-

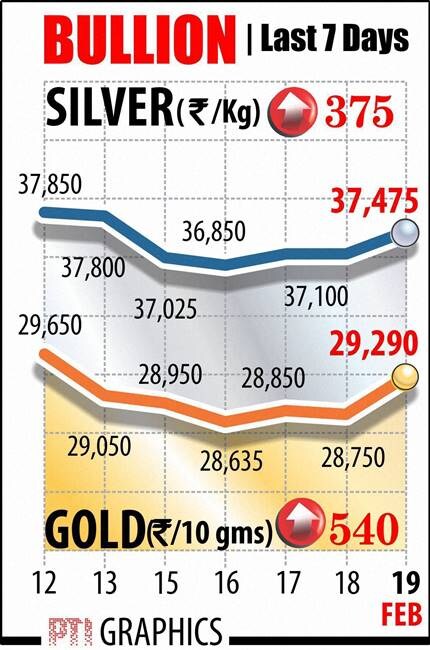

Riding on a firm global trend and strong demand from domestic jewellers, gold prices shot up by Rs 540, topping the 29,000 mark again, to close at Rs 29,290 per 10 grams. Silver also shot up by Rs 375 to Rs 37,475 per kg on increased offtake by industrial units and coin makers.

-

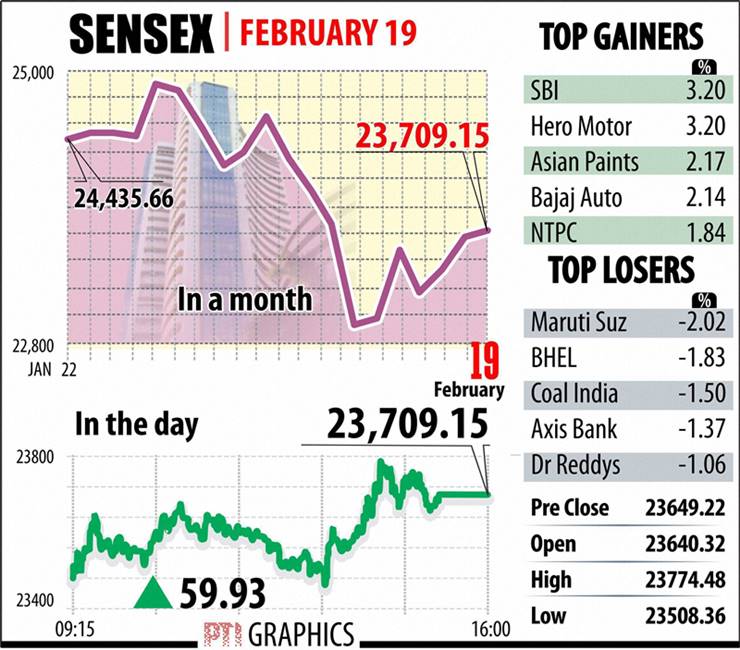

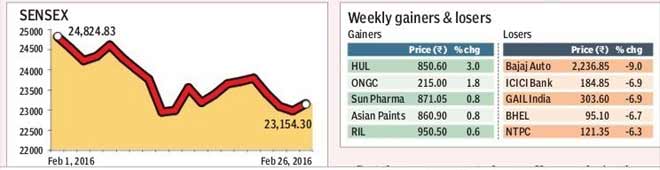

Late-buying saved the day for markets today as the benchmark Sensex overcame its early losses and advanced by a modest 60 points, helped by banking and blue-chips to log the best weekly gain since October. Recovery in European markets in early trade too lifted mood. Sensex staged a strong comeback on emergence of buying and covering-up of short positions by speculators before closing at 23,709.15, up 59.93 points, or 0.25 per cent.

-

The NSE Nifty crossed the 7,200-mark in a volatile trade. At the close, it was higher by 19 points, or 0.26 per cent, at 7,210.75. Out of the 30-share Sensex pack, 18 ended higher.

-

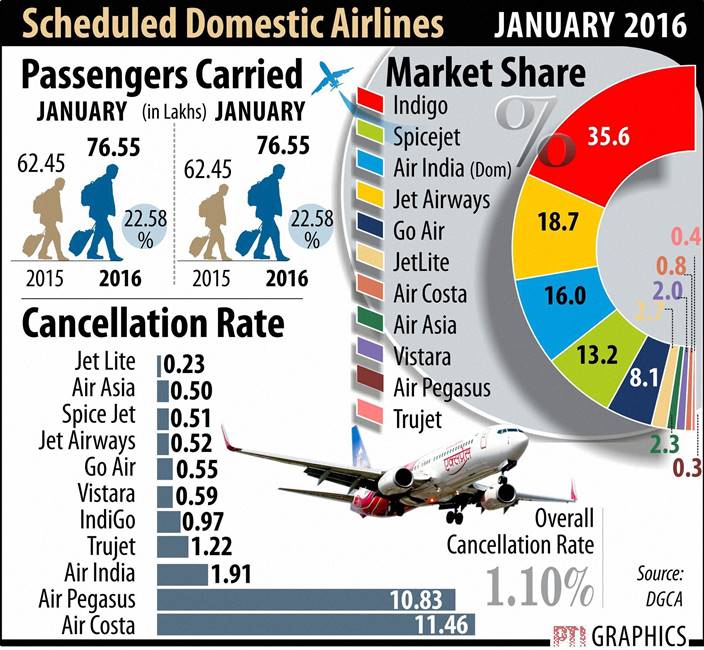

Indian carriers together flew 76.55 lakh passengers in January 2016 as compared to 62.45 lakh fliers ferried by them during the same period in the previous year, logging 22.58 per cent growth, according to the DGCA data released today. Budget carrier IndiGo maintained its leadership position carrying 27.26 lakh passengers, more than one-thirds of the total traffic pie, while another budget carrier SpiceJet continued seeing highest seat occupancy in its aircraft at 92.1 per cent during the month.

-

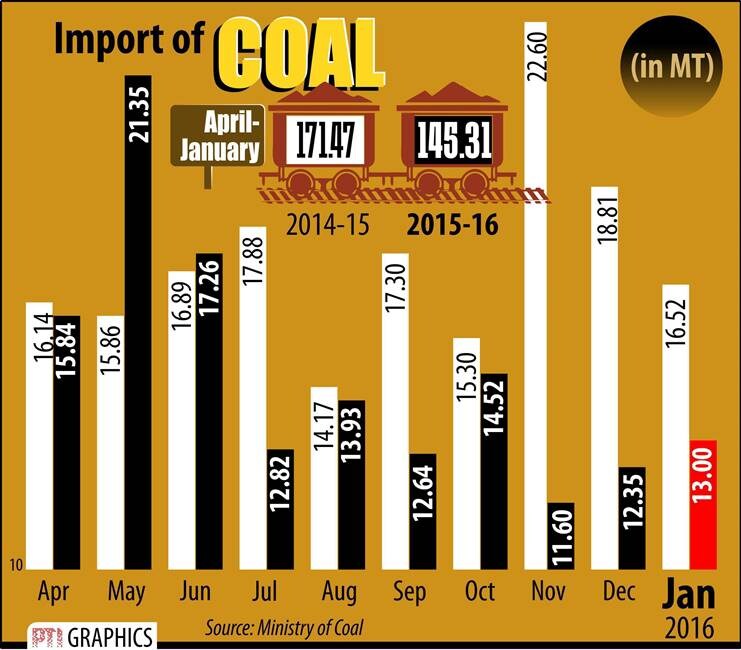

Higher output of domestic coal may see India's import of the dry fuel drop to 155-160 million tonne in the current fiscal from 185 MT in 2014-15. The imports may decline further to about 150 MT in the next fiscal.

-

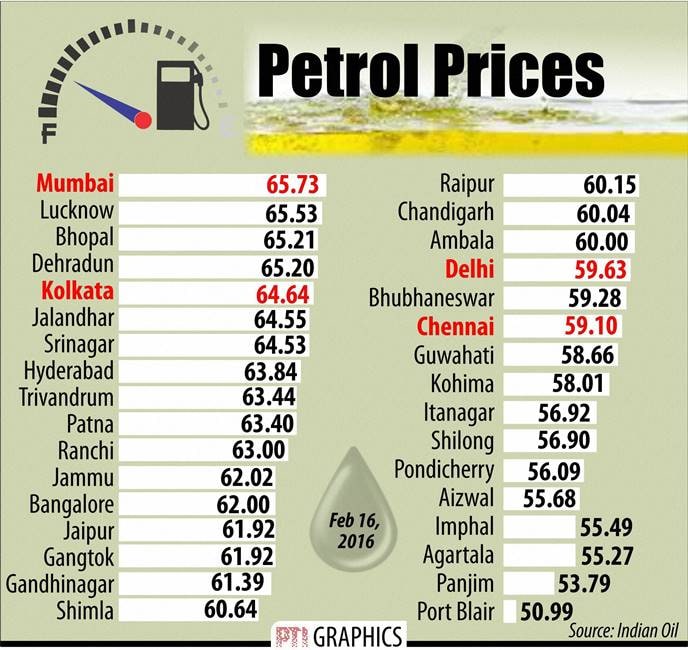

Petrol in Delhi will cost Rs 59.63 per litre as against Rs 59.95 a litre currently. A litre of diesel will cost Rs 44.96 a litre as compared to Rs 44.68 now, according to Indian Oil Corp (IOC).

-

JNU controversy: Scores of lawyers, including those who defied police summons over the violence in a Delhi court complex, took out a protest march today even as the JNU row sparked clashes between rival student groups in Jaipur and police action in Hyderabad where several people were detained.

-

Addressing governance issues of banks reeling under high NPAs and passing of the bankruptcy code could help in reducing bad loans in the banking system, says a report by CARE Ratings. In 2015-16, the NPA (non-performing asset) scene has become even more serious over the quarters, the report said. Average Gross NPAs across all banks increased from 4.4 per cent in Q4 FY15 to 4.7 per cent in Q1 FY16 to 4.9 per cent in Q2 FY16 and 8.1 per cent in Q3 FY16. Most of the increase in the NPAs can be attributed to the public sector banks.

US announces new visa immigration fee for foreign nationals