-

From Goods and Services Tax to Moody’s India rating upgrade, it has been a jam-packed year of financial events in India. On Friday Yahoo announced its Year in Review (YIR) for India for 2017. Along with other categories, Yahoo announced Top Business Story That Shook the Nation, where GST – the major reform in India’s indirect taxation system topped the list. Other stories that made it to this list were India’s giant leap up 30 places in the World Bank’s Ease of Doing Business Ranking, and Moody’s Investor Services’ first sovereign rating upgrade for India in 14 years. Let us take a look at the most important events in the world of finance in the year 2017:

-

In July, the Goods and Services Tax (GST) (an indirect tax) was introduced in India. GST appears to have had an immediate and significant impact on economic growth. (PTI Photo)

-

India's GDP growth slumped to a three-year low of 5.7 per cent during April-June as manufacturing slowed amid demonetisation effect. The GDP growth was lesser than China which registered a record 6.9 per cent growth in January-March as well as April-June quarters. (Reuters Photo)

-

India jumped 30 places and entered the top 100 club among 190 countries in the World Banks Ease of Doing Business (DB) Report. (Reuters Photo)

-

In November, Moody's has upgraded the Government of India's local and foreign currency issuer ratings to Baa2 from Baa3 and changed the outlook on the rating to stable from positive. (Reuters Photo)

After Panama Papers, new ‘Paradise Papers’ leak reveals secrets of the world elite's hidden wealth. It reveals 714 Indians on tax haven list, leaving India ranked 19 among the 180 countries. (Reuters Photo) -

In October, the government announced an aggressive Rs 2.11 lakh crore capital infusion for the NPA hit public sector banks over a period of two years. (Reuters Photo)

Linking of Aadhaar made necessary for a host of financial services like bank accounts, pension plan, insurance policies and also for social security scheme. (Reuters Photo) -

In April, five associates of State Bank of India (State Bank of Bikaner & Jaipur, State Bank of Hyderabad, State Bank of Mysore, State Bank of Patiala and State Bank of Travancore) became part of the State Bank of India. (PTI Photo)

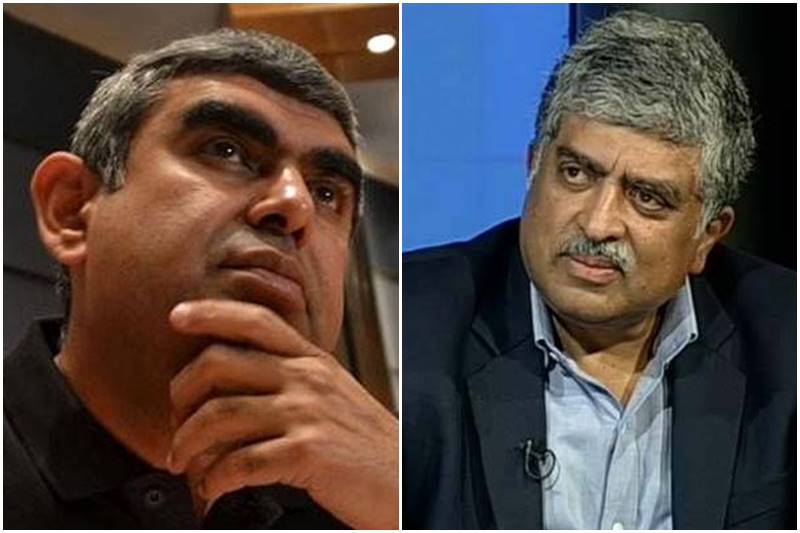

In August, Infosys had gone through a period of turbulence following the resignation of its CEO and MD Vishal Sikka. After that Nandan Nilekani, Infosys co-founder returned as its non-executive chairman. (Reuters Photo) -

In June, the Union Cabinet has given in-principle approval to the Civil Aviation Ministry’s proposal to divest a stake in Air India. (PTI Photo)

Perplexity CEO Aravind Srinivas congratulates Sridhar Vembu as Arattai jumps from 3,000 to 350,000 sign-ups within days of its launch