-

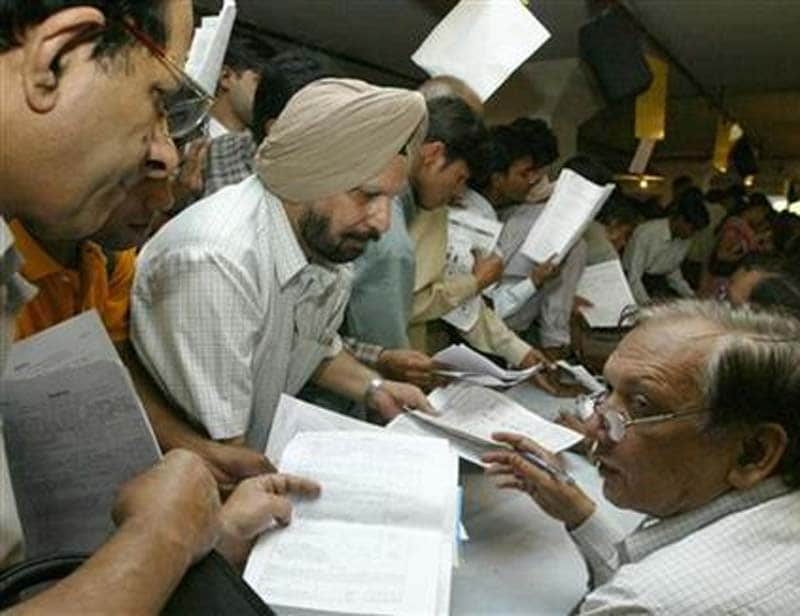

A high level panel on simplification of income tax laws today recommended raising the threshold limits for deduction of tax at source (TDS) as also slashing the rate of withholding tax. The Committee was constituted on October 27 last year to study and identify the provisions/phrases in the Income Tax Act which have given rise to litigation on account of interpretative differences. Here are 10 points to note about how tax payer will benefit in case proposals are accepted: (Reuters)

-

1. Income Tax panel: The Justice (rtd) R V Easwar Committee in a 78-page draft report said nearly 65 per cent of the personal income-tax collection in India was through tax deducted at source (TDS) and TDS provisions need to be made more tax friendly and not as 'tedious' as they have remained over the years. It recommended "enhancement and rationalisation of the threshold limits and reduction of the rates of TDS. TDS rates for individuals and HUFs to be reduced to 5 per cent as against the present 10 per cent". (Reuters)

-

2. Income Tax panel: Presently, TDS is applicable on "such tiny annual limits" of Rs 2,500 in case of payment of interest on securities and on interest on NSS accounts, Rs 5,000 for payment of interest on private deposits and commission or brokerage and Rs 10,000 for payment of bank interest. "Considering the importance of the long overdue revision of these puny limits, the Committee has recommended suitable hikes in such threshold limits," it said. (PTI)

-

3. Income Tax panel: For interest on securities it proposed raising the threshold for TDS to Rs 15,000 from Rs 2,500 annually and halving the tax rate to 5 per cent. (Reuters)

-

4. Budget 2016 expectations and income tax relief: The Committee has also felt the dire need for rationalization of TDS rates, more particularly on account of the lowering down of the average tax rates in case of majority taxpayers in the Individual and HUF 28 categories, keeping in view the restructuring of the Income-tax rates over the past decade. To illustrate, in FY 2004-05, taxable income of Rs 5,00,000 in the case of an Individual or HUF attracted income-tax of Rs 1,24,000 at an average rate of tax of 24.8%. In FY 2015-16, the same taxable income of Rs 5,00,000 attracts income-tax of only Rs 23,000 (after rebate u/s. 87A), with the average tax rate working out to just 4.6%. (Reuters)

-

3. Budget 2016 expectations and income tax relief: It is a matter of record that a number of annual threshold limits in respect of TDS have just not come to be revised over the years. With the liability of TDS being attracted on such tiny annual limits of Rs 2,500 in respect of payment of interest on securities and on interest on NSS accounts, Rs 5,000 for payment of interest on private deposits and commission or brokerage and Rs 10,000 for payment of bank interest, one can just imagine the enormous work that goes into compliance of these provisions. Considering the importance of the long overdue revision of these puny limits, the Committee has recommended suitable hikes in such threshold limits. (Reuters)

6. Income Tax panel: TDS limit on rent income threshold for TDS is proposed to be raised from Rs 1.8 lakh annually to Rs 2.4 lakh. The threshold for fees for professional or technical services is recommended to be raised to Rs 50,000 from Rs 30,000 but TDS rate is proposed to be retained at 10 per cent. (PTI)

7. Income Tax panel: The panel has also recommended deferment of Income Computation and Disclosure Standards (ICDS) to provide more time to taxpayers grappling with regulatory changes such as Companies Act 2013, Ind-AS and the proposed GST. (Reuters) -

8. Income Tax panel: Addressing the vexed issue of Sec 14A disallowance, it has proposed that dividend received after suffering dividend-distribution tax as also share income from firm suffering tax in the firm's hands will not be treated as exempt income and no expenditure will be disallowed as relatable to them. It also suggests that expenditure disallowed under Section 14A shall not exceed the amount claimed as exempt. (PTI)

-

EFPO OFFERS INSURANCE COVER<br> If your salary is below Rs 15,000 you can avail of benefits under the Employees Deposit Linked Insurance Scheme (EDLI). The scheme provides life insurance of up to Rs 6 lakhs. The actual amount to be paid in the event of death to your family or nominee is decided on the last drawn salary. The employer contributes 0.5 per cent of your basic pay as premium for this cover. The sum assured is paid to the family of an EPF subscriber in case of his or her death. However, companies that already provide life insurance benefits or group insurance policy to employees are exempted from contributing to this scheme.</br>

-

Budget 2016: If the tax is hiked to 16%, it would mean a rate rise of over 3.5 percentage points in a short span of nine months. Since the service tax’s launch in 1994, at a rate of 5% on a small set of services, the steepest rate hike previously was in 2003-04. On June 1 last year, the rate went up from 12.36% to a flat 14% (in the process, eduction and higher-eduction cesses were subsumed in the rate) and 0.5% Swatch Bharat cess was levied on November 1. Spending on almost all intermediary services — those which are not consumed by end-consumers but by businesses for value addition — would be treated as legitimate business expenditure and allowed as credit, the sources added.

8th Pay Commission News: No DA increase, pension revision for central government pensioners? Fact checked