-

10th Pay Revision Commission recommendations have been accepted by the Kerala government and now nearly five lakh government employees, including teachers will get revised pay package from February – this will be with effect from July, 2014.

-

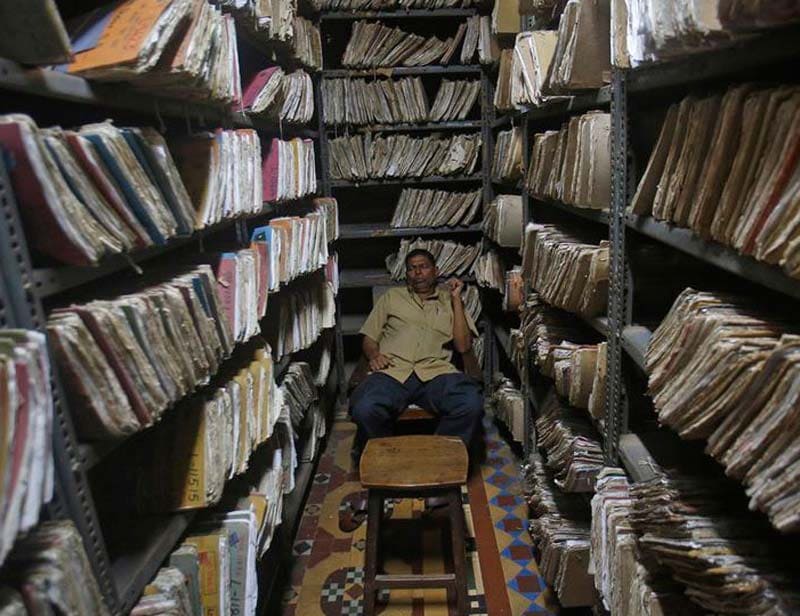

1. A decision to approve 10th Pay Revision Commission recommendations report with three amendments was taken at state cabinet meeting, Chief Minister Oommen Chandy said. The cabinet also approved the revision recommended for pensioners, who number more than four lakh. (Image Source: AP)

-

2. The 10th Pay Revision Commission recommendations report salary increase would range from Rs 2,000 to Rs 12,000 for employees depending upon their grades after the revision, which will have retrospective effect from July, 2014. (Image Source: AP)

-

3. Budget 2016: Make NPS more attractive – The National Pension Scheme is widely advocated by the Government. However, it is taxed in a manner that even though there are tax exemptions at the time of making investments, there is taxation when the corpus is encashed along with the returns on the investment. This makes NPS less attractive as compared to other investment avenues that allow for tax free withdrawal. Therefore, in order to make the NPS more attractive, there is an expectation that the FM will make the withdrawal under NPS tax free to bring it with par with other pension oriented schemes.

-

4. Additional burden for the government due to the 10th Pay Revision Commission recommendations pay hike would be around Rs 7,222 crore annually. Total amount of salary, pension and interest will be nearly 80 per cent of the total revenue of the state.

-

5. As per the 10th Pay Revision Commission recommendations, the arrears would be disbursed in four instalments from April, 2017 instead of the earlier practice of merging it with Provident Fund.

-

6. Referring to the 10th Pay Revision Commission recommendations highlights regarding the pay scale, CM said cabinet approved the commission's recommendation of minimum master scale of Rs 16,500 while the practice of earned leave surrender and LTC will continue. (Image Source: AP)

-

7. As recommended by the 10th Pay Revision Commission, it was also decided to implement a medical insurance scheme for the pensioners. The Finance Department has been asked to work out details.

-

1. EPF tax in Budget 2016: All contributions and interest accrued to employee provident fund (EPF) before April 1, 2016, will not attract any tax on withdrawal. Withdrawal of principal amount contributed to EPF after April 1 would also remain exempt from any tax. It is only the interest on contributions made after April 1, 2016 which will be taxed, Revenue Secretary Hasmukh Adhia said in an interview here.

-

CONTRIBUTION CAN BE HIKED BEYOND 12 PER CENT OF BASIC<br> If you so feel, you can ask your employer to hike your EPF contribution beyond the 12 per cent of your basic that is deducted. In fact, this can go up to 100 per cent of your basic pay. This is called Voluntary Provident Fund. However, if you do so, the employer is under no obligation to match that extra contribution as they have to do for the initial 12 per cent. </br>

-

10. The Cabinet set up a committee headed by the Chief Secretary to examine the recommendations of the second part of the commission and submit a report to the government.

e-Aadhaar app launch in India: Update your date of birth, address and phone number instantly with the upcoming all-in-one app