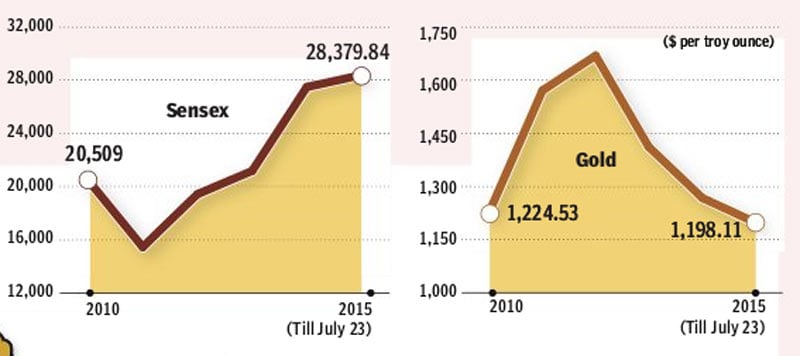

Gold prices have been on the slide globally. The yellow metal has seen prices slump as the US dollar has strengthened. Despite prices falling to $1082/oz, demand for consumer gold has yet to pick up in the two largest markets—China and India—that account for over 50% of sales.This could also be driven due to the perception that there could be a further fall in prices. </br><br> Better returns on the Sensex: </br><br>While gold prices have fallen, there has been a steady rise in the BSE Sensex. As a result, the returns on the Sensex are much higher than on gold during the period 2010-2015. -

-

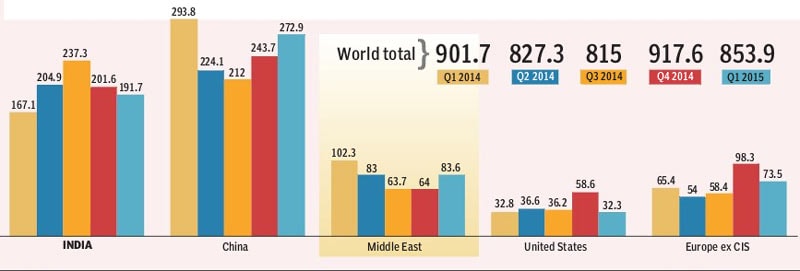

Steady global demand: </br><br>China and India together account for over half the world consumer demand for gold. While China is now the leading consumer, there has been no major change in the overall demand across the world. Consumer demand (in tonnes)

-

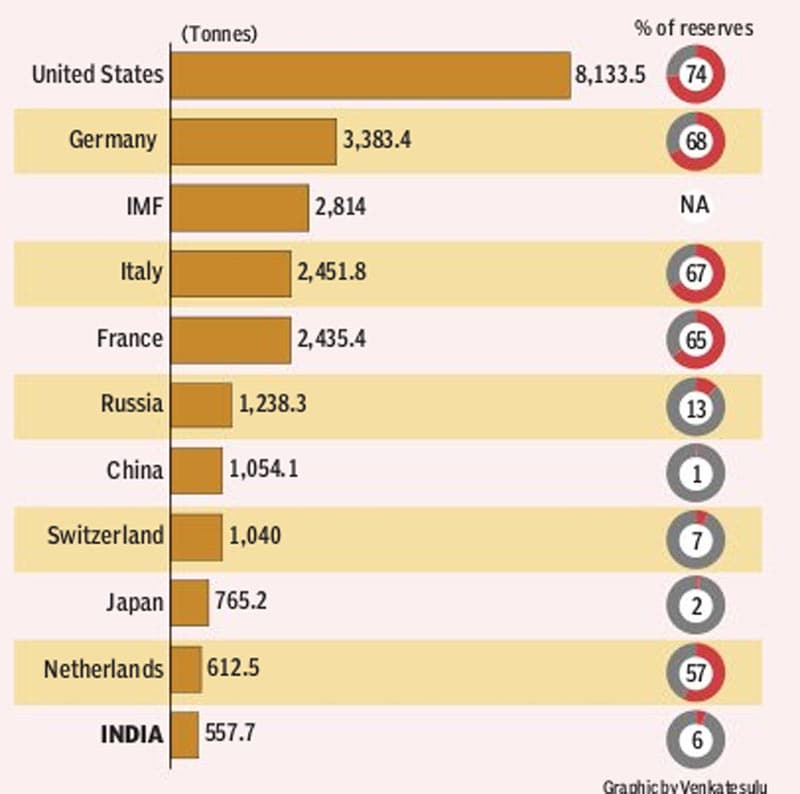

The biggest hoarders: </br><br>Across the world, goverments stock gold as a reserve. The US has the maximum reserves followed by Germany. In India, gold accounts for just 6% of the reserves. Largest gold holdings (as of Mar 2015)

Aadhaar Card update October 2025: Here’s how to change name, address, date of birth and phone number online in simple steps