessed 56% of its work exceed high estimates at its 2024 Indian & Himalayan Art sale. (Photo source: Canva)

-

Luxury watches: Timepieces like Rolex and Patek Philippe are no more just fashion statements, but they are appreciating investments and are constantly surpassing traditional returns. (Photo source: Canva)

-

Handbags are holding their stronghold: According to the Knight Frank Luxury Investment Index 2025, handbags are leading in all categories with a 2.8% growth in 2024 and have overtaken jewellery and watches. (Photo source: Canva)

-

Antiques and heritage collections: Vintage chandeliers, silver artefacts usually generate double their estimates at auctions conducted by AstaGuru Auction House. (Photo source: Canva)

-

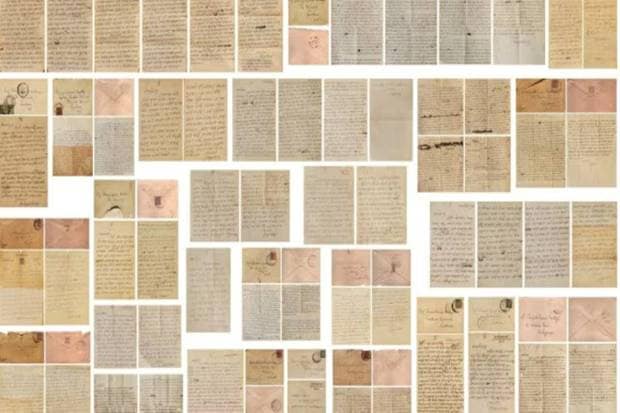

Rare letters and cultural collections or archives: Rabindranath Tagore’s letter has amassed Rs 5.9 crore, showing the increasing worth of cultural souvenirs. (Photo source: Indian Express)

-

Millennials lead the change: According to Christie’s International, 44% of APAC region buyers in 2024 were from the younger generation or millennials, resulting in 26% of global sales. (Photo source: Canva)

-

Diversification beyond financial markets: As per Knight Frank, collectibles have often outperformed stocks during global crises. (Photo source: Canva)

-

Legacy and emotional value driving the demand: Industry leaders have observed that buyers are just expecting returns, but they are also seeking emotional and cultural significance with their acquisitions. (Photo source: Canva)

Not Thailand or Vietnam: This visa-free country with direct flights is the new favourite destination for Indian travellers