-

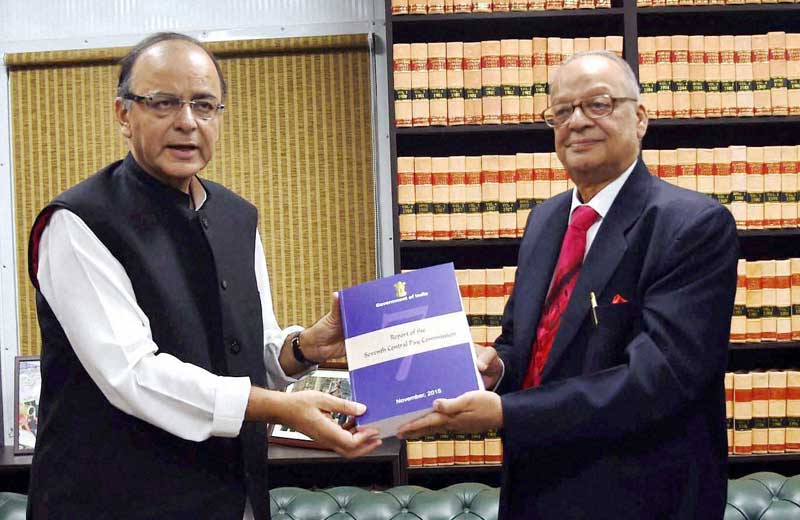

The 7th Pay Commission on pay, pension and allowances of government servants expects a huge outgo and analysts have raised flags of their own – from red to green. Some say it is going to boost inflation to new highs as bureaucrats will hit the markets to shop-till-they-drop, others are saying it will be a booster shot for the industry, which has been hit by a slowdown. Be that as it may, we look here at the top financial implications and impact points of the 7th Pay Commission report:

-

1. 7th Pay Commission on pay, pension – minimum pay, based on the Dr Wallace Aykroyd formula (nutrition), the minimum pay in government is recommended to be set at Rs 18,000 per month.

-

2. 7th Pay Commission on pay, pension: The total impact of the Commission‟s recommendations are expected to entail an increase of 0.65 percentage points in the ratio of expenditure on (Pay+Allowances+ Pension) to GDP compared to 0.77 percent in case of VI CPC.

-

3. 7th Pay Commission on pay, pension: The total financial impact in the FY 2016-17 is likely to be Rs 1,02,100 crore, over the expenditure as per the “Business As Usual” scenario.

-

4. 7th Pay Commission on pay, pension: Of this, the increase in pay would be Rs 39,100 crore, increase in allowances would be Rs 29,300 crore and increase in pension would be Rs 33,700 crore.

-

5. 7th Pay Commission on pay, pension: Out of the total financial impact of Rs 1,02,100 crore, Rs 73,650 crore will be borne by the General Budget and Rs 28,450 crore by the Railway Budget.

-

6. 7th Pay Commission on pay, pension: In percentage terms the overall increase in pay & allowances and pensions over the 'Business As Usual' scenario will be 23.55 percent.

-

7. 7th Pay Commission on pay, pension: Within this, the increase in pay will be 16 percent, increase in allowances will be 63 percent, and increase in pension would be 24 percent.

-

8. 7th Pay Commission on pay, pension – maximum Pay: Rs 2,25,000 per month for Apex Scale and Rs 2,50,000 per month for Cabinet Secretary and others presently at the same pay level. Recommended Date of implementation: 01.01.2016.

ITR due date extension: Over 7 crore returns already filed, income tax department urges remaining taxpayers to act